Key takeout

- NASDAQ's Crypto ETF tracks mainly Bitcoin and Ethereum and was launched with a $70 million asset.

- The ETF will charge an annual management fee of 0.25%, which will increase to 0.50% from 2025 onwards.

Please share this article

Hashdex, a well-known player in the Crypto ETF sector, is seeking approval from the SEC to expand the Nasdaq Crypto Index US ETF, including avalanche (avax), avalanche (avax), litecoin (ltc), avalanche (sol), Cardano (ADA), ChainLink (Link), Avalanche (Avax), Litecoin (LTC) and Uniswap (Uni).

The ETF, which is trading under the Ticker NCIQ, was officially launched on February 13th after securing approval from the SEC. The fund is also the first dual-bitcoin echo ETF in the United States.

The ETF will charge an administrative fee of 0.25% each year until December 31, 2025, and will then increase to 0.5%. Coinbase Custody and Bitgo Trust will act as the cryptocurrency manager for the fund.

Currently, the ETF holds around 88% of Bitcoin and around 12% of Ethereum, with approximately $70 million in total net worth.

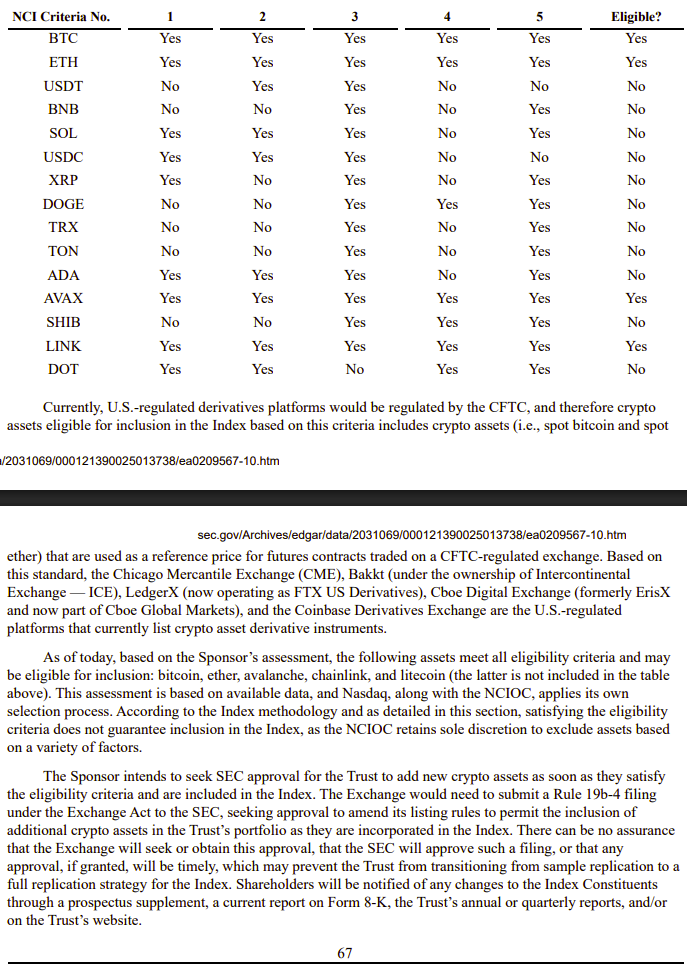

In a statement regarding the launch of the ETF, HashDex said that Crypto Assets must maintain trading, custody support on at least two core crypto platforms, maintain minimum trading volumes, and meet several criteria that are eligible to be included in the index, including being listed on the US regulated Crypto Asset trading or derivative platforms.

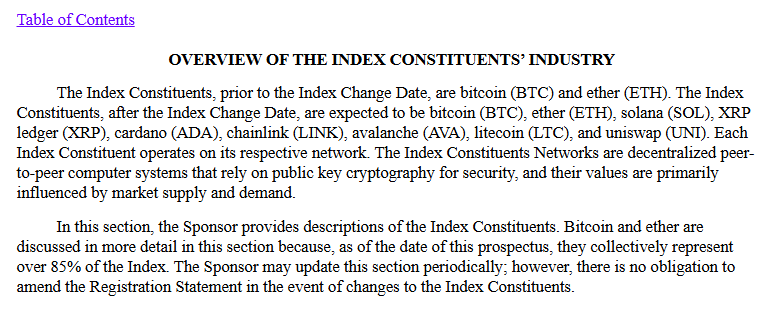

Filing has explained in detail the valuation of the top 15 crypto assets by market capitalization as of October 23, 2024 against five “NCI standards.” Only BTC, ETH, AVA, LINK and LTC met all the criteria of the time.

Hashdex also noted that new crypto assets are considered to be included only if they meet the prescribed “eligibility criteria” outlined in the submission.

The proposal came less than a month after Hashdex launched the Hashdex NASDAQ XRP Index Fund, the world's first spot XRP ETF, with approval from the Brazilian Securities and Exchange Commission (CVM).

Please share this article