After Donald Trump's World Liberty Financial made a significant investment in altcoins, the move from the recent decline has sparked speculation of the possibility that it could be encompassed by the government's strategic cryptocurrency reserve.

Amid escalating trade war concerns, after hitting a record low of $0.391121 on March 4, 2025, travel (movement) rebounded to the top of $0.505 on March 6, double-digit profits recorded around 29.1%.

According to a final check during the Asian afternoon session, that profit reached over 33% from the local low on Tuesday. Altcoin's market capitalization exceeded $1.15 billion, with daily trading almost tripling to over $258 million.

Today's profits have been sparked after President Donald Trump linked cryptographic project World Liberty Financial, and after the US president purchased $1.5 million worth of mobile tokens from a newly created multi-signed wallet.

With the White House Crypto Summit just a day away, Move has sparked speculation in the Crypto community that it could be part of the Crypto Strategy Preparation Plan, which recently revealed that President Trump would position the United States as the “crypto capital of the world.”

The summit, set for Friday, March 7th, will be chaired by venture capitalists David Sachs and Rep. Bohein. It is expected to bring together crypto founders, CEOs, investors and policymakers to discuss the future of US digital assets and mark another step in promoting Trump to make America a leader in digital finance.

As procrypt's sentiment is based on policy-making circles, investors seem to be bet that the move could also benefit from potential government-supported initiatives, particularly as it aligns with the narrative of “American Maids.”

With each data from Coinglass, demand from derivative traders has skyrocketed, and open interest in the Altcoin futures market has risen to $91 million, up from over 50% in the past day at the time of writing.

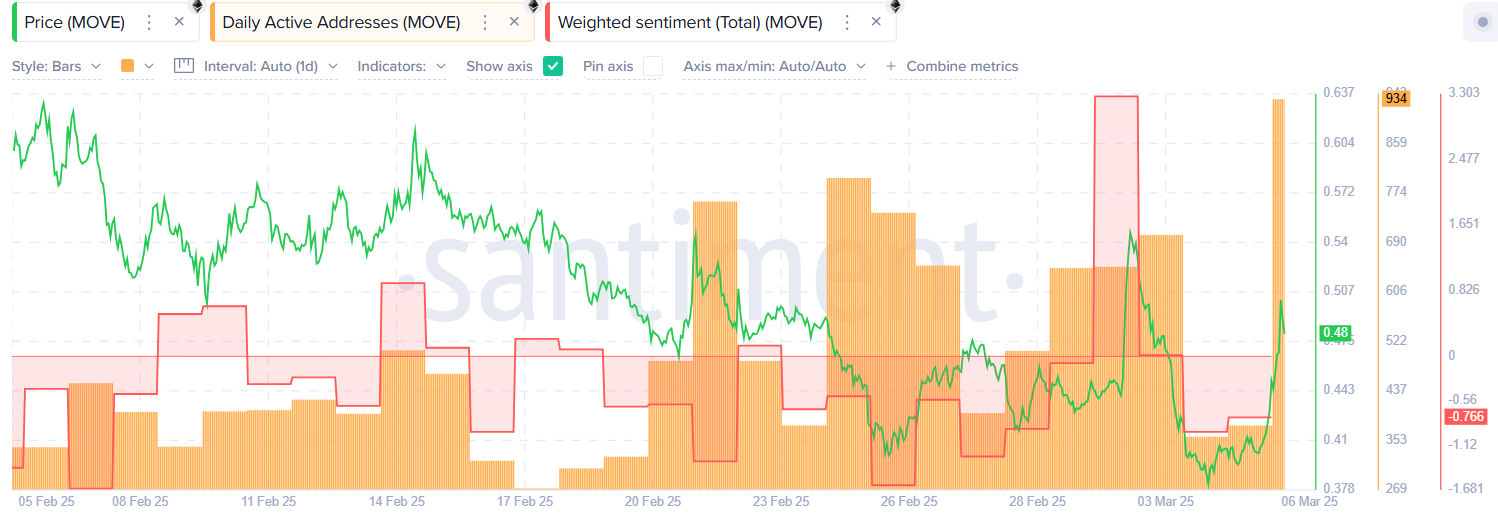

Meanwhile, Santiment data shows a 146% increase in daily active addresses. This is often seen during increased trading activities between holders.

The movement was a trend for X and Coingecko, despite the social sentiment being negative during the report. Usually, this means that prices have followed recent events.

Move price analysis

Technical metrics show that Altcoin is recovering from the bearish momentum that has been winning since early January this year.

The 4-hour/USDT price chart surpasses the descending trend line that traders consider to be the precursor of trend reversal, which has been formed since January 6th at lower highest and lower lowest values.

Move was trading near the Upper Bollinger Band, and new money was pouring into the market, suggesting strong buying pressure.

Also, the MACD line is pointed upwards, and while the MACD line remains above the price line, we see a reversal of the trend, especially as Altcoin trading volume has skyrocketed over the past day.

Further Coinglass data shows investors are accumulating movements due to net outflows from exchanges totaling nearly $11.5 million in the last 12 days, indicating that investors believe in potential future profits.

Therefore, the move could potentially gather psychological resistance at $0.55, a level that could not be broken on March 3rd. Once above this level, my next move target was $0.68, which I struggled with breaking multiple times in early February.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.