Monero experienced a drop of more than 30%, but was corrected by half the next day. Let's take a closer look at the future outlook for XMR's price.

Monero situation (XMR)

It rose to $174. This price level acted as a resistance level. However, Monero price has formed higher and higher peaks, suggesting that bullish pressure is increasing. Unfortunately, the inevitable happened. Binance has delisted Monero. After that, Monero's value fell sharply, breaking several supports and rising from $165 to $100. The next day, the cryptocurrency made some recovery by testing the $132 level. As a result, Monero received support from all those who responded on the network and are staunch defenders of anonymity. Monero price is hovering around $119 this morning.

This recent decline has pushed XMR below its 50-day and 200-day moving averages, highlighting the increased volatility experienced by the cryptocurrency. This suggests that investors may need to adjust their strategies. As for the oscillator, it is naturally tuned downwards and placed well below the intermediate threshold. From an optimistic perspective, this could indicate that the cryptocurrency is currently undervalued. Nevertheless, from a more pessimistic angle, this can also be interpreted as a sign that momentum is shifting towards a bearish trend.

The current technical analysis was carried out in collaboration with Elly FT, an avid investor and trader in the crypto market.He is currently a trainer family tradingis a community of thousands of independent traders active since 2017, offering live sessions, educational content, and peer support on financial markets in a professional and welcoming atmosphere.

Focus on derivatives (XMR/USDT)

Contrary to the price, the open interest of XMR/USDT has clearly increased significantly. In fact, it recorded an increase of over 246%, adding nearly $50 million to Monero's permanent contract. On the clearing side, we are seeing a sharp increase at the moment. However, these do not affect open interest. In summary, we can understand that speculators' interest is mainly on the seller side.

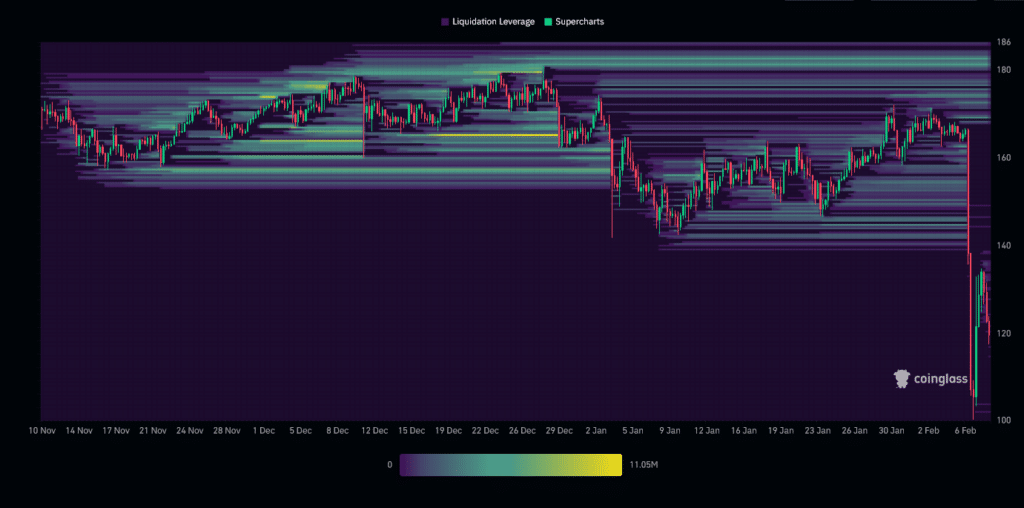

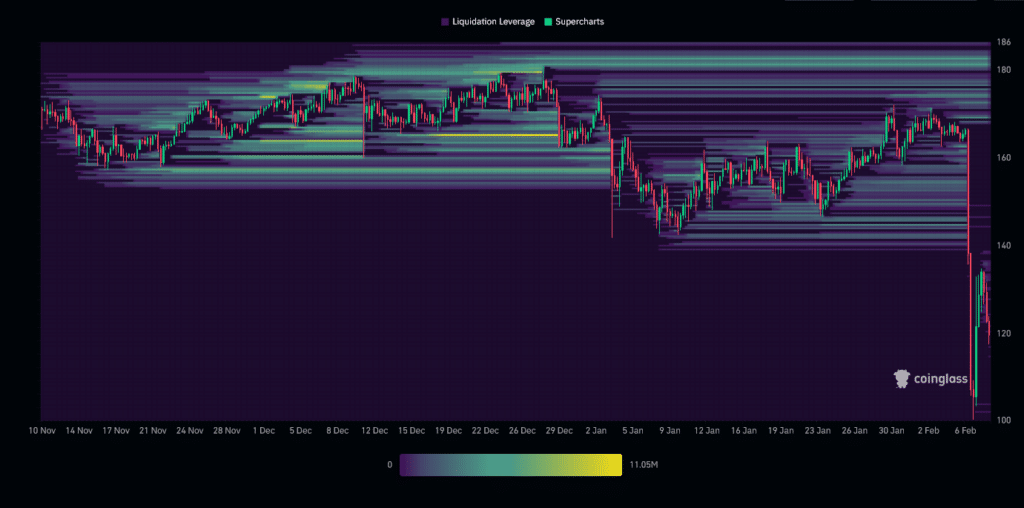

The XMR liquidation heatmap over the past three months reveals that the cryptocurrency has boldly traversed different liquidation zones. Currently, the most important zone is above the current price. The focus is on the $170 zone, and more importantly the $180 zone. When the market approaches these levels, a large number of orders can occur and increase the volatility of the cryptocurrency. These zones are therefore a major point of interest for investors.

Hypothesis on Monero Price (XMR)

- If Monero price manages to sustain above $96, we can expect a bullish recovery to the $174 threshold. If the bullish move continues, the next resistance to consider would be $200 or even $250. At this stage, this corresponds to an increase of nearly +97%.

- If Monero’s price fails to sustain above $96, it could return to $85. If the bearish move continues, the next level to consider would be around $60. At this stage, this means a drop of close to -53%.

conclusion

Monero, a cryptocurrency that has the advantage of enhancing privacy, sees this asset as a weakness. In fact, it has started to be boycotted by exchange platforms, which understandably worries investors and leads to a drop in prices. Nevertheless, cryptocurrencies seem to be facing this situation. To confirm or dispel current assumptions, it will be important to closely observe price reactions at various key levels. In each scenario, it is also important to remain alert to potential “fakeouts” or “squeezes” in the market. Finally, please keep in mind that these analyzes are based solely on technical criteria and that cryptocurrency prices can change rapidly based on other more fundamental factors as well.

Maximize your Cointribune experience with our Read to Earn program! Earn points and access exclusive benefits every time you read an article. Sign up now and get rewards.

Family Trading aims to help active traders raise capital in 2017 and help investors and traders invest with passion in the crypto asset market.

Disclaimer:

The content and products mentioned on this page are in no way endorsed by Cointribune and should not be construed as Cointribune being responsible for them.

Cointribune strives to provide its readers with all relevant information available, but cannot guarantee its accuracy or completeness. Before taking any action regarding our company, we ask our readers to contact us and accept full responsibility for their decisions. This article does not constitute investment advice or an offer or solicitation to purchase any products or services.

Investing in digital financial assets involves risks.

read more