Cryptocurrency prices rose slightly more than the first crypto summit at the White House.

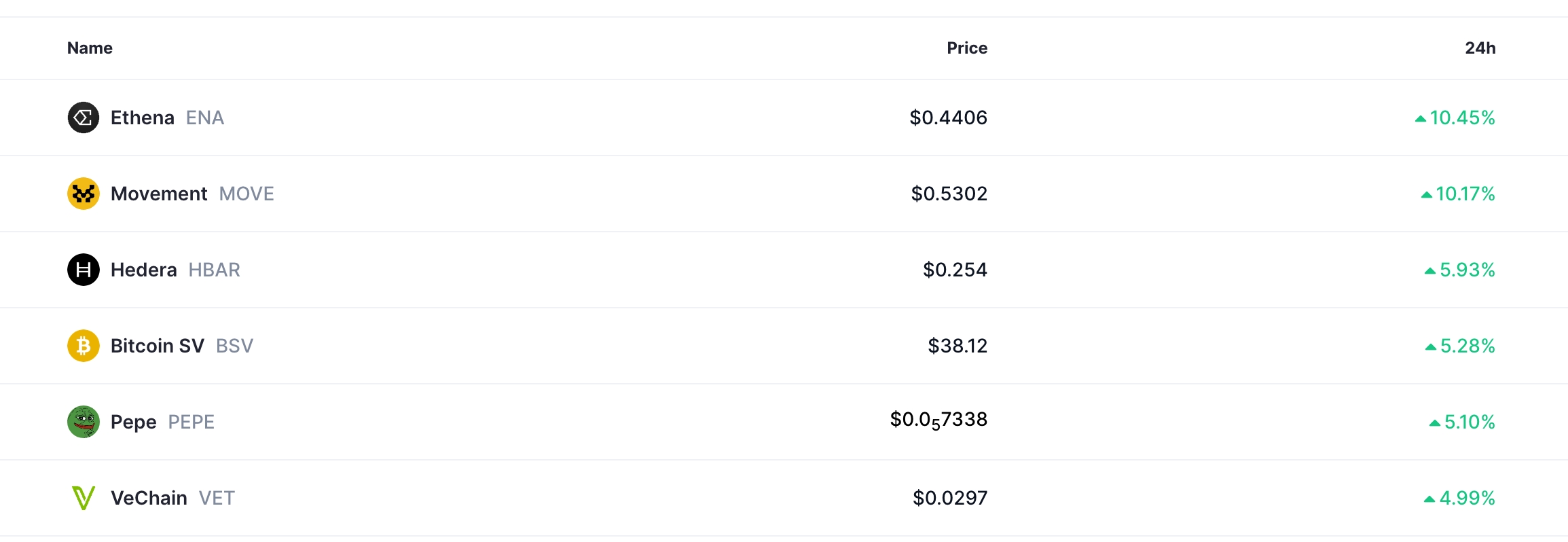

Bitcoin (BTC) rose to 90,200%, with popular altcoins such as Ethena (ENA), Movement (Movement), and Hedera Hashgraph (HBAR) jumping by more than 10%. Most of these coins are rallying with two digits this month from the lowest level.

The Crypto Summit is the day after Donald Trump signed an executive order creating a strategic Bitcoin Reserve. The order also created a US digital asset stockpile that manages other coins. Some of the top coins in the stockpile are Solana (SOL), Ripple (XRP), and Cardano (ADA).

The upcoming Crypto Summit will have some of the biggest players in the Crypto industry. Some of the most well-known confirmed guests are Brad Garlinghouse from Ripple, Michael Saylor of Strategy, JP Richardson of Exodus, and Brian Armstrong from Coinbase.

At the summit, these officials can have the Trump administration share their experiences and regulatory recommendations. The Trump administration has already done a lot for the industry, and the SEC has ended lawsuits against several companies, including Uniswap, Gemini, Kraken and Opensea.

Ideally, such a summit would lead to a rise in crypto prices due to the importance of the US government and friendly regulations.

Crypto could crash after Trump Summit

However, there is a risk that Bitcoin and other cryptocurrencies will crash after the summit. That's because of a situation known as buying rumors and selling news. In this case, investors usually buy the asset after a big event and throw it away when it happens.

A good example of this is what happened when Donald Trump won the election. The cryptocurrency then surged, erasing these profits when he was launched in January.

Similarly, Ethereum prices rose before the Spot ETF approval last September and then fell since.

The possible reason for DIP after the summit is that there is no new news from the summit. Moreover, Trump has already signed an executive order on Bitcoin Reserves and Cryptocurrency Stockpiles, and the SEC has begun improving its regulatory environment.

Additionally, macro-related risks still exist, such as Donald Trump's tariffs on the largest US trading partner.