Bitcoin price fluctuations are frequently assessed using on-chain metrics, technical indicators, and macroeconomic trends. However, one of the most undervalued but important factors in Bitcoin price action is global liquidity. Many investors may be misconstruing whether they are not fully utilizing this metric or how it affects the cyclical trends of BTC.

Impact on Bitcoin

With increasing discussion on platforms analyzing liquidity charts on platforms such as Twitter (X) and analysts, understanding the relationship between global liquidity and Bitcoin is equally important for traders and long-term investors. However, recent differences suggest that traditional interpretations may require a more nuanced approach.

Global M2 Money Supply refers to the sum of liquid money supplies, including cash, deposit checks, and easily converted nearby assets. Traditionally, as Global M2 expands, capital is seeking high-yield assets, including Bitcoin, stocks and commodities. Conversely, when M2 contracts, risk assets are often reduced in value due to stricter liquidity conditions.

View live charts 🔍

Historically, Bitcoin prices have followed a global M2 expansion that rises when liquidity increases and suffers during contraction. However, there was a deviation in this cycle. Despite the steady increase in global M2, Bitcoin price action shows a contradiction.

Changes from the previous year

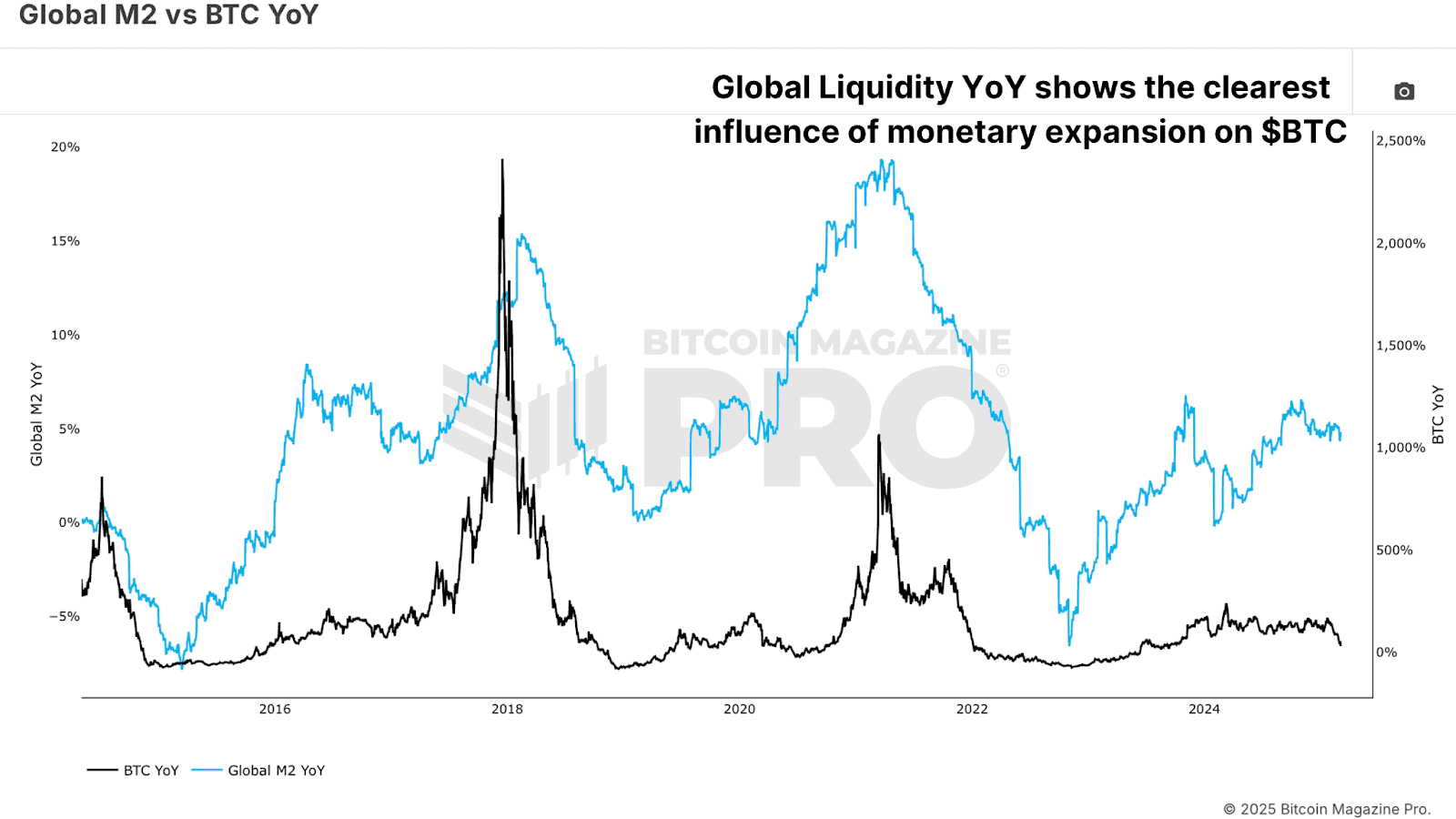

Rather than simply tracking the absolute value of the global M2, a more insightful approach is to analyse its year-over-year rate of change. This method explains the rate of liquidity expansion or contraction and reveals a more clear correlation with Bitcoin performance.

Comparing Bitcoin returns (Yoy) year-on-year with the global changes in M2 Yoi, there is a much stronger relationship. Bitcoin's strongest bull coincides with a period of rapid liquidity expansion, but contractions precede a price drop or long-term integration phase.

View live charts 🔍

For example, during the Bitcoin integration phase in early 2025, global M2 had steadily increased, but its rate of change remained flat. Only if the expansion of the M2 is significantly accelerated can Bitcoin break down towards new highs.

Liquidity delay

Another important observation is that global liquidity does not immediately affect Bitcoin. Research shows that Bitcoin is about 10 weeks behind global liquidity changes. By moving the global liquidity indicator forward ten weeks, the correlation with Bitcoin is greatly enhanced. However, optimization suggests that the most accurate lag is about 56-60 days, or about 2 months.

Bitcoin outlook

Throughout most of 2025, global liquidity was in the flattening phase following the massive expansion that pushed Bitcoin to a new high in late 2024. This flattening coincided with Bitcoin integration and retracement, about $80,000. However, if there is a historical trend, the recent revival of liquidity growth should lead to another leg of BTC by late March.

Conclusion

Global liquidity monitoring is an important macro indicator for predicting the trajectory of Bitcoin. However, rather than relying on static M2 data, focusing on its rate of change and understanding the delay effect of two months provides a much more accurate and predictive framework.

As the global economic situation evolves and central banks adjust their financial policies, Bitcoin price behavior continues to be affected by liquidity trends. The next few weeks will be extremely important. If global liquidity continues to accelerate with updated acceleration, Bitcoin may be ready for a big move.

Did you enjoy this? In our recent guide to mastering Bitcoin on-chain data, please go into detail about Bitcoin price shifts and market cycles.

Be ahead of Bitcoin price action with Bitcoin Magazine Pro, explore live data, charts, indicators and in-depth research.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.