(Bloomberg) — Bitcoin has become easier to trade on U.S. crypto exchanges compared to foreign platforms, but that’s due to the impact of new exchange-traded funds (ETFs) on the nation’s largest digital asset. This is due to changes in

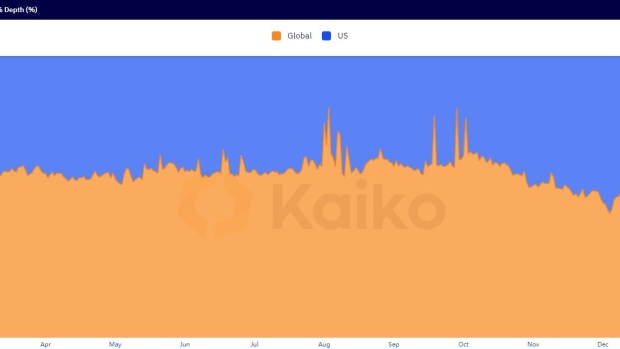

U.S. trading venues have, on average, accounted for almost half of the buys and sells within 2% of Bitcoin's midpoint so far this year, according to data from research firm Kaiko, during which time U.S. spot ETFs It's past the start-up period.

Based on this metric, non-US platforms accounted for the largest share of the Bitcoin market depth in 2023. Increasing the number of bids and asks within 2% of the mid-price increases liquidity, allowing orders to be executed without excessive price fluctuations.

Nine US Bitcoin ETFs debuted on January 11th, with the more than 10-year-old Grayscale Bitcoin Trust converting to an ETF on the same day. The group, which also includes investments from BlackRock Inc. and Fidelity Investments, has attracted net investor inflows of $5 billion to date. The anticipation and development of these products has caused the price of Bitcoin to double in the past 12 months.

“Improving liquidity”

“Bitcoin’s positive price movement was most pronounced during U.S. trading hours as market participants took advantage of increased liquidity,” said Matthew Siegel, head of digital asset research at VanEck. This was especially noticeable in the hours leading up to the U.S. market closing at 4 p.m., he said. One of the spot ETF issuers.

Some observers see the Spot Bitcoin ETF as an inflection point, arguing that the adoption of cryptocurrencies will expand. Optimists expect digital asset trading volumes to recover from the depressed levels left behind after the collapse of the FTX exchange and its sister hedge fund Alameda Research during the 2022 bear market. .

The effects of ETFs are already visible. For example, 57% of Bitcoin trades against the US dollar now take place during US market hours, compared to 48% a year ago, according to Desislava Ober, senior analyst at Kaiko.

Open interest

In the derivatives sector, open interest in Chicago-based CME Group's Bitcoin futures market is rising toward record levels reached when the ETF was approved. The increase in outstanding contracts indicates increased interest among U.S. financial institutions in crypto-related exposures and hedging.

The new ETF calculates its net asset value against a proprietary benchmark at the U.S. closing price each weekday. This is a process that helps in Bitcoin price discovery.

Such a “transparent and reliable reference point” could allow investors to “pool large trades at specified times,” potentially reducing the impact on the market, Cryptocurrency Prime said. said David Rowant, head of research at broker FalconX.

Rawant said investors should closely monitor ETF inflows, as “there is an increasing likelihood that prices will decline as buying flows recede.”

As of 7:37 a.m. Wednesday in Singapore, Bitcoin was steady at $52,236, near its highest in more than two years.

(Updates last paragraph with market price.)

©2024 Bloomberg LP