What is going on here?

The euro zone economy grew by 0.4% in the third quarter, surprising market expectations for a meager 0.2%.

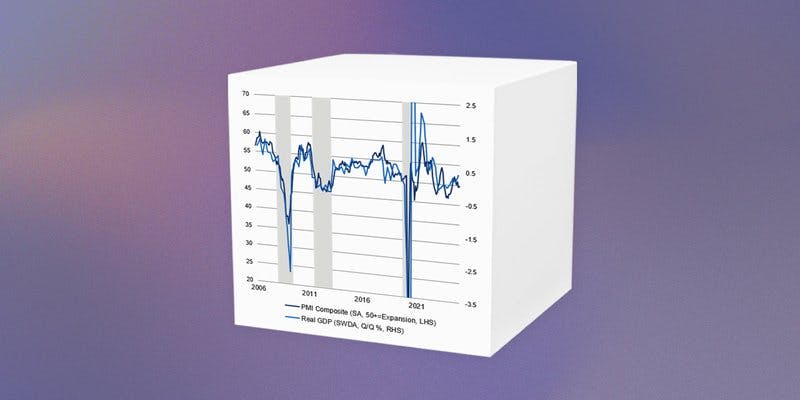

Soft survey data suggests that the euro zone's surprisingly strong third quarter is unlikely to be repeated this quarter. Source: Haver, Abdon.

What does this mean?

This economic surprise was driven primarily by the better-than-expected performance of Germany and France. Germany showed resilience in economic activity, posting growth of 0.2% despite a slightly downwardly revised second quarter.

Furthermore, nationally, consumer Price index (CPI) data showing expected growth rates across Spain and Germany; inflation Concerns remain.

The unexpected economic growth complicates the possibility of a rate cut planned for December as the European Central Bank (ECB) reviews economic data. Current growth and inflation figures are not strong enough to definitively rule out an ECB rate cut, but they do make the decision more nuanced. However, the overall economic situation is showing weakness, with some forecasts predicting that the region's economic growth rate will be only 1.1% by 2025.

Why should we care?

For the market: Europe's economy surprises investors.

The higher-than-expected numbers caught investors off guard and could delay the ECB's expected monetary easing. This unexpected growth could spark cautious optimism and have an impact. bond Stock market movements will impact investors' strategies, potentially causing them to reassess the timing and nature of expected ECB policy changes.

Big picture: Complex economic situation.

Persistent inflation and only modest growth forecasts highlight the complex economic situation in the euro area. Inflation remains a significant challenge, as regional statistics show. This presents a complex set of circumstances for policymakers and businesses across Europe, with implications for strategic economic decisions and potential changes in fiscal policy in response to evolving economic dynamics. Masu.