Robert Mitchnick, BlackRock's head of digital assets, has signaled low interest in Ethereum exchange-traded funds (ETFs) from his company's customer base, in stark contrast to the growing demand for Bitcoin. Ta.

The revelation was announced during the Bitcoin Investor Day conference in New York, where Mitchnick shared insights into the company's digital asset strategy and acceptance among investors.

Not interested in Ethereum ETF

Despite the growing interest in various cryptocurrencies, BlackRock's customers have a noticeable preference for Bitcoin, with Ethereum being relegated to the sidelines. Mitchnick's comments reflect a critical assessment of demand within the crypto market, stating that aside from Bitcoin, demand for other cryptocurrencies, including Ethereum, remains lukewarm at best. It suggests something.

“With our customer base, I would say by far Bitcoin is the biggest focus, with a little focus on Ethereum as well,” Mitchnick said.

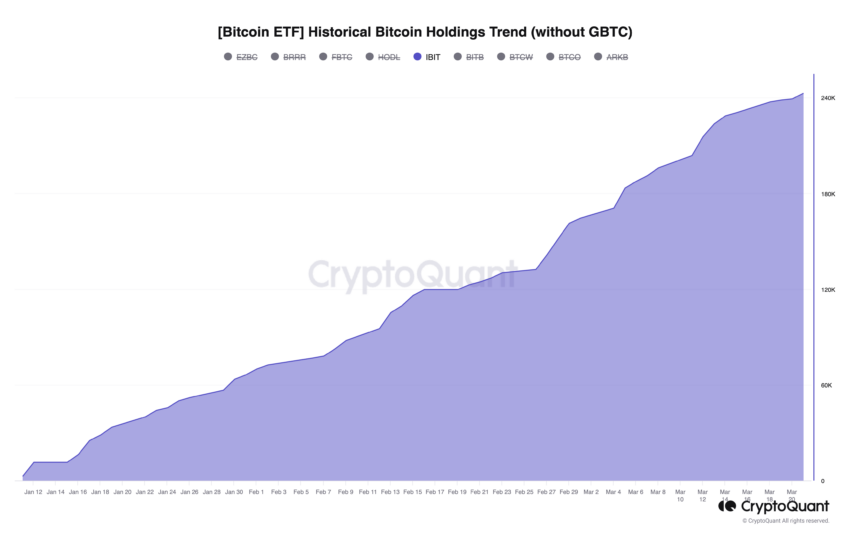

BlackRock's strategic moves in the cryptocurrency market are attracting attention. Especially following the successful launch of the iShares Bitcoin ETF (IBIT) earlier this year. With an impressive $15 billion in assets, the fund's rapid rise to become one of the top five ETFs on the market reflects strong investor interest in Bitcoin.

This is in sharp contrast to the “very, very little” interest in the potential of an Ethereum ETF.

Still, BlackRock's approach to cryptocurrencies has been both enthusiastic and cautious. For example, the launch of his $100 million Money Market fund on the Ethereum blockchain highlighted unforeseen challenges in operating within the crypto market. BlackRock's Ethereum wallet, intended for legitimate transactions, quickly became a magnet for a range of low-quality meme coins and NFTs.

The incident highlighted the legal and operational challenges associated with implementing blockchain technology and prompted a reassessment of strategies for managing and protecting digital assets.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.