Bitcoin was resilient during the sale of its latest markets, but Altcoins faced an estimated liquidation of between $8 billion and $10 billion, with funding rates being deeply negative, the survey claims Masu.

A sharp spike in volatility has shaken up the crypto market, erasing billions of dollars with open interest, and Bybit and Block Scholes report that Bitcoin (BTC) remains stable.

In a research report shared with crypto.news, Bybit said that Bitcoin “outperformed compared to the broader crypto market,” adding that its persistent swap is just as good. In contrast, the Ethereum (ETH) options market experienced a sharp surge in short-term volatility, surged beyond its highest level in over three months, over 140%.

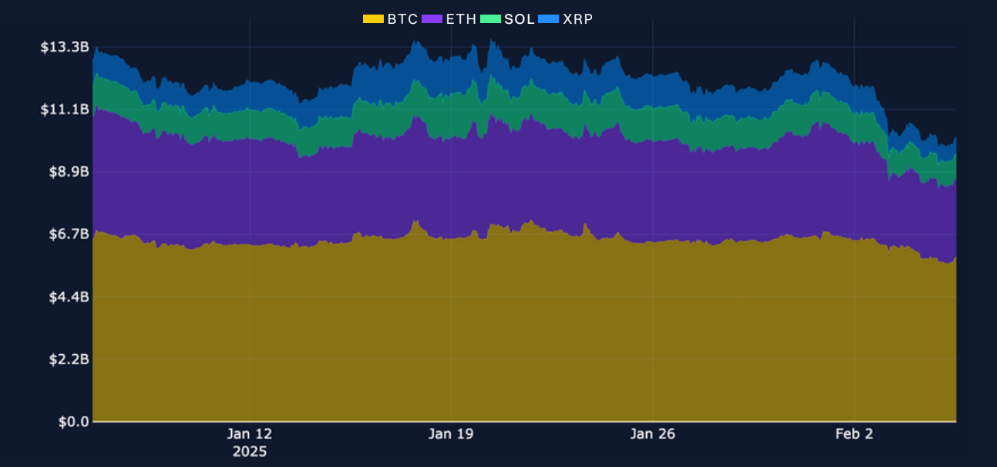

The settlement was cruel. As previously reported by Crypto.News, BYBIT CEO Ben Zhou estimated that the true conceptual value of the liquidated position could have been “at least $8 billion to $10 billion.” Masu. Over the entire permanent swaps of BTC, ETH, XRP (XRP) and Solana (Sol), open-in tests exceeding $3.1 billion disappeared after a late high on Friday.

Altcoins funding rates will decline

Funding rates reflect a bearish change. Altcoins saw a deeper negative funding rate for days after crash, but BTC remained relatively stable, the report said. With one important exception, open interest levels plummeted across key tokens. This is the Vitocoin option market. Unlike permanent, Bitcoin options have not experienced any major liquidation events, and the inversion of its term structure was resolved quickly, noted Bybit.

Despite market turmoil, trading volumes recorded the highest daily volume in more than a month, with a permanent swap of over $31.1 billion traded on February 2nd. In the case of Bitcoin, the volatility of short-term options suggests a return to stability, at least for now.