Key takeout

- US inflation in February showed a decline, with annual CPI falling from the past 3% to 2.8%.

- Economists warn that Trump's tariffs could reverse the trend in cooling inflation, leading to further price increases.

Please share this article

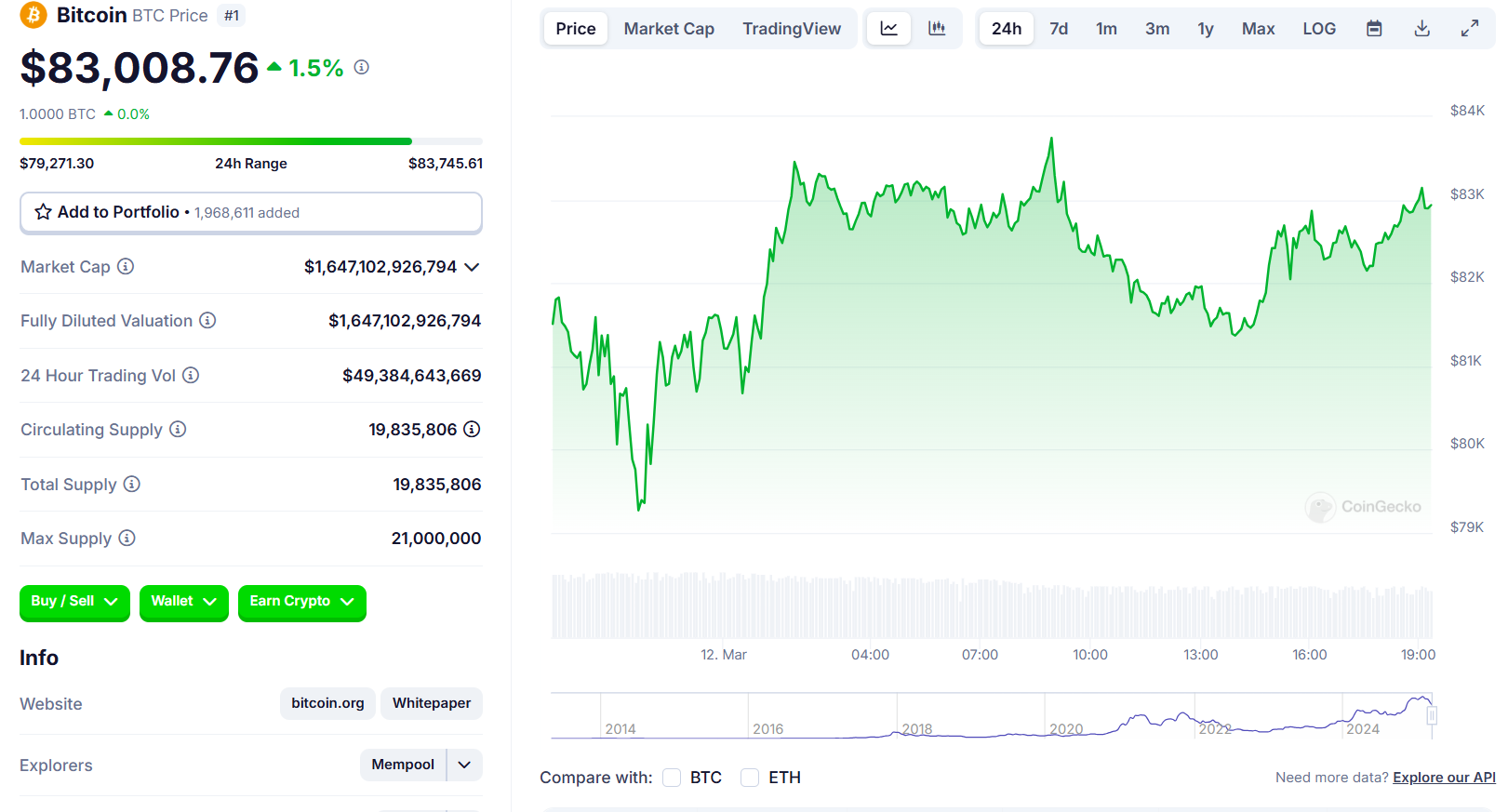

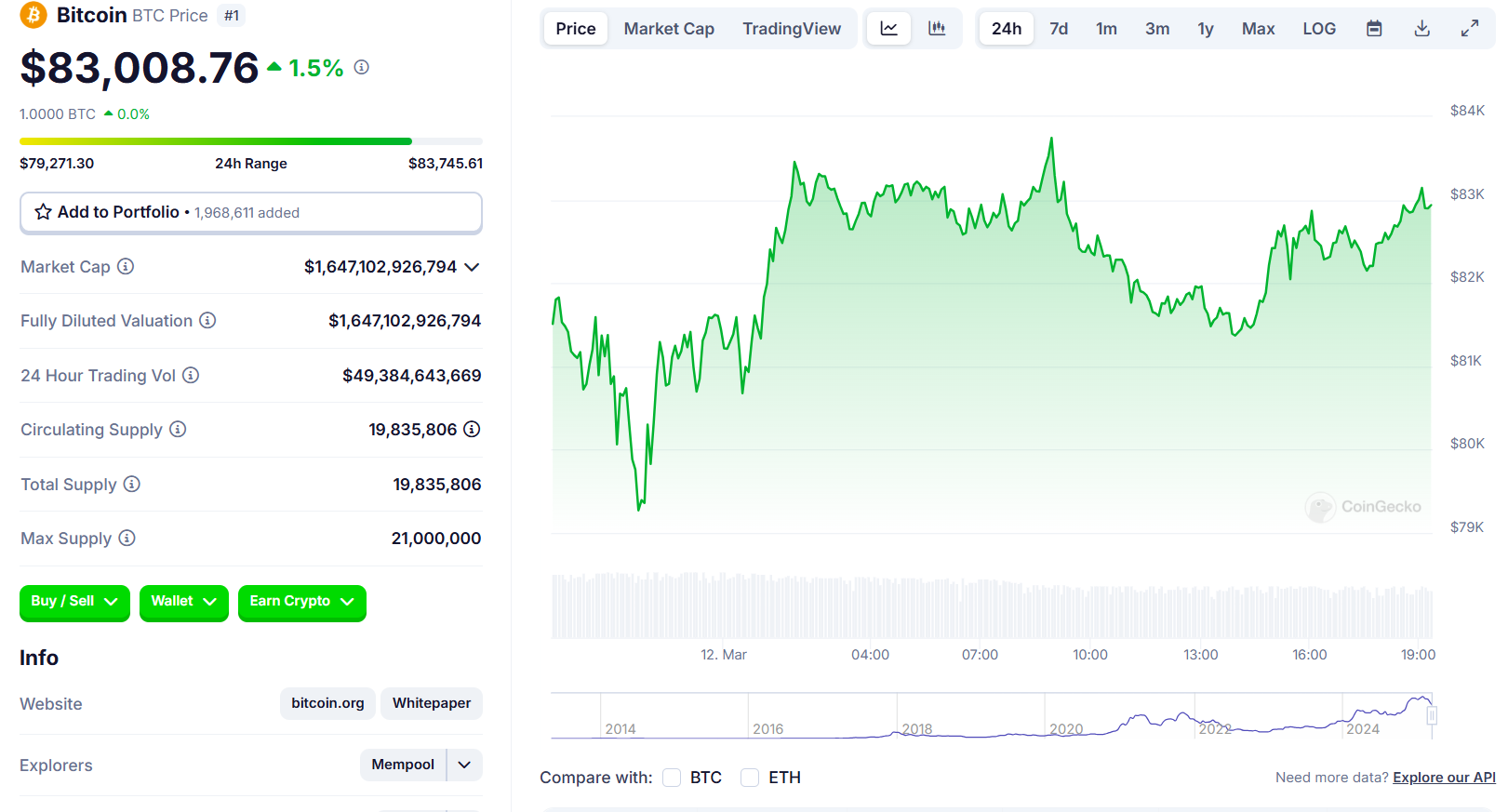

According to new CPI data released on Wednesday, consumer prices rose 0.2% between January and February, with annual inflation rates reaching 2.8%, down from 3% the previous month. Bitcoin exceeded $84,000, in response to lower than expected data.

Core CPI, which excludes volatile foods and energy prices, increased by 0.2% per month, with an annual rate of 3.1% below 3.3% in January.

But economists have warned that President Trump's tariff policies could raise prices in the coming months.

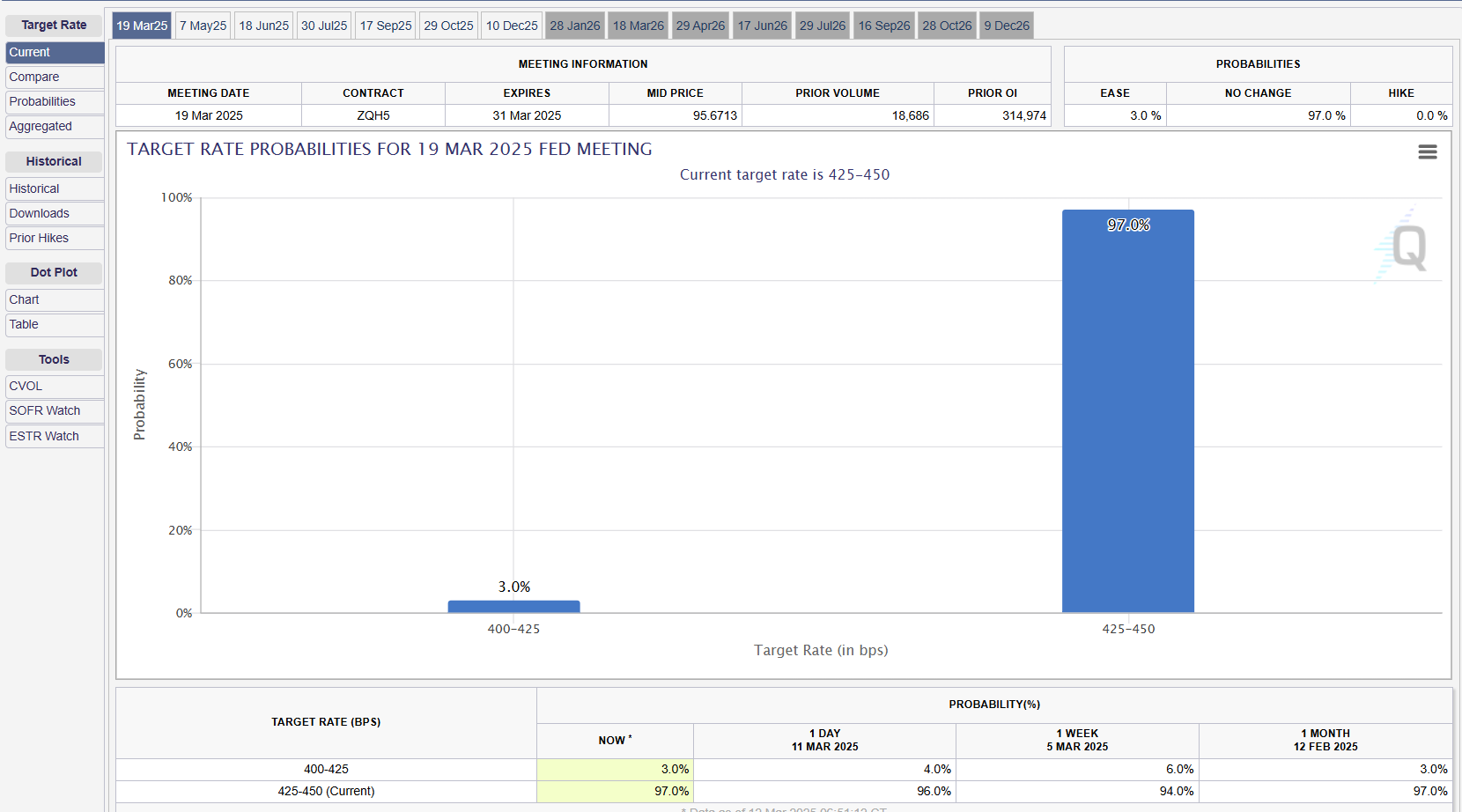

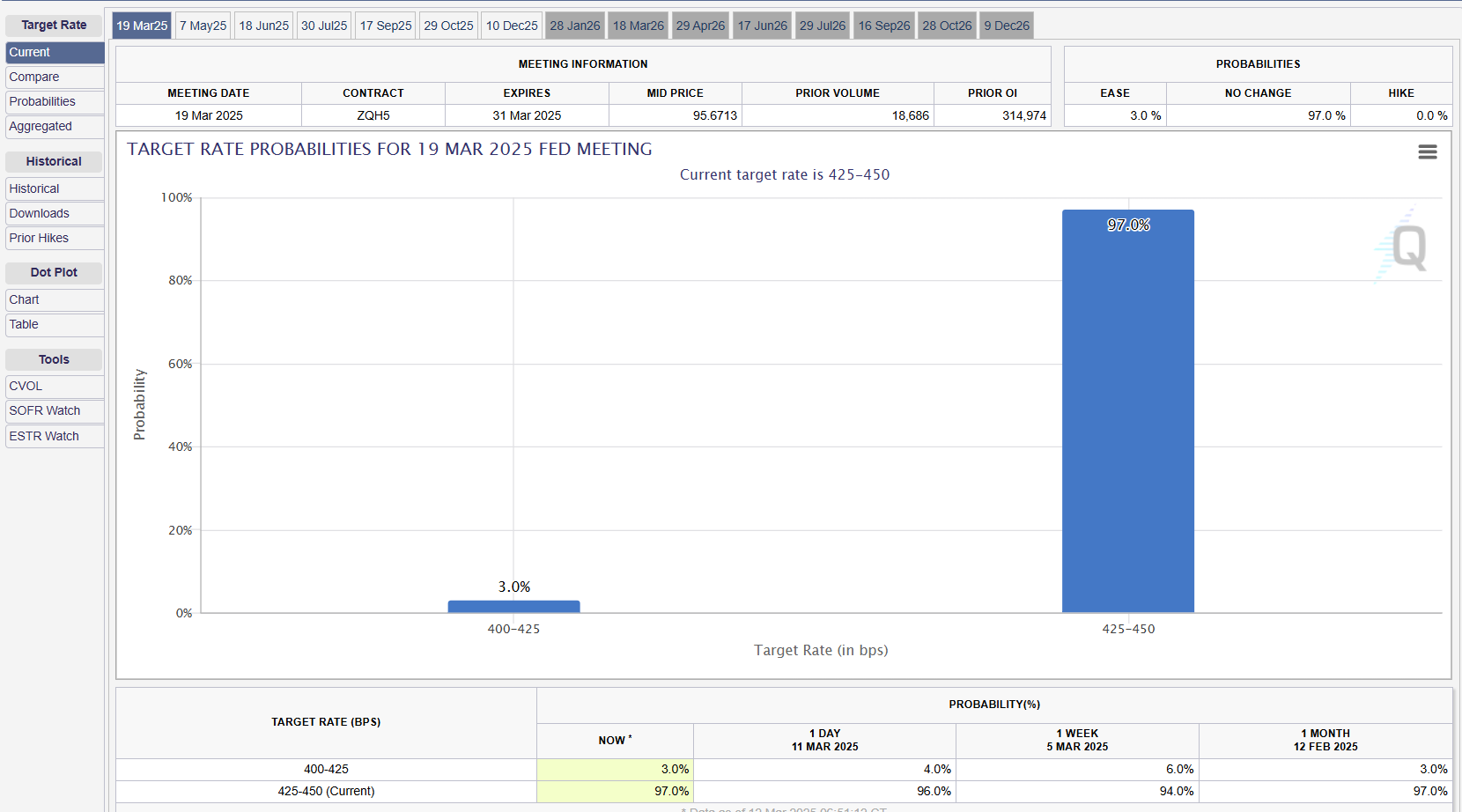

This is because the inflation report broadly hopes that the market will hold interest rates consistently in the near future. As of the latest data from CME Group's FedWatch tool, traders had priced the central bank meeting next week as a low chance of interest rate reductions.

Fed Chair Jerome Powell warned last Friday that Trump enacted tariffs could lead to a string of price increases, potentially allowing consumers to predict higher inflation.

Inflation rates appear to be stagnant after previous declines, stubbornly surpassing the Fed's target. Long-term inflation expectations are relatively stable, but short-term expectations are rising, partly due to tariff concerns.

The Fed, which had been implementing interest rate cuts, suspended monetary policy adjustments and stabilized federal funding fees from 4.25%-4.5%.

Unless inflation clearly aligns with the Fed's goals, the Fed will maintain a strict monetary policy. This allows investors to keep Bitcoin prices high as they weigh the potential for future interest rate reductions against ongoing economic uncertainty.

The observed resilience of Bitcoin to short-term macroeconomic changes indicates that its prices may not be heavily affected by inflation data alone. However, the general economic situation and investor sentiment can still affect its value.

Bitcoin has been traded over $83,000 after the release of inflation data and recovered below $80,000 from its recent DIP. For each Coingecko data, Crypto Asset has scored 1.5% in the last 24 hours.

Please share this article