Analysts at major US financial institution JP Morgan have expressed the view that there is still room for further price declines in the virtual currency Bitcoin (BTC). This rating comes after Bitcoin hit new highs earlier this month, but has since entered a downward trend.

According to data from CoinGecko, the price of Bitcoin has fallen by 7.2% over the past week. However, analysts at JPMorgan believe that cryptocurrencies are still overbought despite the sharp decline experienced last week. Their analysis is based on futures trading conditions, specifically the premium of futures prices over spot prices and current positioning in the futures market.

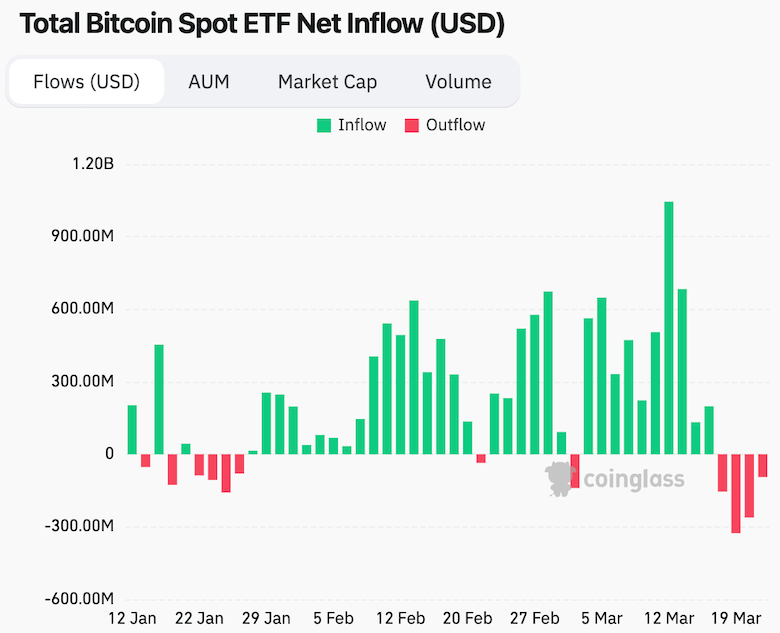

In addition to the overbought situation, analysts also note that inflows to Bitcoin spot exchange-traded funds (ETFs) have declined. In fact, net outflows have been ongoing since March 18th, with the highest single-day outflow of $320 million on March 19th.

The combination of overbought conditions and waning investor interest, as evidenced by outflows from Bitcoin ETFs, led JPMorgan analysts to conclude that Bitcoin prices could fall further. . As the cryptocurrency market continues to evolve, investors will be closely monitoring these developments to assess the future trajectory of Bitcoin and other digital assets.

Bitcoin prices continue to be under downward pressure, with JPMorgan analysts saying profit-taking is likely to continue in the coming weeks. This prediction comes as the cryptocurrency market prepares for the highly anticipated Bitcoin halving event scheduled for April.

Bitcoin's halving, which occurs approximately every four years, is a key feature of the cryptocurrency's design. During this event, the rewards given to Bitcoin miners for validating transactions will be cut in half, effectively reducing the rate at which new Bitcoins are put into circulation.

Historically, Bitcoin halvings have been associated with price volatility and increased speculation. Analysts at JPMorgan suggest that many investors who have benefited from the recent surge in Bitcoin prices may be inclined to sell their holdings ahead of the halving to lock in profits. are doing. This profit-taking behavior could put further downward pressure on the price of cryptocurrencies.

Bitcoin price prediction by JP Morgan

JP Morgan predicts that the price of Bitcoin could fall to $42,000 after the halving.

In a recent analysis, JPMorgan predicted that the price of Bitcoin could potentially fall to around $42,000 after the halving event scheduled for April. This prediction is based on the bank's assessment of Bitcoin's production costs, also known as mining costs.

Analysts at JPMorgan observe that historically Bitcoin's manufacturing cost has served as a floor for its price. In other words, the price of Bitcoin tends to exceed the cost miners incur to produce new coins. This relationship is likely due to the fact that miners are unlikely to sell their Bitcoin holdings below their production costs, and doing so may result in financial losses.

Looking ahead to the impending halving event, JPMorgan analysts estimate that the reduction in mining rewards will effectively reduce the cost of producing Bitcoin to around $42,000. This prediction suggests that Bitcoin price could fall to this level as it becomes a new lower bound based on mining costs.

According to current data from MacroMicro, the current production cost of Bitcoin is just under $50,000. This suggests that a halving event could lead to a significant reduction in production costs, which in turn could put downward pressure on Bitcoin prices.

conclusion

In conclusion, JP Morgan analysts expressed a cautious outlook on Bitcoin's near-term price outlook. They highlight the cryptocurrency's overbought status, declining investor interest, and the possibility of continued profit-taking ahead of the April halving, which could put further downward pressure on Bitcoin prices. suggested sex. Additionally, the bank's analysis of the historical relationship between production costs and Bitcoin's price floor suggests that the upcoming halving could lead to a significant decline in the value of the cryptocurrency, which is expected. The potential target could be $42,000 based on mining costs.