https:/sol;/x.com/GuerillaV2

In a recent announcement, Best in Slot, the infrastructure company that powers some of the most popular Bitcoin applications and wallets such as Xverse and Liquidium, revealed that BRC-20 will be upgraded.

The service, called BRC2.0, will be launched on the Bitcoin testnet in the first quarter of 2025, with the aim of introducing “smart contracts” to BRC-20 and making it competitive with Bitcoin's sidechain designs. It is scheduled to be operational.

In short, the “BRC20 programmable module” “unlocks endless new use cases for native assets on Bitcoin, including seamless DeFi, RWA, DAO, stablecoins, etc. without relying on multisig bridges or L2. ” is designed to.

After spending years in space, we'll all agree that we've heard promises like this before. However, metaprotocols have one clear advantage. It's completely on-chain rather than relying on a completely separate chain with new trust assumptions. Granted, meta-protocols may not be the best approach to decentralizing Bitcoin's token economy, but they are a start.

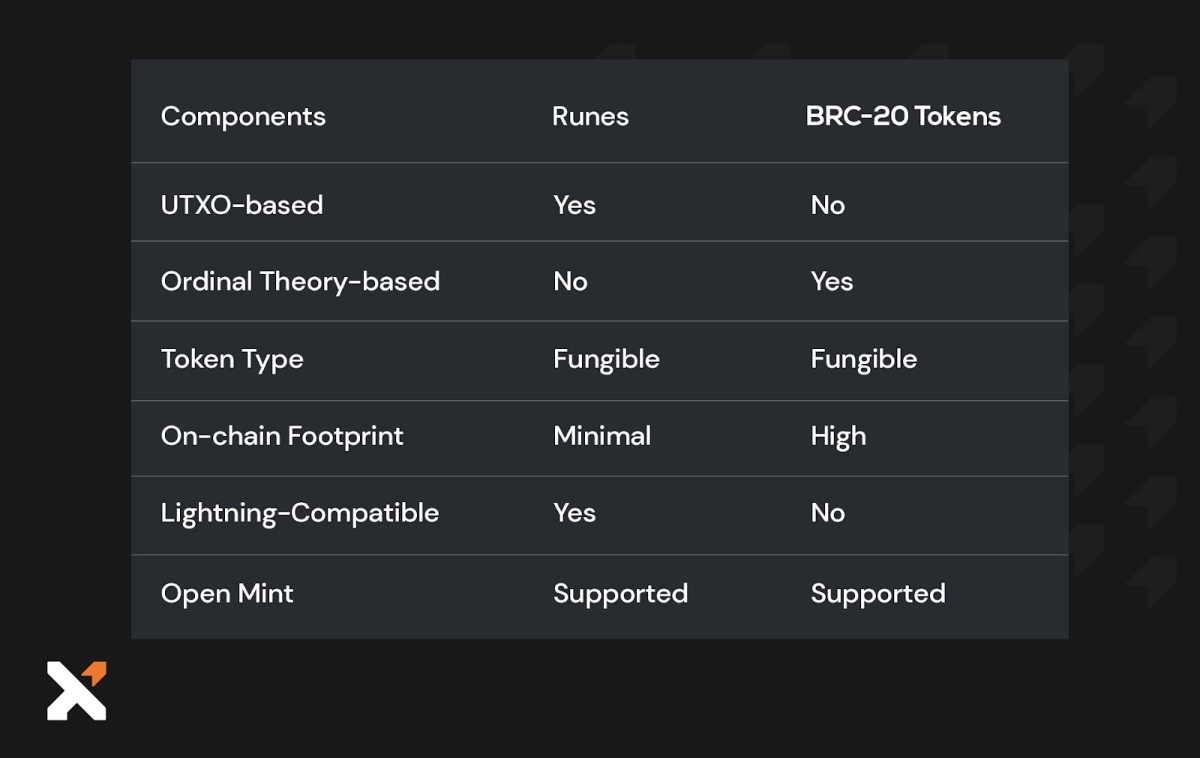

Runes suffered from overwhelming expectations prior to its release, but this is a chance for BRC to make a comeback. Regardless of your stance on Bitcoin tokens, competition between different standards will ultimately lead to increased efficiency and reduce on-chain bloat. We can all agree that this is desirable.

The real question is, for regular Bitcoiners who use Bitcoin purely as a monetary network, do they really need to go through this again? On-chain congestion, wasteful pump-and-dump schemes, rising prices…

My answer is “Absolutely!”

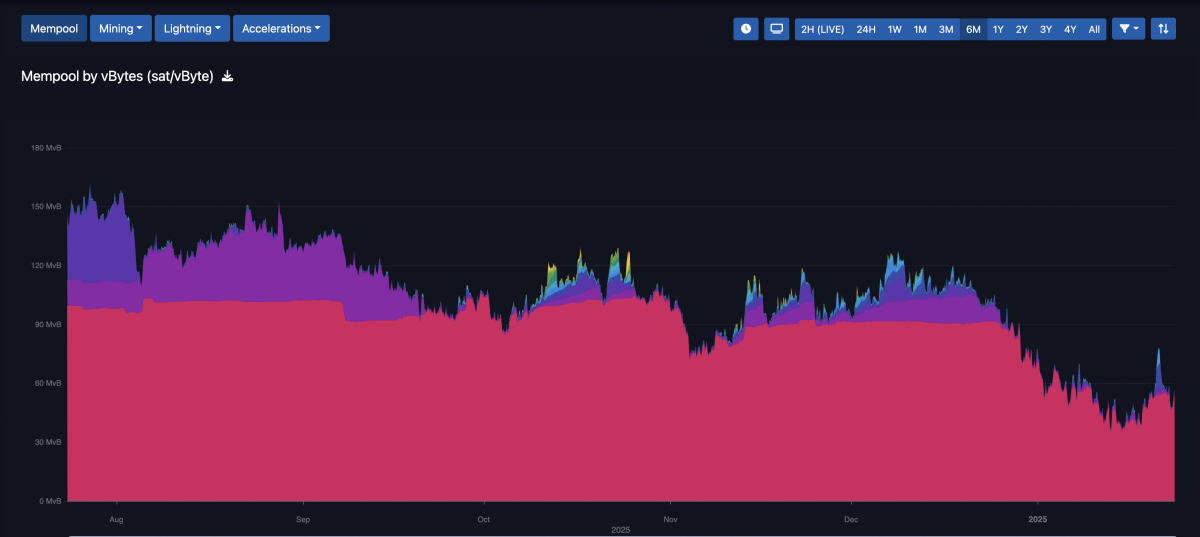

mempool has been “down” for the better part of the past 6 months.

First, as Bitcoiners, we need to support the free market. Acquiring additional paying users is literally the best outcome for Bitcoin's survival. Miners have just reached their halving again, and maintaining mining profitability is the only way to prevent centralization in the hands of subsidized actors (be it governments or financial markets, yes). Miners issuing unlimited loans to buy machines won't last forever).

Due to intense trading activity for TRUMP and MELANIA tokens, Solana validators experienced record inflows of more than SOL 100,000 in fees and tips, worth approximately $25.8 million, according to CoinDesk.

Second, Pandora's box has already been opened. Bitcoin tokens will continue to exist. If users want additional programmability, who has the power to prevent them from doing so? (Aside from pro-censorship advocates, of course.)

As the Bitcoin ecosystem evolves, the introduction of the BRC-20 upgrade presents a compelling case as to why it has the potential to overturn the Rune token standard. Here's why:

- The main appeal of BRC2.0 lies in its promise of improved efficiency. With smart contract capabilities, BRC-2.0 tokens can process complex operations directly on the Bitcoin blockchain, potentially reducing the need for additional layers and sidechains. This could lead to more compact transactions and reduce the on-chain bloat that Loon has been criticized for due to its initial hype and subsequent congestion. This efficiency could be a game-changer for Bitcoin's scalability, providing a streamlined approach to tokenization without changing the security or decentralization of the core protocol.

- BRC2.0 is designed to integrate with existing Bitcoin infrastructure. User experience and interoperability can be improved thanks to collaborations with Layer 1 Foundation and others. Unlike Runes, which had user adoption challenges due to its complex minting process and poor UX, BRC2.0 aims to provide a more user-friendly interface for token creation and interaction. This could allow for broader acceptance and use, making Bitcoin a more attractive platform for both developers and users.

My basic position on anything new related to Bitcoin is always cautious. While we will have to wait for the actual details of this new protocol to become public, we are excited at the prospect of more efficient DeFi use cases on Bitcoin rather than on smaller chains.

If you're still skeptical, I'll leave you with this question: If Bitcoin tokens are inevitable, what could be worse?

- A meta-protocol that uses Bitcoin's block space in exchange for fees, without changing the rules of the network?

- Or will it be Bitcoiners bridging their hard-earned Bitcoin to a centralized competing chain to access the same token market?

As a Bitcoin Maxi, I want all the fees. I want all users. Unless the core ethos of the underlying network changes, Bitcoin Maxis should be fee-earning Maxis (see Cat Fun).

My TL;DR:

- Wait and see what BRC2.0 has to offer. Will Bitcoiners really be programmable in a reliable and secure way?

- If BRC makes a real comeback, runes could become irrelevant, especially if the UX improves.

- Please the miners with degen fees.

- Bitcoin tokens that don't change the rules are better than Bitcoin tokens that require new opcodes or rule changes.

- Thank you to all the Gigabrain developers who are building Bitcoin apps instead of the Vaporware chain.

This article is take. The opinions expressed are solely those of the author and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

Articles I write may discuss topics or companies that are part of my company's investment portfolio (UTXO management). The views expressed are solely my own and do not represent the views of my employer or its affiliates. I received no financial compensation for these takes. Readers should not consider this content to be financial advice or a recommendation for any particular company or investment. Always do your own research before making any financial decisions.