This week's economic calendar is also busy, with the Federal Reserve's interest rate decision set to determine the direction of future rate cuts. Additionally, the crypto market has been recovering recently, but will this week's economic events halt that progress?

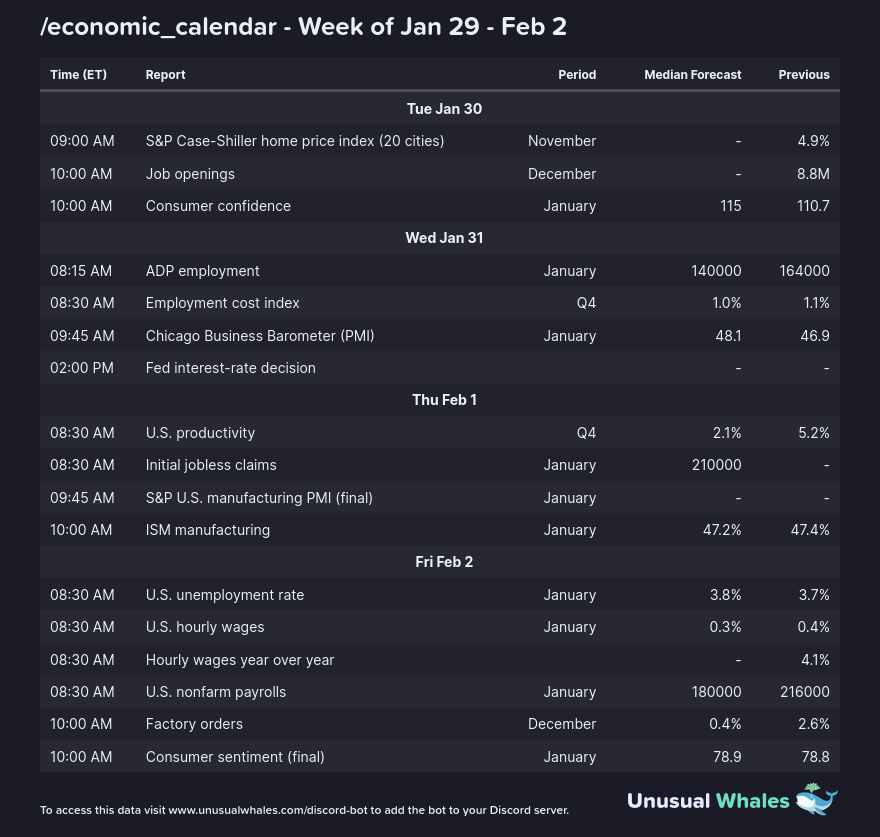

The biggest event on this week's economic calendar is the U.S. central bank's interest rate policy meeting on January 31st.

Impact on interest rates

The Consumer Confidence Report is scheduled to be released on Tuesday, January 30th, and is expected to improve slightly from last month. Because consumer spending accounts for about 70% of economic activity in the United States, economists pay close attention to measuring how it affects the overall economy.

Additionally, the Department of Labor will release December U.S. jobs statistics on Tuesday.

But all eyes are on Jerome Powell and the Fed on Wednesday. He is scheduled to speak at a press conference. The central bank is expected to keep its key short-term interest rate unchanged for the fourth consecutive meeting at 5.25-5.5%, the highest level in 22 years.

Some analysts believe the Fed could begin lowering benchmark interest rates as early as March. Therefore, it is possible that they will make that decision after this week's meeting.

read more: How to protect yourself from inflation using cryptocurrencies

Goldman Sachs economist David Mericle wrote in a note to clients:

“(The Fed) will likely aim to hold off on its March rate cut without sending a definitive signal.”

Meanwhile, Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management, said he expected Powell to be “patient” in cutting rates.

“That's because, in his view, the economy looks strong and the Fed has time to be patient and make sure the true long-term trend in inflation is coming down.”

The market reportedly expects six rate cuts in the range of 3.75% to 4% in 2024, double the amount the Fed predicted last month.

Nevertheless, the consumer price index, a broad measure of inflation, rose more than the Fed's target last month. With inflation concerns still lingering, the Fed could keep interest rates high for a longer period of time.

Impact on the virtual currency market

Generally, high interest rates are not good for the cryptocurrency market. Savers can earn higher returns on safe investments such as cash deposits, which typically result in higher debt repayments. This means fewer funds are available for high-risk investments such as cryptocurrencies.

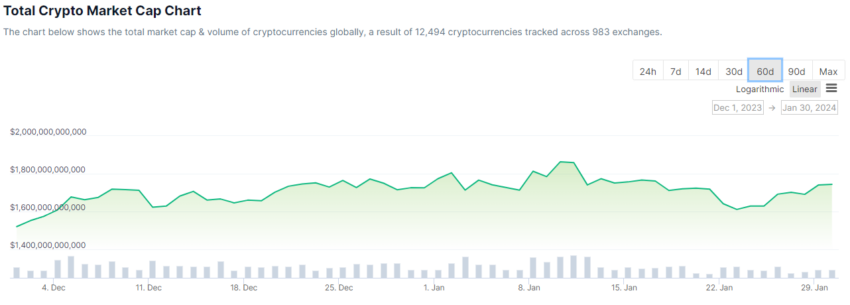

The cryptocurrency market rebounded 2.8% on the day, reaching $1.75 trillion at the time of writing.

Bitcoin led the way, rising 2.6% to $43,533, while Ethereum rose 1.7% to $2,313.

Other altcoins showing solid gains so far include Solana, which rose 5.3%, Cardano 7.6%, and Dogecoin, which rose over 3% on the day.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.