BlackRock, the world's largest asset management company, has increased the amount of Bitcoin on its balance sheet.

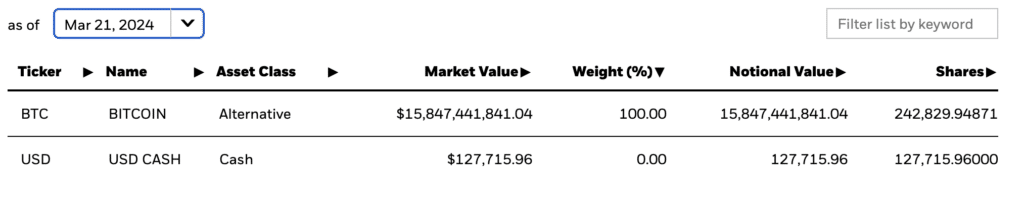

According to its website, BlackRock has increased the amount of Bitcoin (BTC) in iShares Bitcoin Trust (IBIT) to 242,829. The fund's Spot Bitcoin ETF has assets under management of $15.5 billion at current exchange rates.

FOX journalist Eleanor Terret also reported that BlackRock's head of digital assets, Robert Mitchnick, indicated that the company's customers' top priority is Bitcoin, followed by Ethereum.

Mitchnick emphasized that while the crypto community expects more crypto products from BlackRock, this is different from the company's current focus.

“The crypto community would like to see the long tail of BlackRock's other crypto products, but that's not where our focus is,” he says.

Robert Mitchnick, Head of Digital Assets at BlackRock

On March 21, IBIT ranked No. 1 in terms of capital inflows, according to SoSo Value. In the balance sheet he added $ 233.4 million, and the amount of funds under management amounted to $ 13.3 billion. In second place was Bitwise Asset Management's investment product with $12.1 million, and in third place was Valkyrie Bitcoin Fund (BRRR) with $4.72 million.

At the same time, total daily capital outflows in the Spot Bitcoin ETF sector reached $93.8 million. The negative trend continued for the fourth consecutive day as outflows from Grayscale Investments' GBTC fund increased by $358.7 million. From March 18 to March 21, that amount increased to more than $1.8 billion, bringing total outflows to more than $835 million.