Ethereum prices remained stable as the market signed for a $1.4 billion hack by the Lazarus Group.

Ethereum (ETH) traded Sunday for $2,795. That's above the lowest price of $2,665 last Friday. It is about 32% below the highest level last December.

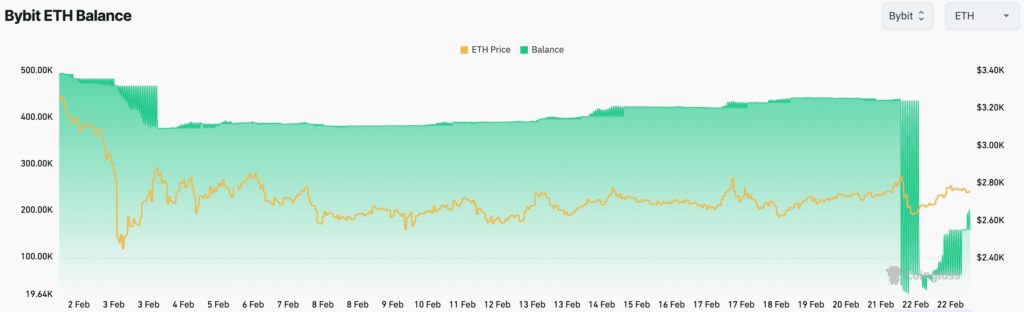

Coinglass data shows that the bibit Ethereum balance began to rise after crashing on Friday following the hack. Balances rose above 200,000 or $558 million from the low of 61,000 last Friday.

There are two potential reasons for the ongoing Ethereum Balance in Bibit. First of all, it is possible that Bibit is actively purchasing ETH from the market as it seeks to increase trust in its users.

Second, the continuous increase is an indication that customers are moving to exchange ETH as confidence increases. That's because Bybit maintains that it covers 100% of the stolen Ethereum coins. BYBIT has also launched $140 million to track funds.

The events come after North Korean Lazarus Group allegedly accessed Bybit's cold wallet and stole $1.4 billion worth of ETKENS. In addition to its size, the hack raised concerns about the security of crypto assets stored in cold wallets through exchange.

Ethereum prices may be greater diving risk

Daily charts show that Ethereum may have a major diving risk in the short term. The weighted moving averages of 200 and 50 days intersect each other, already forming a cross-pattern of death. This is one of the most bearish chart patterns in technical analysis.

Ethereum Price also formed the Bearish Flag Chart pattern, a popular continuation sign. This pattern consists of vertical lines and integration. This integration is also similar to the rising wedge pattern.

So, ETH tokens are likely to have a bearish breakdown, with the next reference level being the lowest point this year, about 23% below the current level.

If the coin exceeds 200-day WMA points, the bullish outlook is void.