Solana Price pulled back after surged to $295 in January as its ecosystem and the broader crypto industry lost momentum.

Solana (SOL) has dropped to a psychological level of $200, showing a 35% drop from the highest point this year.

This retreat is primarily due to the withdrawal of Bitcoin (BTC) and other altcoins. Bitcoin has fallen from $109,200 to under $99,000 from this year's high, weighing in tokens in the Solana ecosystem.

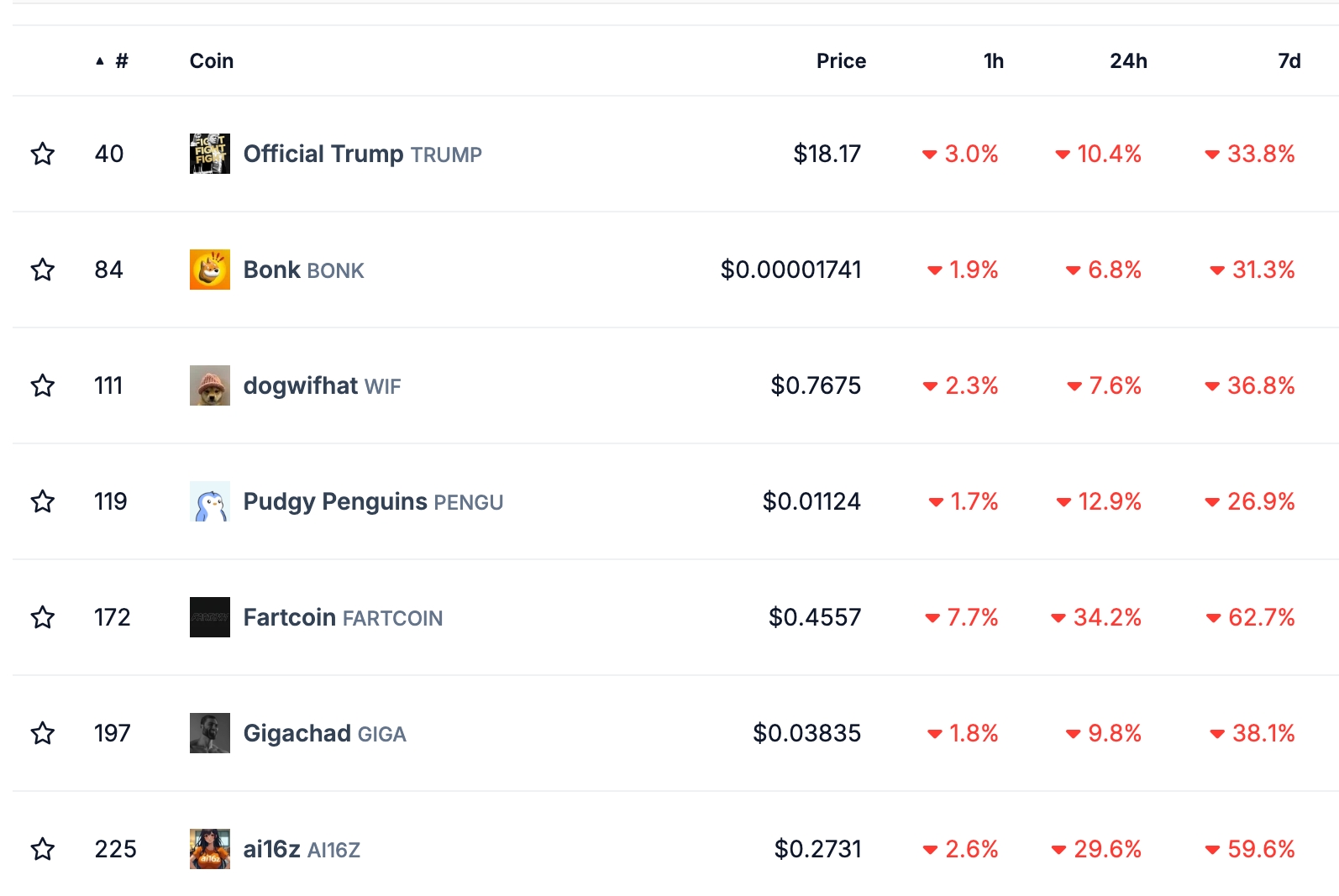

According to Coingecko, the total market capitalization of all Solana Meme Coins It fell from over $25 billion in January to $12 billion. Most of these tokens, including Bonk, Dogwifhat, Pudgy Penguins and Fartcoin, have dropped by more than 30% over the past 30 days.

Further data shows that Solana's decentralized exchange trading volume has been declining recently as investors leave the coins of memes. Over the past seven days, trading volume has dropped 25% to $41.6 billion. Raydium, Meteora, and Lifinity lost more than 30% weekly volumes over the same period.

Solana's inappropriate token sales have also declined over the past 30 days. Those sales have fallen 36% to $75 million over the past 30 days, according to Cryptoslam.

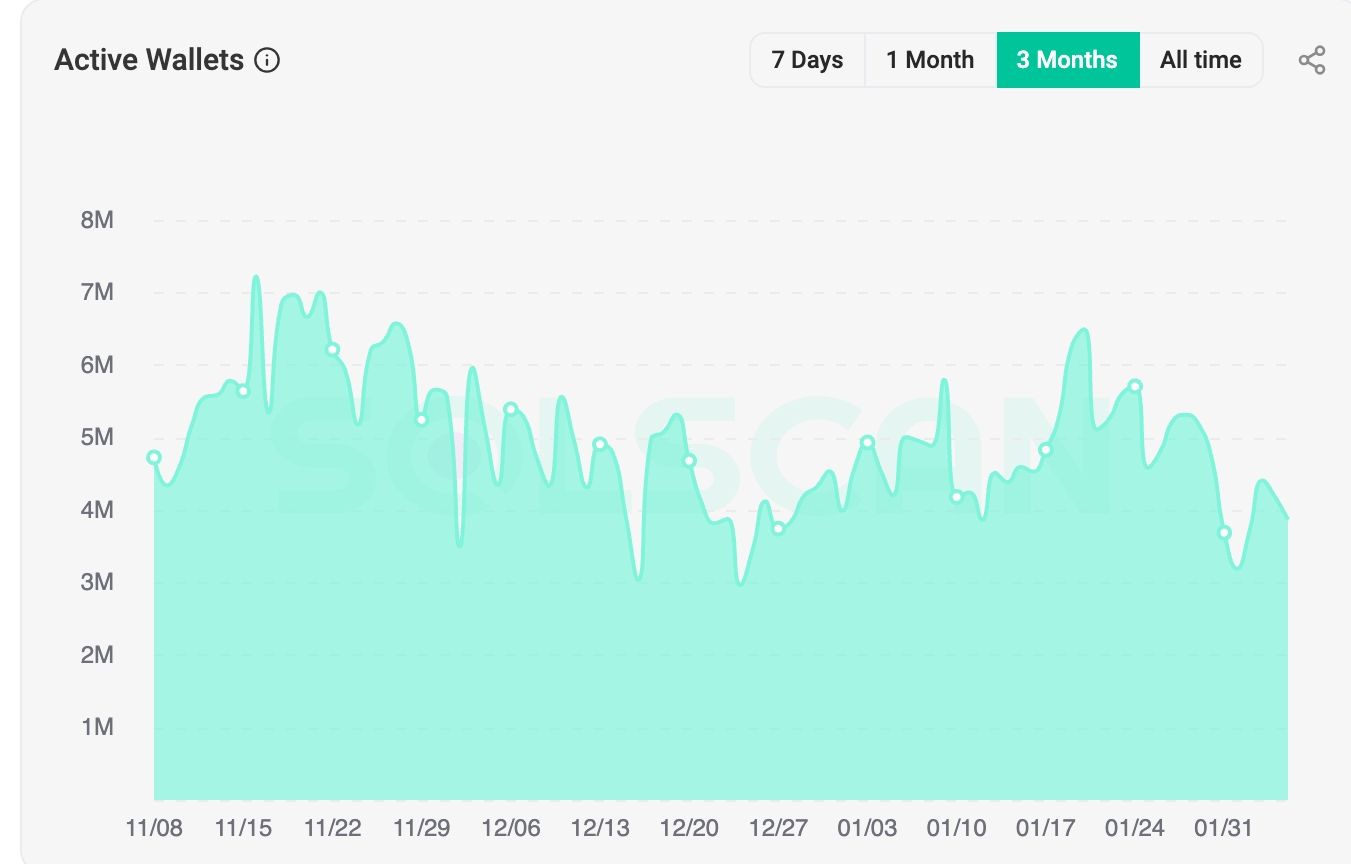

It also shows that more data shows that the number of active wallets in the network has fallen from 6.5 million in January.

Solana price forecast

Daily charts show that Sol Price peaked at $295.05 in January, moving into the technical bear market, falling about 35%. Solana is also below the exponential moving average of 50 and 25 days.

It is below the exponential moving averages of 25 and 50 days. This is a sign that the bear is gaining control. SOL also fell below the Fibonacci retracement level of 23.6%. In particular, the coin forms a double-top pattern for $265, with its neckline of $170.

Double top is a bearish inversion pattern that is widely recognized in technical analysis. Drops underneath the neckline and the rising channel lower bound sees another downside, pushing the price up to $120 to a 61.8% retracement level, representing a 40% decrease from the current level.