Key takeout

- Franklin Templeton has applied for an XRP-centric ETF with the SEC.

- The proposed XRP ETF is intended to track the price performance of tokens and will be traded on CBOE BZX Exchange.

Please share this article

Chicago Board Options BZX Exchange (CBOE) has filed the 19B-4 form on behalf of Franklin Templeton and proposed changes to rules to list and trade stocks in the US Franklin XRP ETF.

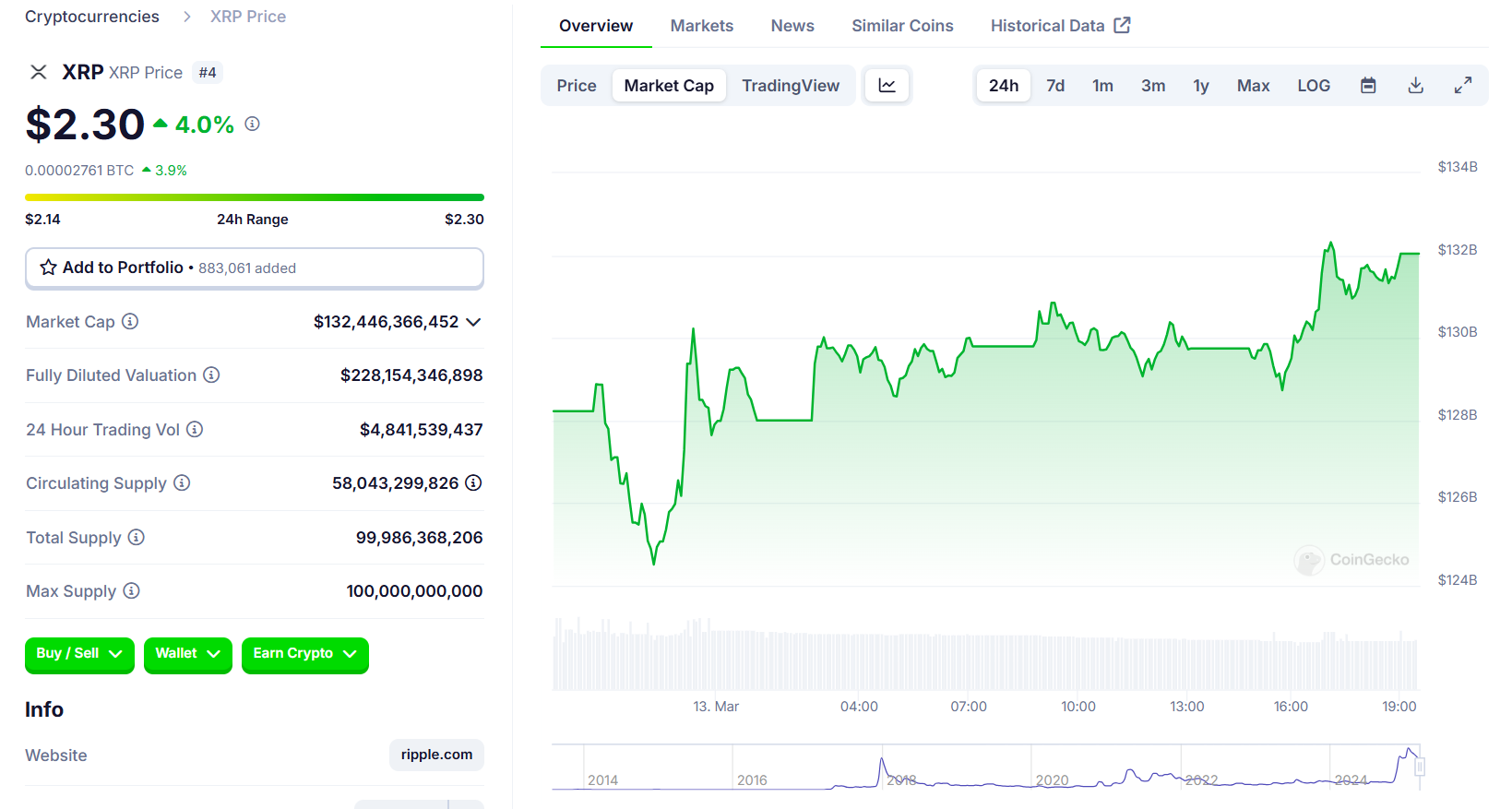

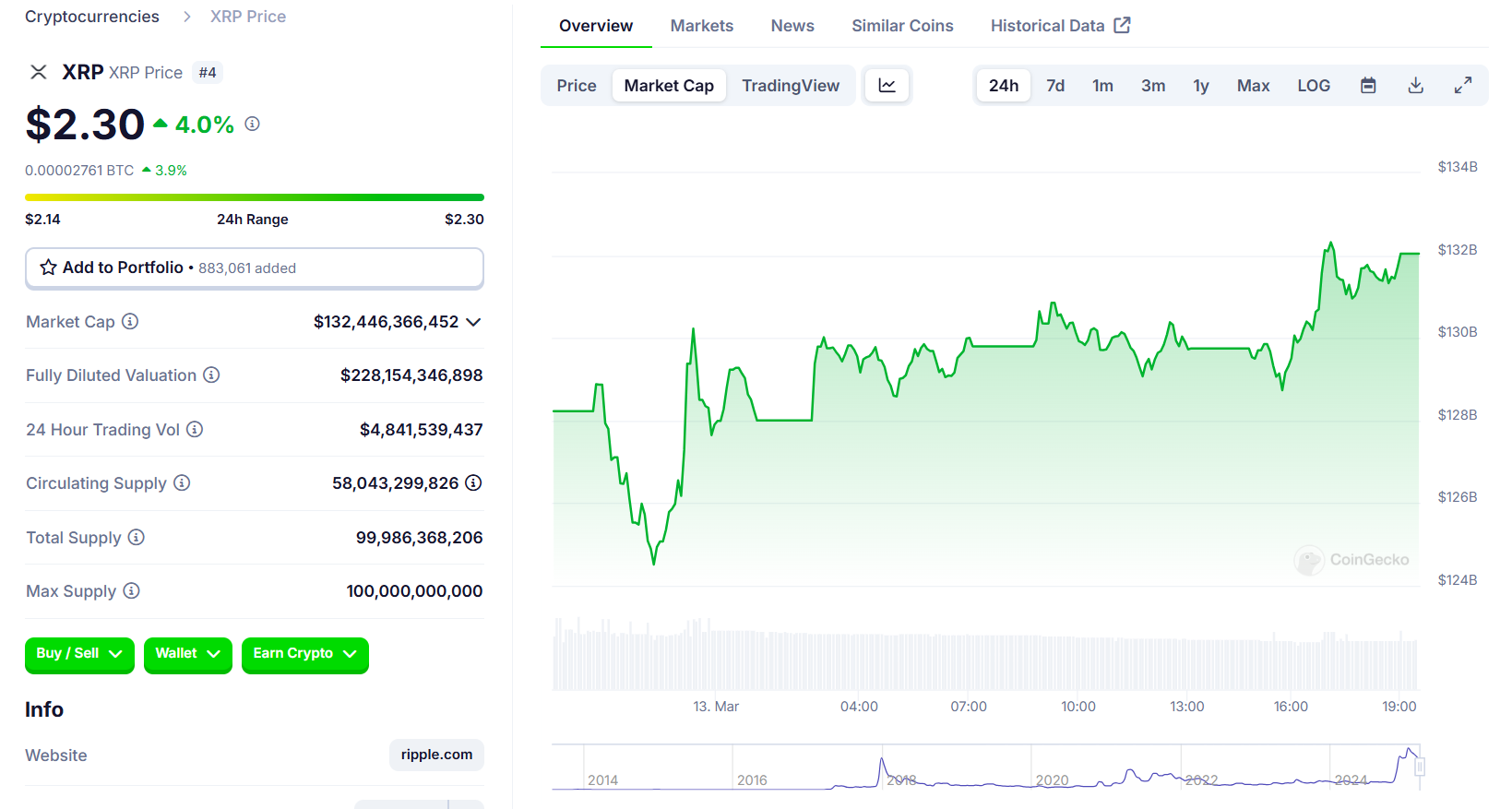

The filing came shortly after Franklin submitted its proposal to SES to SES and to the SEC for an investment product focused on XRP, the fourth largest cryptocurrency by market capitalization. Digital assets skyrocketed 2% to $2.3 after the SEC filed, according to Coingecko data.

The leading asset manager overseeing $1.6 trillion in client assets has joined the growing list of key companies seeking approval for ETFs related to crypto assets beyond Bitcoin and Ethereum.

The proposed Franklin XRP ETF will be traded on the CBOE BZX exchange, with Coinbase Custody, which serves as custodians with XRP. The fund aims to track XRP price performance and provides investors with exposure to digital assets without the need for direct custody.

The filing follows Franklin Templeton's recent expansion to Solana ETF filing and Crypto ETF, which previously launched Spot Bitcoin and Ethereum ETFs. Other companies awaiting regulatory approval for the XRP ETF proposal include Bitwise, 21shares, Canary Capital, Grayscale, and WisdomTree.

ETF analyst James Seyffart noted that delays are a standard procedure, but by October 2025 these Altcoin ETFs had “relatively high approval potential.”

Please share this article