This week, Bitcoin prices were under pressure as trade concerns remained, but two rare patterns show the final rebound.

Bitcoin (BTC) has been shaking, but the Crypto Fear and greedy index has slipped into the 35-year-old's fear zone this week. Most of this weakness was due to the continued fear of the trade war between the United States and its top partners.

The US has already begun collecting tariffs on Chinese goods, which could affect trade volumes of over $450 billion. Tariffs in Canada and Mexico have been suspended, but could be rebooted next month.

These trade jitters have created a sense of fear among market participants. Crypto's fear and greedy index fell to a 35 fear level, while the CNN money index fell to 39.

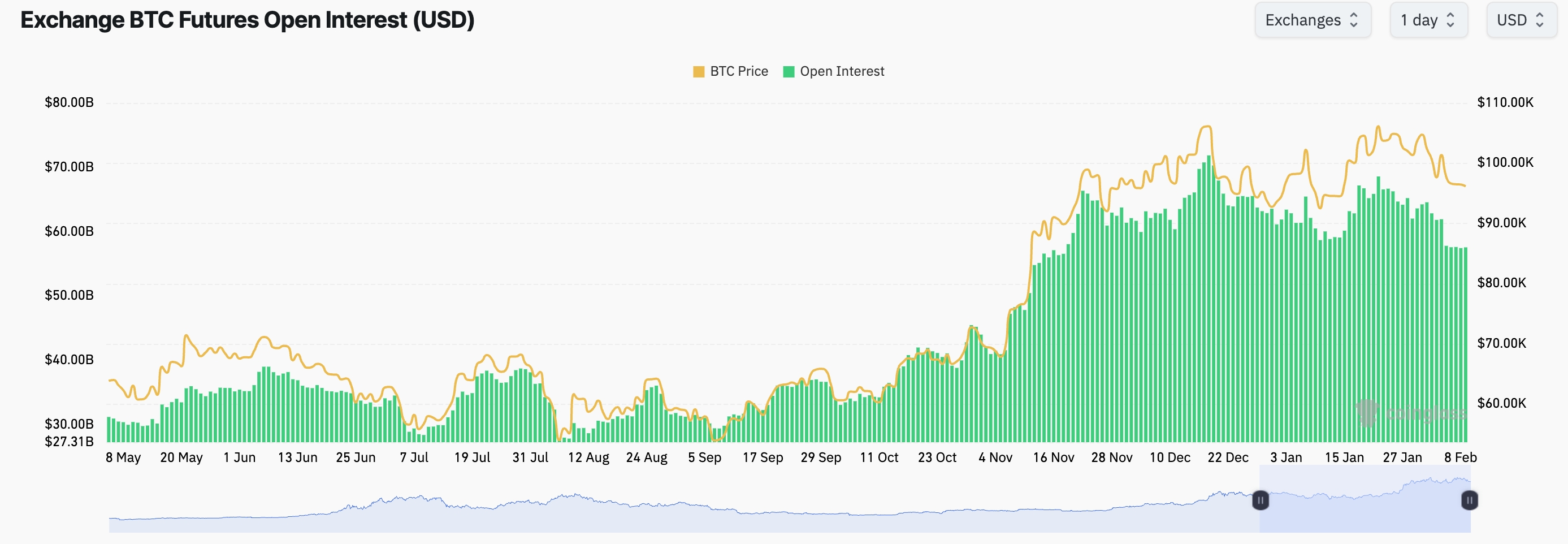

Also, Bitcoin remains at the edge as investors remain on the sidelines for now. The strategy paused Bitcoin purchases, but Coinglass data points to a weaker future. The inflow of Spot Bitcoin ETFs remains at around $57 billion, up from the peak of $68 billion this year.

Bitcoin prices also shook the Federal Reserve. This pointed to more taki-prone tone at the first monetary policy meeting this year. The bank has suggested it will leave interest rates unchanged and offer two cuts this year. Bitcoin and other altcoins work well when there is a tremendous tilt in the Fed.

Technical refers to the rebound of the price of Bitcoin

The weekly chart shows that BTC formed two rare chart patterns. The first one is a cup and handle formed between November and November last year. This pattern consists of a horizontal line and a round bottom, forming a cup, followed by some integration.

Profit targets are established by measuring the depth of the cup and measuring the same distance from the top of the cup. In this case, the depth is about 80%. This means the coin will rebound to $123,000.

The recent integration of Bitcoin is part of a bullish flag pattern with long vertical lines and rectangular patterns. The flag pole size is approximately 55%. If you measure that distance from above, it refers to a $166,000 breakout.

A note with this BTC price forecast is that it may take some time after using the weekly chart. For example, it took about three years to form the C&H pattern. So, a surge in Bitcoin price to $166,000 can take some time to complete.