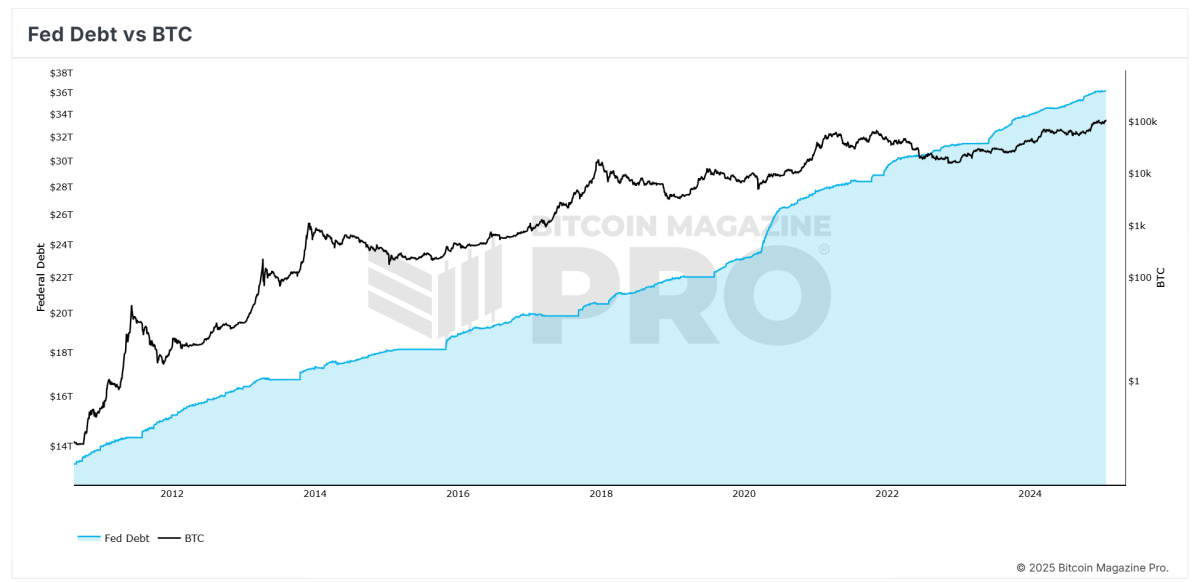

Although short -term yields are declining, long -term yields are increasing, but the number of US Treasury has increased the number of interests in the entire financial market. This development provides important insights on macroeconomic conditions and potential strategies for bitcoin investors who navigate these uncertain times.

We have recently observed the divergence of the US Treasury yield, but the short -term yields are declining, but long -term yields have risen. Lingering

What do you think of the government's bond market, bitcoin, and a wider wider financial market signal? Lingering

Please let me know 👇 pic.twitter.com/ejmj6hhykv

-Bitcoin magazinePro (@bitcoinMagpro) January 27, 2025

The Ministry of Finance will acquire dynamics

The yield of the Ministry of Finance reflects the demands for investors to hold the US government's debt, and is an important barometer for the expectation of economic and monetary policy. This is a snapshot of what is happening:

- Short -term yields decrease: The decrease in short -term financial bond yields, such as six months, suggests that the market expects the federal preparation system to evaluate the reduction in economic deceleration or inflation expectations. 。

- Long -term yields rise: On the other hand, the rise in long -term bond yields, such as the yield of the Ministry of Finance, is the sustainable inflation, budget deficit, or high -term insurance premiums required by investors to maintain long -term debt. It shows a growing concern about.

This difference in the harvest is often a change in economic landscape, which is a signal for investors to re -adjust the portfolio.

Related: Repetition of the 2017 Bitcoin Birthle

Why is finance important for bitcoin investors?

Bitcoin's unique properties as non -sewers' distributed assets are particularly sensitive to the tendency of the macro economy. The current yield environment can form a bitcoin story and performance in several ways.

- Inflation hedge appeal:

- Long -term increase in yields may reflect sustainable inflation concerns. Historically, bitcoin is considered a hedge for inflation and the collapse of currency, which can increase the appeal of investors who are trying to protect wealth.

- Risk -on feeling:

- The decrease in short -term yields may indicate a gentle financial status. More simpler monetary policies often promote risk -on environments that benefit bitcoin -like assets, as investors seek higher returns.

- Financial unstable hedge:

- Especially when it is connected to a reverse ray curve, the divergence of yields may indicate the risk of economic instability or recession. During such a period, the story of bitcoin as a safe asset and the substitute for the conventional finance may be trolled.

- Thinking matters related to liquidity:

- Low -term yields can reduce borrowing costs and improve the liquidity of financial systems. This liquidity often leaks into risk assets, including bitcoin, and promotes the momentum of the rise.

Inspired of a wider market

The impact of yields extends beyond bitcoin to other areas of financial ecosystem.

- Stock Market: Usually, when short -term yields decrease, borrowing costs are reduced and the shares increase by supporting the evaluation doubling. However, long -term increase in yields can pressure pressure on stocks that are particularly sensitive to high discount rates.

- Debt sustainability: As long -term yields increase, the government and corporate funding costs increase, burden the entities with potentially large debt, creating a ripple effect on the entire global market.

- Economic outlook: The divergence, combined with long -term inflation pressure, reflects the expectations of slow, short -term growth, and shows the risk of potential stagflation.

Related: Bitcoin price history predicted in February 2025

Take -out for bitcoin investors

Understanding the interaction between the Ministry of Finance's yield and the macro -economic tendency for Bitcoin is essential for information -based decision -making. There are some important points here:

- Monitor monetary policy: Please note the announcement of the federal preparation system and the economic data. Dovish Pivot could create bitcoin tailwind, but harder policies could cause short -term tasks.

- Diversification and hedging: Long -term increase in yields can lead to volatility throughout the asset class. Diversification of bitcoin as a part of a wider portfolio strategy can help inflation and economic uncertainty.

- Please use the story of bitcoin: In an environment of budget deficit and currency easing, the story of bitcoin as a valuable non -expanded storage is more attractive. Educating new investors about this story can promote further adoptions.

Conclusion

The divergence of the Ministry of Finance emphasizes the market expectations on growth, inflation, and monetary policy. This is a factor that has a significant impact on bitcoin and wider financial markets. Understanding these dynamics and positioning for investors can solve the opportunity to take advantage of the unique role of bitcoin in rapidly changing economic conditions. As usual, staying positively based on information is the key to navigating these complex time.

Access BitcoinMagazinePro.com for live data, advanced analysis, and continuous access to exclusive content.

Disclaimer: This article is intended for information only and does not make a financial advice. Readers recommend a thorough independent survey before making an investment decision.