With gold and Bitcoin both at or near record highs, which 'hard money' is better as investors seek hedges against economic uncertainty, inflation and geopolitical shifts? The debate over this is intensifying.

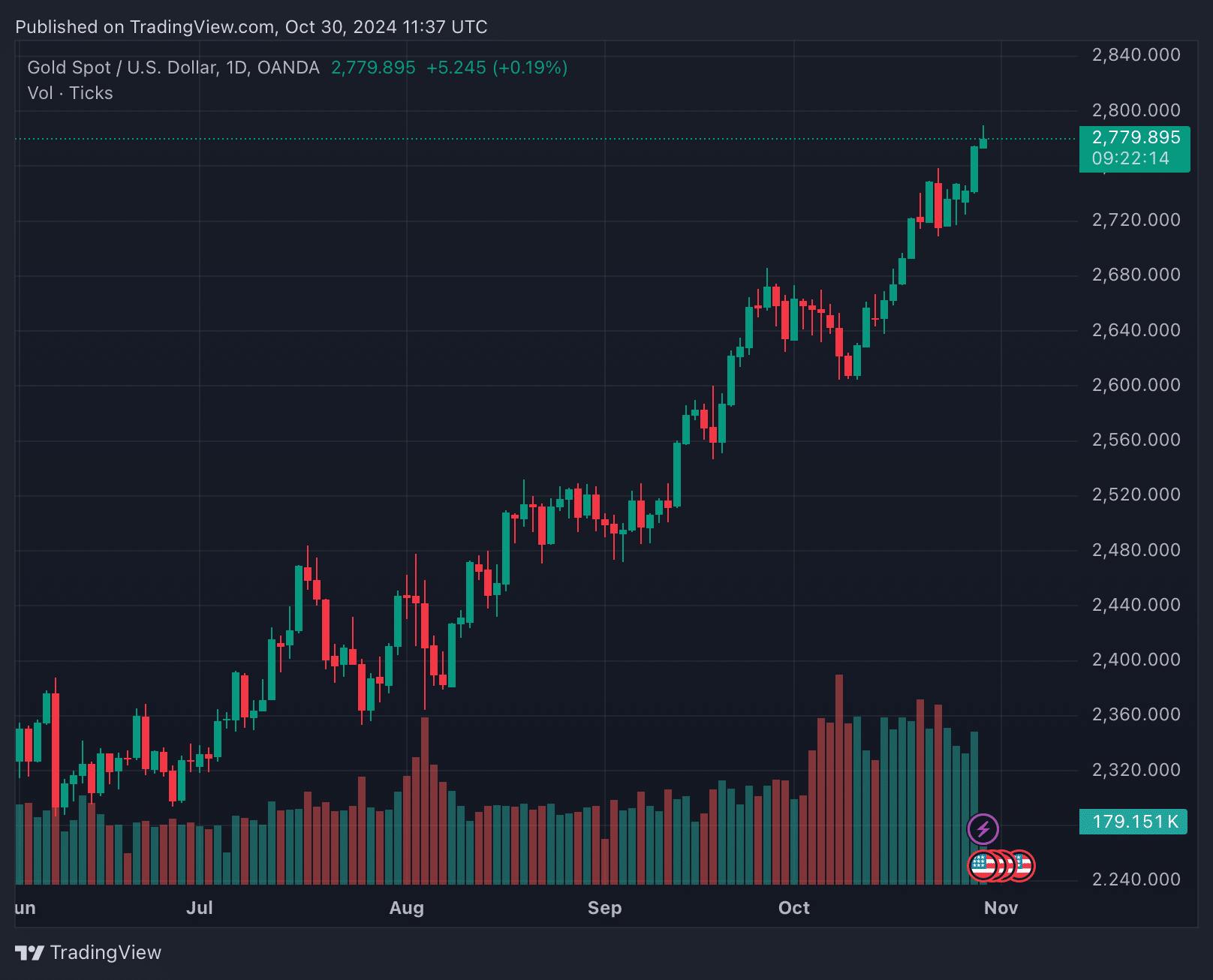

Amid mounting economic pressures, two traditionally antagonistic assets, gold and bitcoin, have soared to or near record highs, sparking debate over their role as “hard money.” With gold passing the $2,770 milestone and Bitcoin (BTC) hovering near its all-time high of $73,800, the simultaneous rise signals underlying anxiety in the market. Investors are increasingly looking to both as a defensive hedge against economic fluctuations, drawing attention to the debate over which asset holds value better.

The need to understand the hard money debate is essential, especially in uncertain times with close US elections. The question arises as to which assets offer a better hedge against potential economic instability, inflation and geopolitical changes that may impact traditional markets.

Over the past year, gold has risen over 38%, while Bitcoin has risen over 115% at the same time. These peaks have been commented on by various investors on both sides of the hard money debate, including Chamath Palihapitiya, Larry Fink, and Peter Schiff.

“Bitcoin is going to be a leading inflation-hedging asset for the next 50 to 100 years,” Palihapitiya said on a recent podcast.

“We are seeing the last vestiges of people using gold as rational economic insurance.”

However, gold's recent all-time highs have also drawn comments from prominent advocates such as notorious metal money advocate Peter Schiff, who wrote in X: 'Gold trades at all-time high above $2,755. “We are on track for our best year since 1979.”

“The difference is that in 1979, inflation was near its peak and the gold bull market was nearing its end, whereas now inflation is near its trough and the gold bull market is just beginning.”

While some people have a bullish view on precious metals, others have a more nuanced view of what hard money looks like in the 21st century.

“The role of cryptocurrencies is to digitize gold,” BlackRock CEO Larry Fink recently said on Fox Business. “We hope regulators will consider spot ETF filings as a way to democratize cryptocurrencies,” said one of the world's leading asset managers.

Bitcoin: “digital gold”, store of value or medium of exchange?

However, unlike gold, Bitcoin does not have a centuries-long track record and has faced episodes of extreme volatility that can be a challenge for those seeking stability. Still, as Bitcoin nears all-time highs, interest in Bitcoin's potential as “digital gold” is growing, especially among younger and tech-savvy investors who value its portability and ease of transfer. continues to increase.

Although the term “digital code” is often associated with developments in computer science and digital information theory, there is no single widely known inventor. However, one of the earliest and most influential figures in conceptualizing digital information was Claude Shannon. Shannon, in his landmark 1948 paper. “mathematical theory of communication,” It laid the foundations for digital encoding and information theory and helped form the idea that digital code, the concept of Bitcoin, and hard money could be encoded through blockchain technology, cryptography, and supply caps.

Are these increases an early warning sign?

The rise in both gold and Bitcoin may not just reflect individual market trends. This may indicate increased anxiety about the economy as a whole.

Historically, sharp movements in these assets have often preceded economic downturns as investors seek refuge from anticipated turmoil. This pattern, observed in the early 1970s and during the 2008 financial crisis, suggests that today's price hikes may indicate a lack of trust in traditional financial markets.

Academic research supports this hypothesis. A study by Bouri et al. (2017) point out that Bitcoin can act as “a hedge similar to gold, especially in response to currency devaluations and macroeconomic uncertainties.” This is especially true during times of financial crisis, as Ratner and Chiu observed that “investors often flock to assets that are perceived to be safer, including precious metals and alternative assets like Bitcoin.” (2013) is similar. Reboredo (2013) emphasizes the stability of precious metals such as gold, stating that macroeconomic conditions and financial crises have “led investors to seek the stability of gold,” reinforcing its role as a safe haven. This further supports this theory.

In fact, although the supply of gold increases gradually through mining, its value remains stable over time due to physical constraints. However, Bitcoin operates with a fixed supply cap coded at 21 million coins, which is expected to be reached by 2140. This planned scarcity, combined with Bitcoin's halving event (where rewards to miners decrease every four years), creates a deflationary view of the asset.

Hard money debate towards 2025

As both gold and Bitcoin continue to rise, investors have important choices to make. Be it traditional assets that have long served as safe-haven assets, or new digital alternatives with distinct advantages in portability and scarcity. The debate over which “hard money” is better is still unsettled, but one thing is clear. Both properties are said to resonate with audiences who value stability in uncertain times. Whether the direction of the economy justifies this defensive position remains to be seen, but if history is any guide, gold and Bitcoin could once again serve as early indicators of changes on the horizon. be. Don't mention Ethereum.

Disclosure: This article does not represent investment advice. The content and materials published on this page are for educational purposes only.