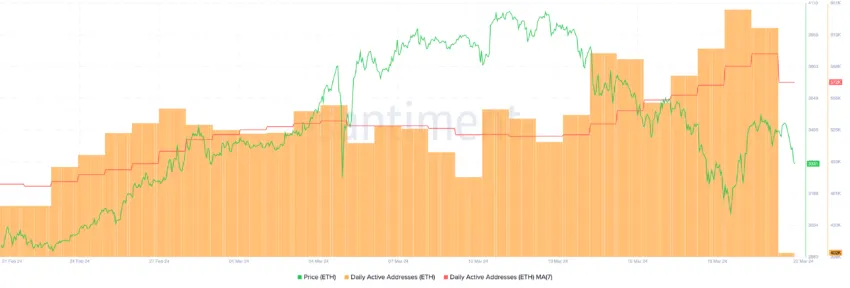

Despite the recent correction in Ethereum (ETH) price, Ethereum daily active addresses continue to increase, suggesting continued interest and engagement within the network. This discrepancy between price fluctuations and network activity raises questions about the immediate future of ETH price.

As the NUPL data shows, ETH's move into the “Belief-Deny” zone, combined with the EMA line suggesting a potential stage of consolidation or further correction, raises a crucial question: What is the ETH price? Will it become stable during the integration stage, or is it still in the process of additional modifications?

Despite recent corrections, daily active addresses are still increasing

From February 22nd to March 11th, the price of ETH saw a significant increase of 36.52%, while daily active addresses increased from 449,000 to 545,000, marking a period of solid growth and engagement within the Ethereum network. highlighted. However, the trend recently changed as the price of ETH underwent a correction, falling from around $4,000 on March 13th to $3,400 by March 21st.

Historically, there has been a significant correlation between the number of active addresses on the Ethereum network and the price of ETH, suggesting that active network participation often reflects price movements. However, last week saw a departure from this pattern.

Despite the price correction, Ethereum's daily active addresses continued to grow, increasing from 540,000 to 626,000 between March 14 and March 21.

This divergence may suggest that increased user activity and sustained engagement on the Ethereum network may be able to mitigate sharp price corrections. Instead of witnessing a strong recession, an increase in the number of daily active addresses and continued network activity could provide enough support to stabilize ETH price, making the market stance more solid in the face of a correction. It suggests that.

read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum’s NUPL metrics fluctuate

ETH's Net Unrealized Gain/Loss (NUPL) indicator has fluctuated between “optimism-anxiety” and “belief-denial” states, with a significant portion of ETH investors viewing their holdings in a positive light. It suggests that you are aware of it.

This recognition shows growing confidence and optimism in Ethereum's value and its future potential. NUPL metrics provide a comprehensive view of the financial health and investor sentiment of the entire network by measuring unrealized gains and losses across Ethereum wallet addresses.

This oscillation between optimism and belief suggests the community's expectation that it will closely monitor price movements to strategize its next move and may stabilize prices through prudent trading actions. . If NUPL consistently trends towards “optimism – anxiety”, it would signal the end of the recent market correction and signal a period of recovery and stabilization for ETH price as investor sentiment hardens in anticipation of Ethereum’s upward trajectory. may suggest.

ETH price prediction: $3,000 next?

ETH price chart reveals important movements. ETH's short-term exponential moving average (EMA) has recently fallen below its long-term EMA, and all have converged near the current price level. This pattern usually signals a moment of decision regarding the future price direction of the asset.

When the short-term EMA falls below the long-term EMA, it often signals a shift towards bearish sentiment and indicates that recent prices have been lower than average, which can portend a downtrend.

EMA is designed to be a more sensitive measure of an asset's trend by emphasizing recent price data over older prices. This sensitivity to new market data makes the EMA particularly useful for traders who want to gauge short-term market momentum and identify potential trend reversals.

Unlike simple moving averages, EMAs adapt more quickly to price changes and provide a nuanced view of market dynamics, helping investors make informed decisions based on the latest trends.

read more: What is Wrapped Ethereum (WETH)?

If this bearish trend occurs, as the EMA line suggests, ETH price could soon test a key support zone at the $3,000 mark.

However, ETH is also very sensitive to news and developments within the ecosystem. For example, positive news such as developments regarding the approval of the Ethereum ETF could quickly change investor sentiment and push the price back towards $4,000 or more.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.