- ENS has a very bullish outlook for the coming weeks.

- On-chain indicators showed an increase in market activity and demand.

Ethereum name service [ENS] It reversed a long-term bearish trend and broke the resistance around $20-$22 that has been challenging the bulls since early August.

Networking activities also told inspiring stories.

That being said, the potential for prices to fall exists. However, the Ethereum Name Service Token is still expected to trend higher.

Significant unlocking is expected in the coming months that could disrupt the relationship between supply and demand.

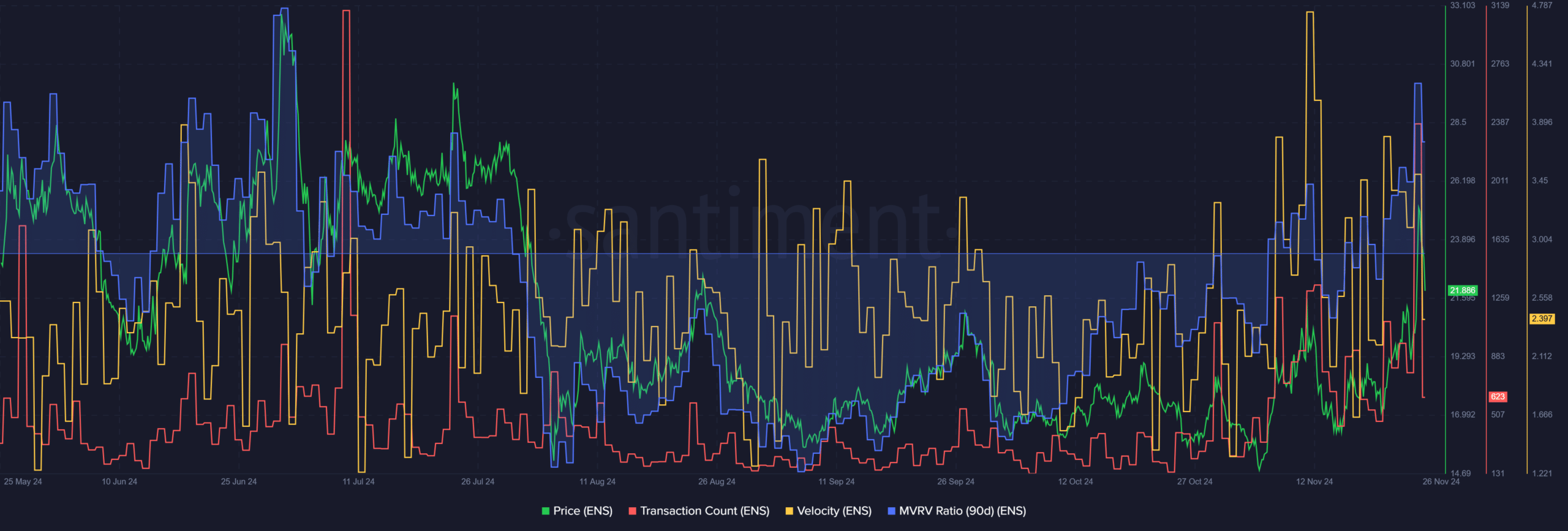

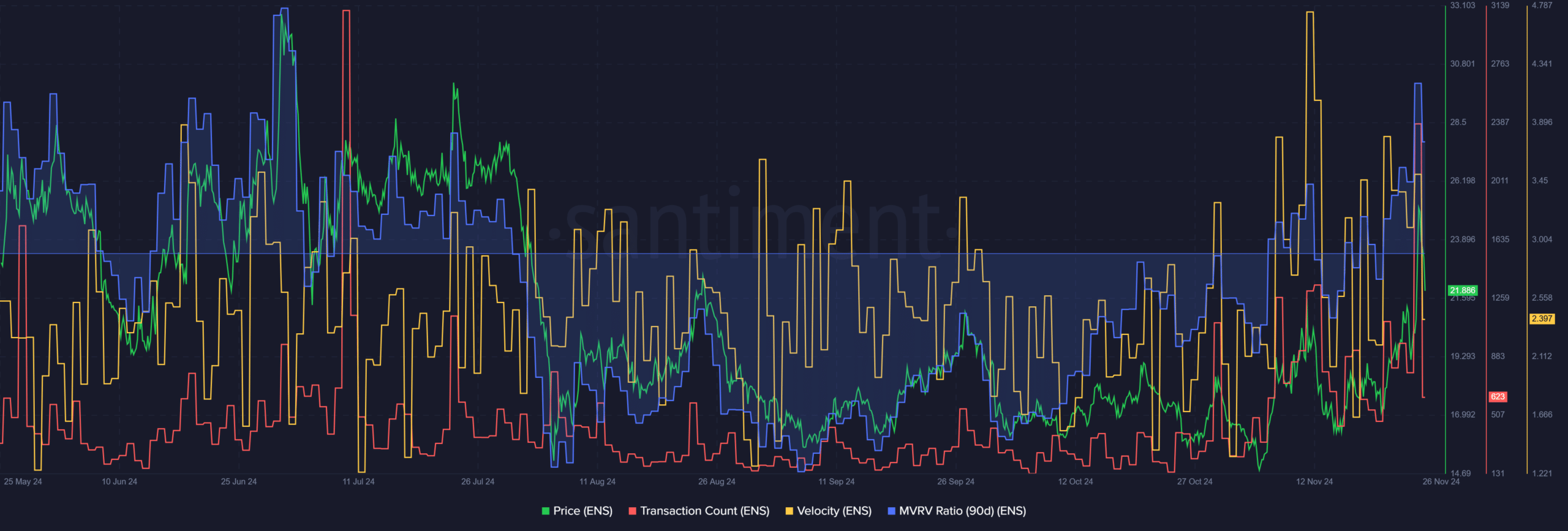

ENS indicator suggests positive market sentiment

Source: Santiment

The 90-day MVRV is now positive following the recent strong rally. This has led to profit-taking activity and the potential for price declines. However, transaction numbers and transaction speeds were more bullish.

The upward trajectory since late October was a sign of increased market activity. Transaction count measures the unique transactions that occur on the network each day.

An increase in this indicator indicates an increase in market participation.

Velocity measures how often a token changes hands. Increases in price, speed, and number of trades mean tokens are traded more frequently, supporting the idea of a healthy and active market.

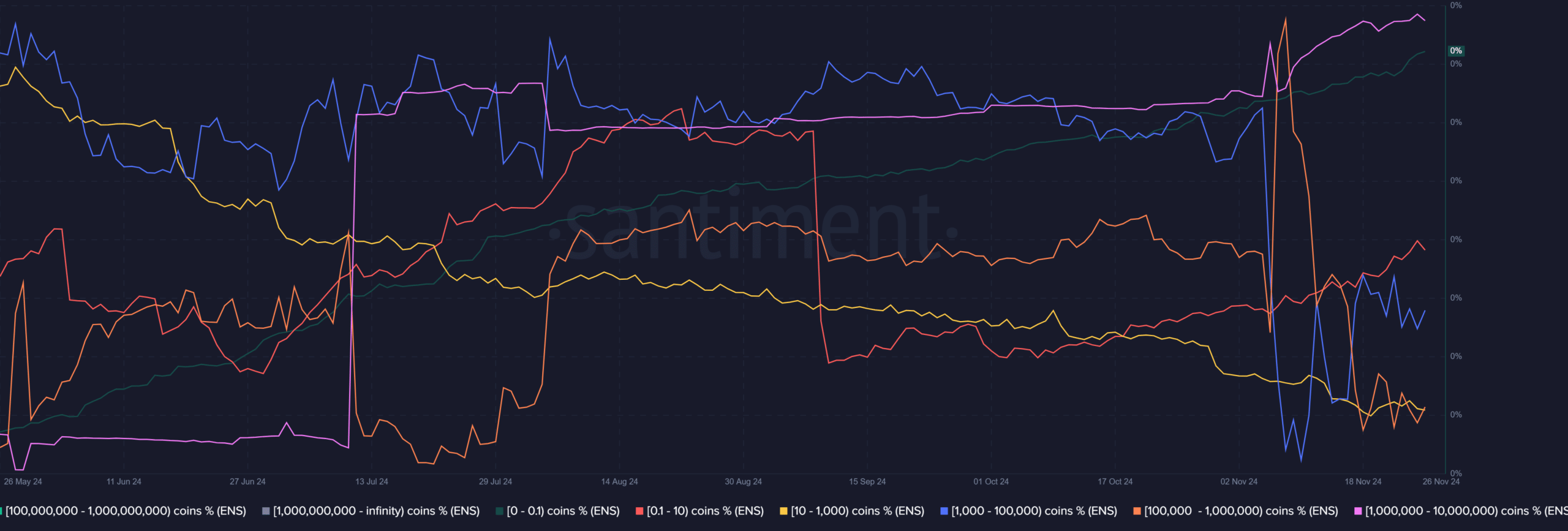

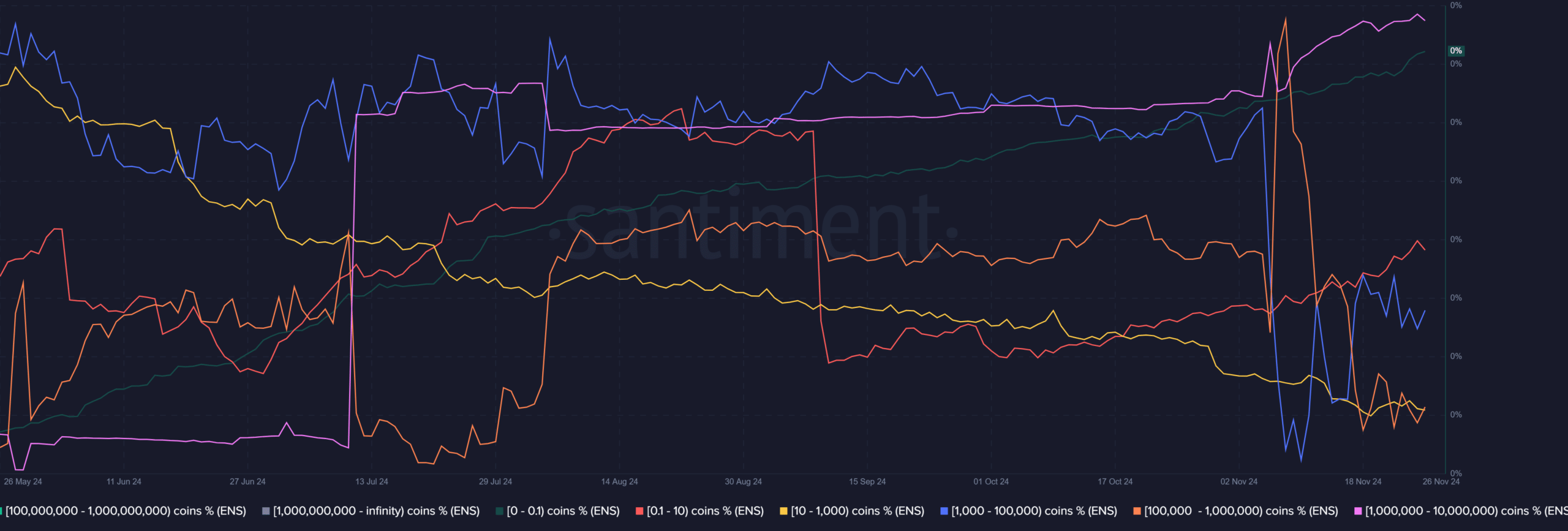

Source: Santiment

Supply distribution by address balance showed that ENS balance addresses between 1,000 and 1,000,000 have shed some of their holdings since October.

The former group is starting to rise and we are seeing some accumulation.

Shrimp addresses with ENS less than 10 were also accumulated. More importantly, large whales with over 1 million ENS have increased their share of the pie, a sign that whales are also buying these tokens.

Does this whale activity increase the likelihood of a gathering?

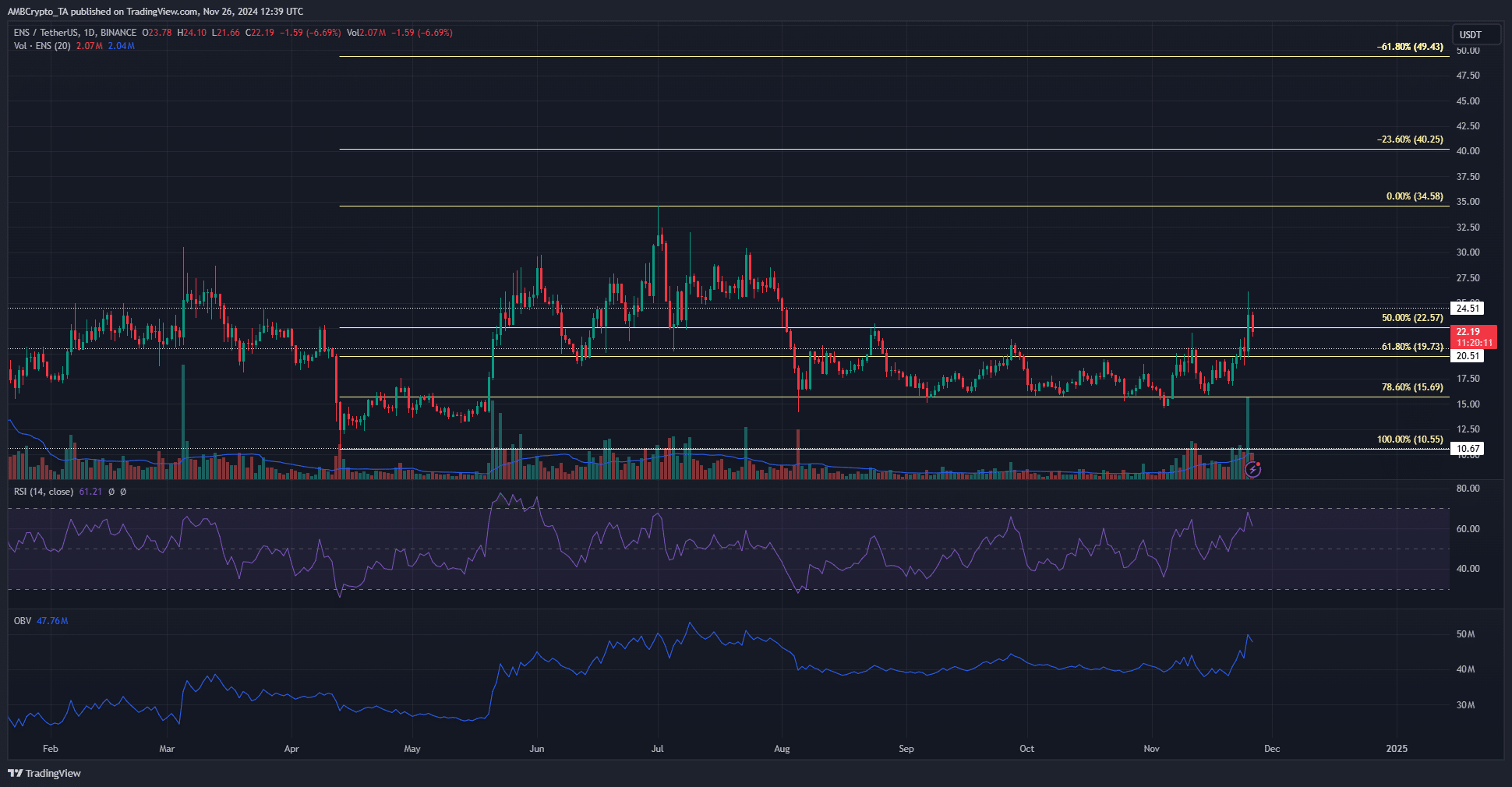

Source: ENS/USDT on TradingView

Read Ethereum Name Service [ENS] Price prediction for 2024-2025

A move above $22 meant there was clear air above the ENS bulls. Volatility with Bitcoin [BTC] ENS could fall below the $20 level, but even in that scenario it could recover quickly.

The 78.6% level of $15.7 has been fiercely defended since early August. A recovery from this level would mean $34.5 and an extended level further north will be the next target in the coming weeks.