- MDIA and MCA showed that ETH is well below this cycle's high.

- Those who bought altcoins recently suffered losses, but more upside could be on the way.

Ethereum holdings [ETH] It may have been an extreme sport for some when it went from $4,200 to $3,445. But long-term market participants who have seen the ecosystem bulls and bears appear unfazed.

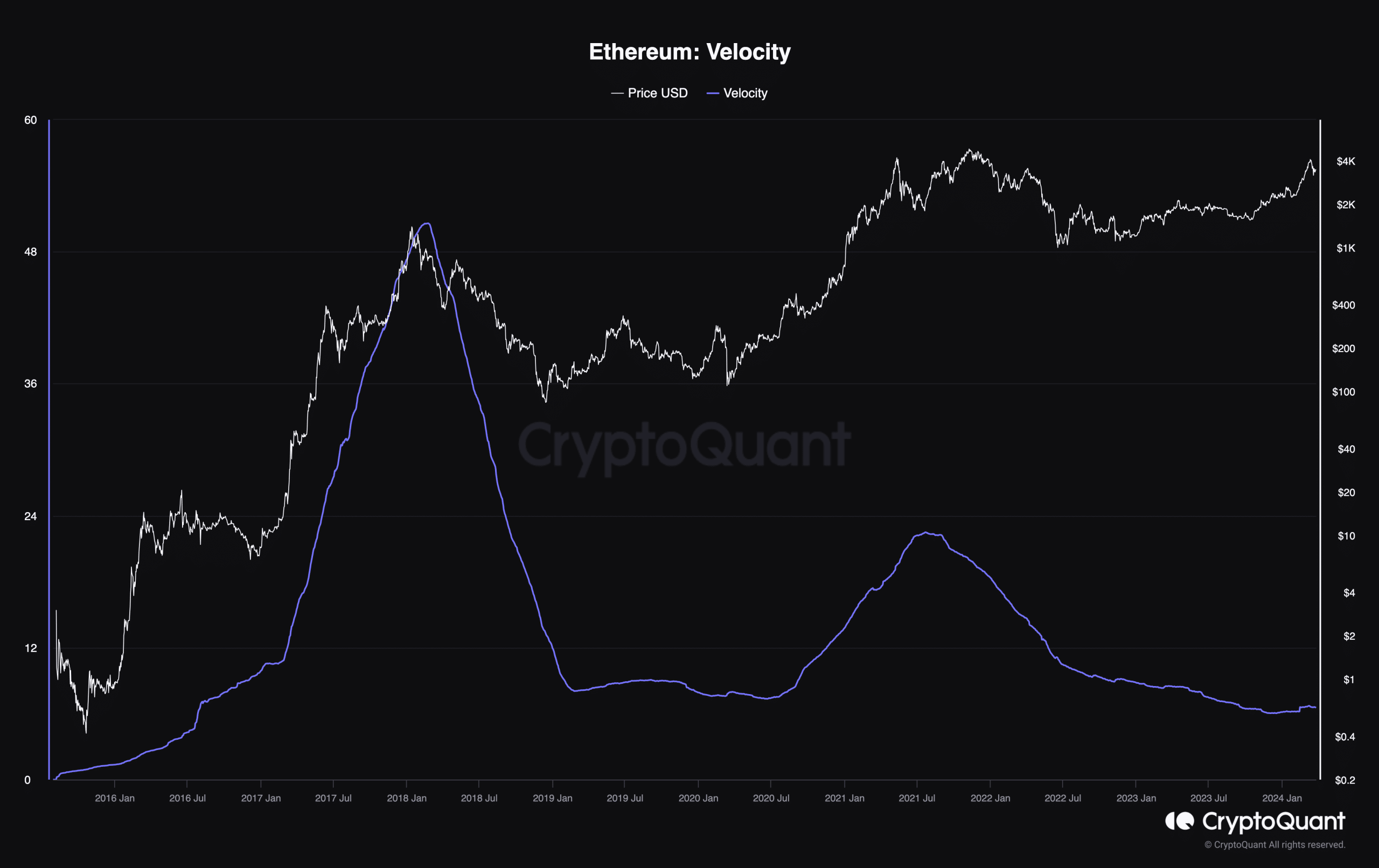

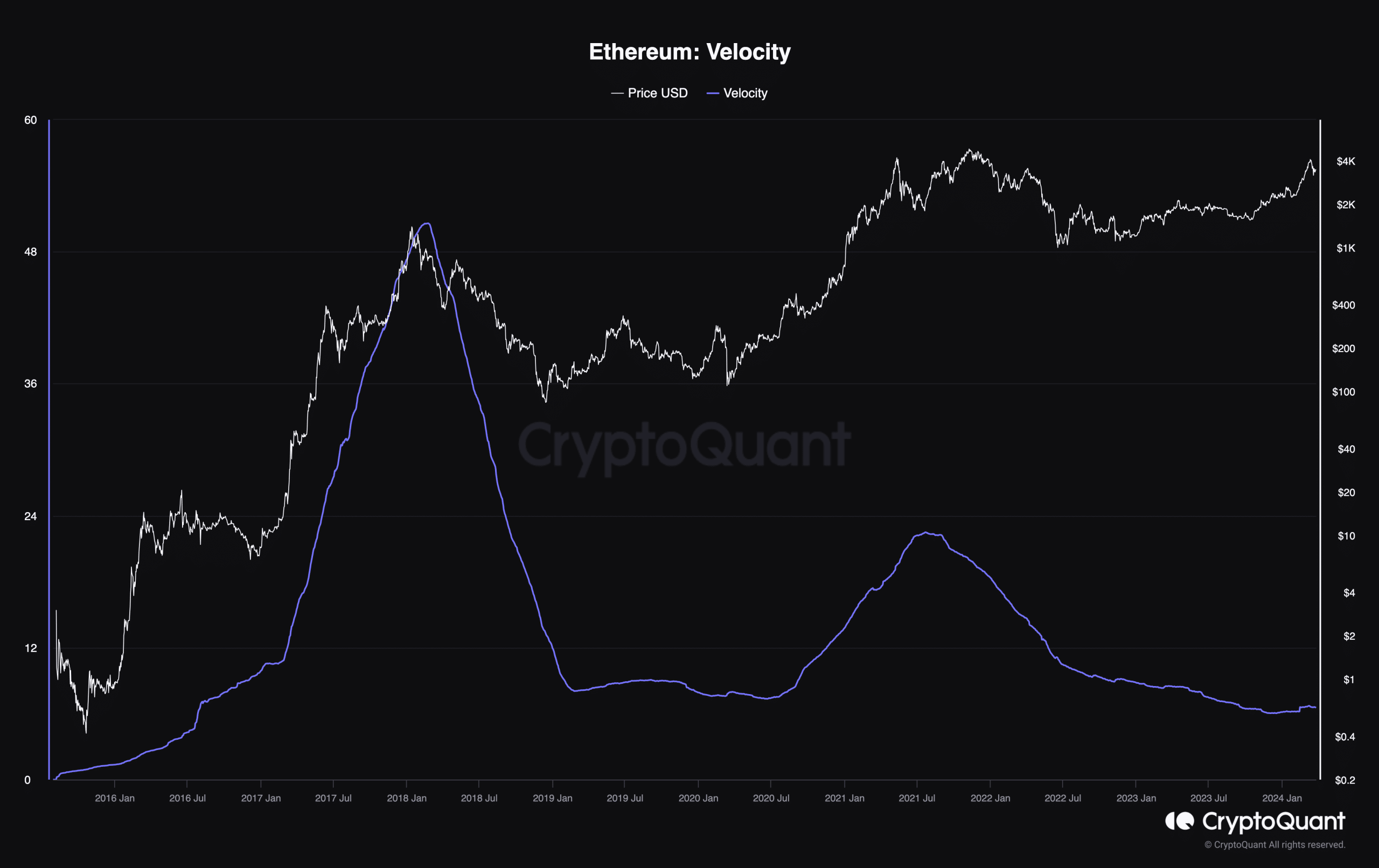

AMBCrypto obtained this information after analyzing the speed. Velocity is the speed at which coins circulate in a cryptocurrency economy. If the velocity spikes, it means the coins are circulating at a fast pace.

It's not the time to take profits

However, analysis of AMBCrypto using CryptoQuant showed that Ethereum’s speed has decreased to 6.57. The slowdown suggests that long-term holders of the cryptocurrency are out of circulation.

If that had happened, the price of ETH could have fallen much more than it has in the past.

Source: CryptoQuant

Moreover, the status of this indicator was also a signal that participants are confident in the bullish future of ETH. Two other of his metrics we considered were Average Coin Age (MCA) and Average Dollar Investment Age (MDIA).

MDIA is the average amount invested in a cryptocurrency at any given time. Conversely, MCA is the average age of the asset. The combination of these two can tell you when to buy and when to sell.

When MDIA goes down, it means market participants bought at a premium price. When this happens, the price of the cryptocurrency will fall.

On the other hand, an increase in MDIA indicates that accumulation is underway and prices are low.

Accumulating ETH may be the right decision

At the time of writing, MDIA has increased and so has MCA. Historically, an uptrend is a good indicator that prices have not yet hit a ceiling.

Therefore, the price of ETH may be considered to be trading at a discount. There may be significant price increases in the future.

If the readings of these indicators continue to rise, Ethereum could see an initial stop at $3,800. The price may then retest $4,000 in the short term.

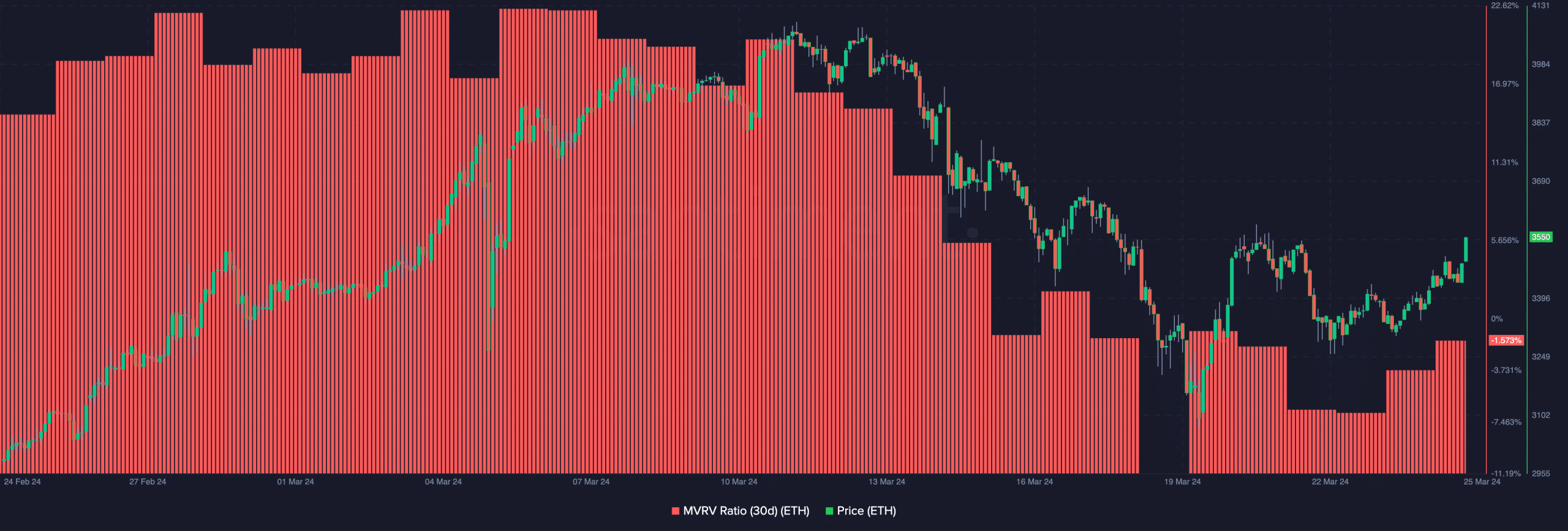

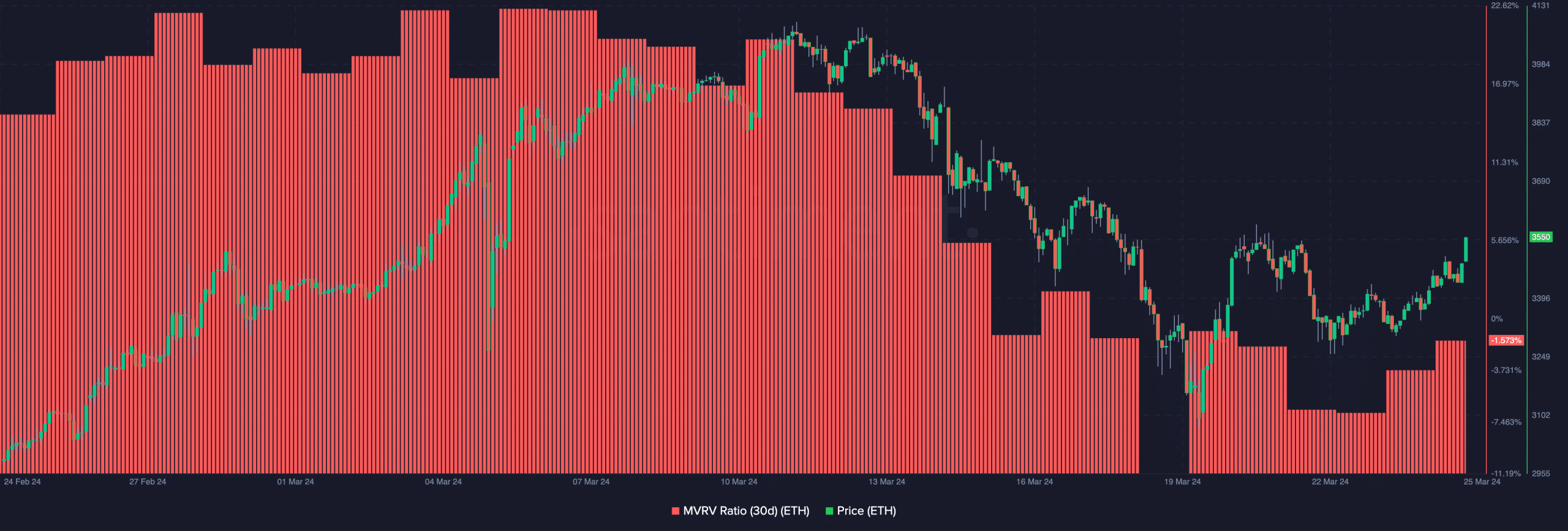

To see if the altcoin provided a purchase opportunity, AMBCrypto looked at the direction of the market value to realized value (MVRV) ratio.

This indicator shows whether a cryptocurrency is undervalued, overvalued, or at fair value.

At the time of writing, the 30-day MVRV ratio was -1.573%. This means that all Ethereum holders who decide to sell their coins now will suffer an average loss of 1.573%.

Source: Santiment

Given its history, this MVRV measurement is perfect for accumulation. During bull cycles when ETH reached local tops, that ratio was well over 40%.

read ethereum [ETH] Price prediction for 2024-2025

Therefore, it can be assumed that ETH has not even reached half of its potential this cycle.

If historical data is followed, crypto prices could reach five digits before the bull market ends. However, it can also be affected by unexpected events.