Key takeout

- The strategy is to raise $500 million through preferred stocks to expand its Bitcoin holdings.

- Preferred stocks have a fixed dividend rate of 10% per year, with potential increases if unpaid.

Please share this article

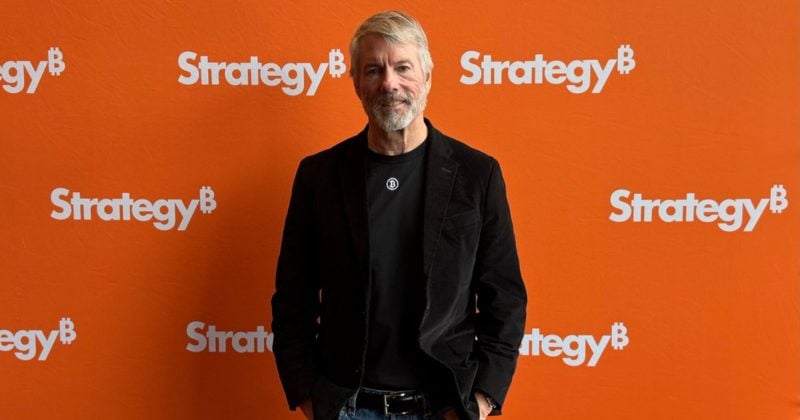

Strategy, the world's largest corporate owner of Bitcoin, announced on Tuesday the launch of STRF (Stride), a new permanent preferred stock offer available to institutional and select retail investors.

The strategy announced today its launch $ strf (“Strif”), a new permanent preferred stock offering, available to institutional investors, and selects non-institutional investors. Click here for more information. $MSTRhttps://t.co/yxnmogcegq

– Strategy (@strategy) March 18, 2025

The strategy also revealed plans to provide 5 million shares of Series A's permanent contested preferred stock in the public offering to raise funds for Bitcoin purchases and working capital.

Preferred Stocks will have a fixed dividend rate of 10% per year for each quarterly paid starting June 30, 2025. If dividends are not paid on schedule, the combined dividend accumulates at an initial rate of 11% per year and increases to 100 basis points per year until the full amount is paid.

The initial liquidation priority is $100 per share, with daily adjustments based on market prices and trading activities. The strategy maintains the right to redeem all shares if the shares are issued less than 25% of the shares issued or for a specific tax event.

Morgan Stanley, Barclays Capital, Citigroup Global Markets and Moelis & Company are co-book running managers for the offering, made through an effective shelf registration statement submitted to the SEC.

According to the strategy, on Monday, he said he purchased 130 Bitcoins at an average price per token between March 10th and 16th.

The latest purchase reported in SEC filing brings the strategy's total Bitcoin holdings to 499,226 BTC, valued at around $41.6 billion.

The acquisition generated approximately $10.7 million from the sale of 123,000 shares of its permanent strike preferred stock in the 8.00% Series A. As of the latest update, the strategy holds more than 2% of the total Bitcoin supply.

Please share this article