(Kitco News) – Bitcoin (BTC) soars above $70,000 on Monday, with dozens of altcoins posting double-digit gains, exciting crypto traders and underexposing investors. The bullish market for cryptocurrencies has regained momentum, with FOMO rekindling.

The situation was the opposite for stocks, which fell under pressure from market opening in the final week of the first quarter, after a quarter in which major indexes hit record highs due to persistent inflation.

As of the closing bell, the S&P, Dow, and Nasdaq were in the red, down 0.31%, 0.41%, and 0.27%, respectively.

After rallying from $64,000 to $67,000 on Sunday, Bitcoin bulls have picked up from where they left off on Monday, pushing the cryptocurrency to its all-time high from $67,000 in the afternoon, according to data provided by TradingView. has pushed the price to a high of over $71,000.

BTC/USD Charts by TradingView

Bulls are currently targeting Bitcoin’s all-time high of $73,865, pushing King Crypto back into uncharted territory.

Increased volatility

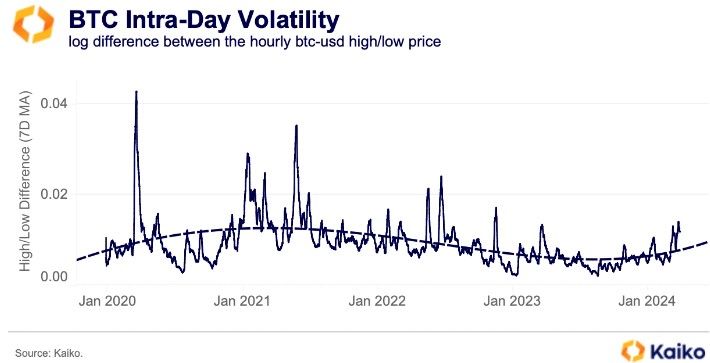

“Bitcoin flash crashes, defined as sudden and extreme price declines, have occurred at least twice in the past few weeks,” Kaiko Research said in a report published on Monday. “The illiquidity and fragmentation of crypto markets, as well as the potential for manipulation attempts, are contributing factors to these flash crashes, something not seen in traditional markets.”

Kaiko noted that volatility is highest during U.S. trading hours (14:00 to 21:00 UTC). “However, BTC intraday volatility, as measured by the log difference between the hourly high and low prices, remains well below the coronavirus-induced market crash and the peak of the 2021 bull market.”

“It is also worth noting that the current spike in volatility comes after a period of unusually low volume and volatility, making recent fluctuations more noticeable,” Kaitaka said.

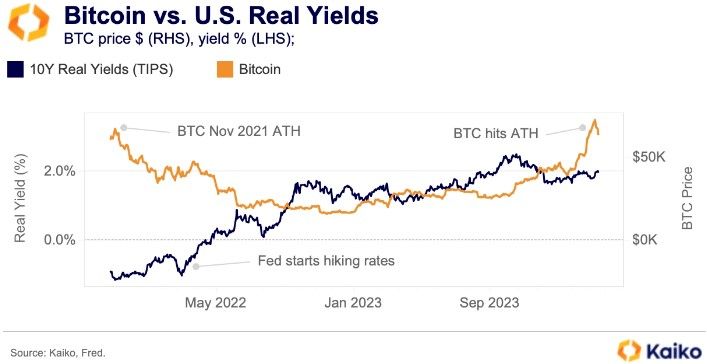

Bitcoin is also showing resilience despite rising US real yields, they added.

“U.S. real yields on 10-year inflation-protected securities (TIPS) have retreated slightly after hitting a year-to-date high of 2% last week,” the report said. “Historically, rising yields have put downward pressure on Bitcoin prices, making risky assets less attractive compared to risk-free government bonds.”

“However, this year BTC has shown resilience against the modest rise in yields, rising 50% year-to-date,” they said. “Despite the recent pullback from all-time highs, BTC’s strong performance suggests that other factors, such as inflows from spot ETFs, may be supporting the price.”

“Interestingly, gold also tends to fall in value as yields rise, but has experienced a similar upward trend. This suggests that it may have contributed to offsetting the impact of

according to “This cycle has been a story of the reaccumulation range (green and red),” said market analyst Rekt Capital.

“And one interesting possibility for prices entering a halving is further consolidation (i.e., reaccumulation) at higher prices. This technical development of events would be historically accurate,” he said. Ta. “It satisfies the fact that pre-half-life retrace occurs 28 to 14 days before half-life, and it satisfies the fact that pre-half-life retrace transitions to post-half-life reaccumulation.”

He further added, “If Bitcoin is able to convert its all-time high of around $69,000 into new support, this 'reaccumulation range' is likely to rise as price is ready for a price expansion into price discovery. The idea would be invalidated,” he added. “However, if Bitcoin is unable to convert ~$69,000 into support before the halving…this re-accumulation range could become a reality, consistent with historical price trends around the halving. Sho.”

Green sea of altcoin market

The altcoin market was a sea of green on Monday, with only two tokens among the top 200 recording losses.

Daily cryptocurrency market performance. Source: Coin360

Polymesh (POLYX) was the biggest gainer, rising 56.4% to trade at $0.61. This was followed by Reserve Rights (RSR), up 44%, and Yield Guild Games (YGG), up 38.5%. The biggest decliners were Conflux (CFX), down 2.5%, and Wemix (WEMIX), down 0.4%.

Currently, the total market capitalization of virtual currencies is $2.68 trillion, with Bitcoin controlling 52.2%.

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided. However, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation for the exchange of products, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept liability for losses and/or damages arising from the use of this publication.