Key takeout

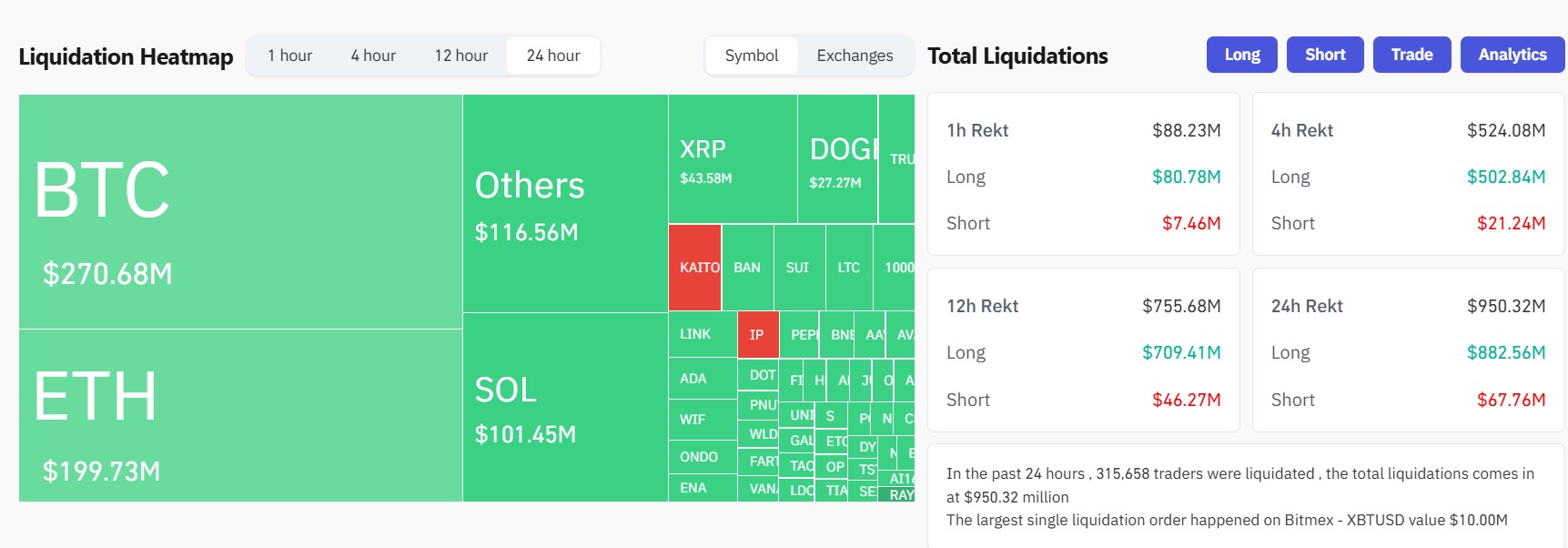

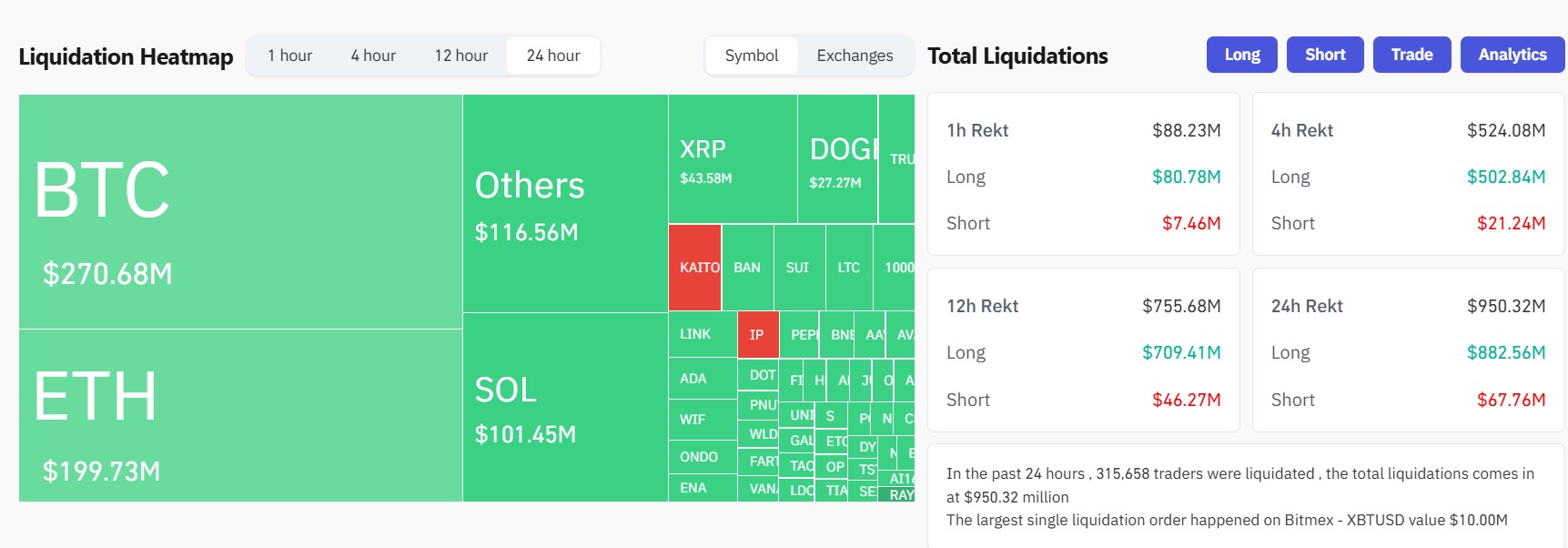

- Trump's announcement of new tariffs resulted in a liquidation of about $900 million in leveraged liquidation in the crypto market.

- The prices of Bitcoin and Ethereum fell sharply, causing huge losses among traders.

Please share this article

Bitcoin slides have caused a $950 million liquidation wave in crypto exchanges at low and lows for multiple weeks. The sale has once again raised inflation concerns after President Trump's statement indicating it has reinvigorated tariffs in Canada and Mexico.

Trump said Monday that tariffs on imports from Canada and Mexico will be in effect next month, ending a one-month suspension of planned import taxes.

A 25% tariff on Canadian and Mexican goods, which began in early March 2025, affects more than $900 billion in US imports, including automobiles, auto parts and agricultural products.

“We're on time to make it to the tariffs and it seems to be going very quickly,” Trump told the White House press conference with French President Emmanuel Macron. “The duties are underway as planned.”

Trump argues that other countries will impose unfair import taxes that harm domestic manufacturing and employment. He argues that tariffs will generate revenue to reduce federal deficits and create new jobs, but his threat is to pose a risk that companies and consumers have to do with potential economic slowdowns and accelerate inflation. It raised concerns among the others.

The announcement of tariffs promptly caused volatility in the crypto market.

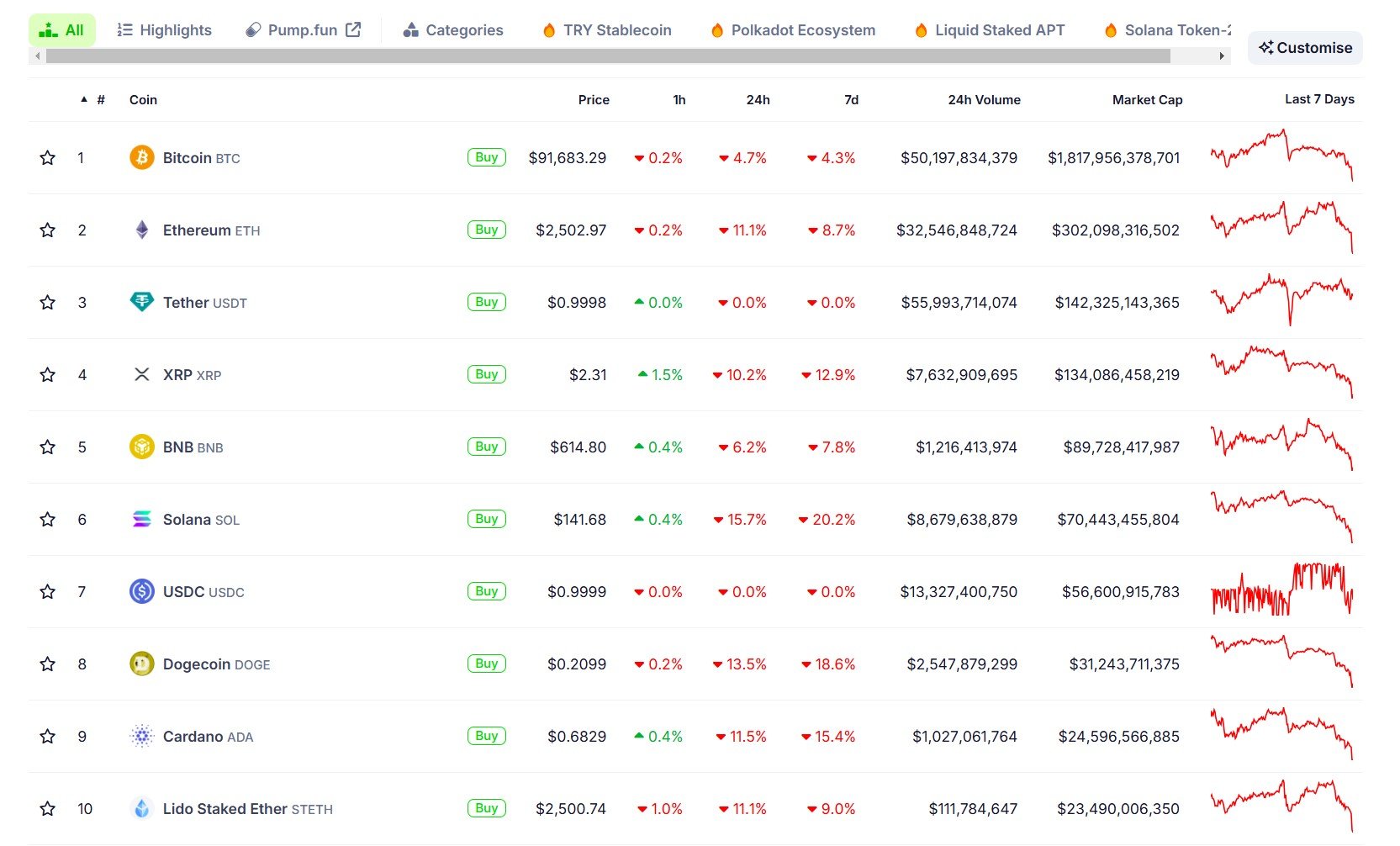

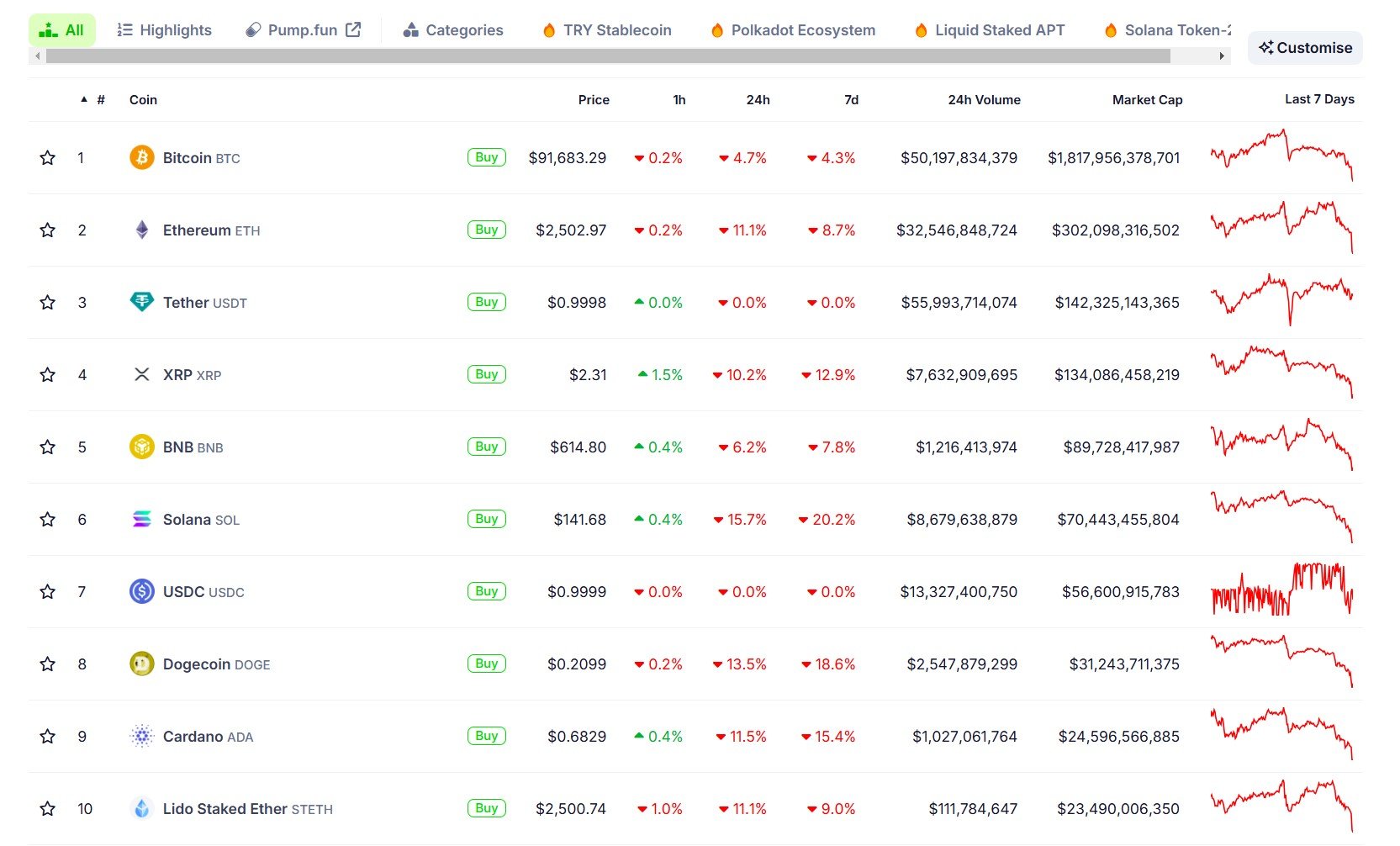

Bitcoin prices fell below $95,000, down to about $91,000, and continued to slide to about $91,000, according to Coingecko data.

The broader crypto market has seen widespread losses, with total market capitalization down approximately 8%.

Market turmoil has resulted in a long position liquidation of $880 million over 24 hours. According to Coinglas data, Ethereum traders suffered a loss of $255 million, while Bitcoin traders experienced a liquidation of $185 million.

Most Altcoins recorded double digit losses. XRP dropped by 10% and Sol fell by almost 16%. Doge fell 13% and ADA fell 11%. BNB has dropped by about 6% over the past 24 hours.

Bitcoin reservation invoice fails in multiple US states

Elsewhere, pushing the state to hold Bitcoin as part of the reserve has hit a wall. The Bitcoin Reserve bill was defeated in Montana, North Dakota, Wyoming and South Dakota.

Montana House Bill 429 attempted to allocate up to $50 million to Bitcoin, precious metals and the stupid, losing to a decisive 41-59 votes.

Designed specifically for the Bitcoin Reserve, North Dakota HB 1184 encountered a similar fate that was lacking in a 57-32 rejection.

Wyoming lawmakers also rejected HB 0201. This would have given the state's accounts the authority to invest public funds in Bitcoin at a margin of 7-2.

In South Dakota, HB 1202, which proposed a 10% Bitcoin allocation, stalled effectively when lawmakers adopted procedural operations to delay votes beyond the session deadline.

Please share this article