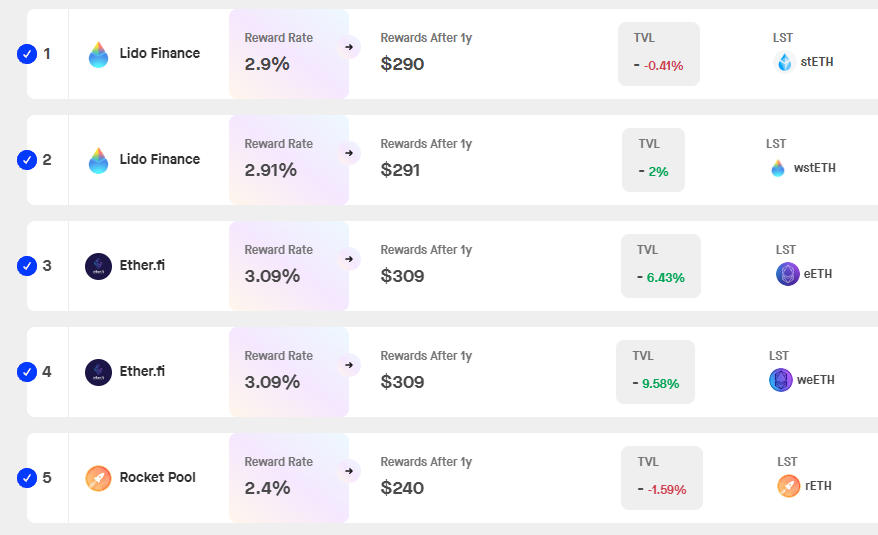

The Ethereum network maintained its staking reward rate near 3% in Q3 2024, a slight decline from over 3.5% earlier this year.

This yield is still significantly lower than that of other popular proof-of-stake networks such as Cosmos, Polkadot, Celestia, and Solana. Staking rewards for these competing networks range from 7% to 21%.

Ethereum continues to underperform in bull market

The decline in staking rewards impacts the Ethereum ecosystem in two ways. Lower yields may help curb inflation in the network, making it more attractive to long-term holders, but may disincentivize some new or existing validators seeking more competitive returns. It also becomes.

Read more: Ethereum re-staking – what is it and how does it work?

According to Kaiko Research, validator queues on the network have recently averaged less than a day, a notable change from the peak wait time of 45 days in June 2023. While this lower latency has made staking more accessible, it also suggests that demand for staking activities is weakening.

The daily number of Ethereum validators waiting for entry has decreased sharply, from over 95,000 in April 2023 to just 473 today.

This trend suggests that interest among potential validators is cooling, and if this trend continues, it could challenge the network's ability to maintain a strong validator community.

Ethereum’s recent performance has lagged amidst a growing bull market. Bitcoin and Solana have both risen over 6% over the past week, while ETH's growth has been flat.

Additionally, Solana generated $25.48 million in network fees last week, surpassing Ethereum’s $22.13 million, according to DeFiLlama data.

The exchange's Ethereum reserves also declined, dropping from more than $42 billion to about $38.9 billion. This reduction in supply on the exchange could support price stability and growth if demand strengthens.

Read more: 9 cryptocurrencies offering the highest staking yield (APY) in 2024

“Solana’s pricing model means that only those who want access to highly competitive apps pay for those apps, with other users largely unaffected,” said Maat Mumtaz, a crypto entrepreneur. he wrote in a recent post on X (formerly Twitter).

Despite these changes, long-term ETH holders continue to express confidence in the asset's future value, contrasting with the more cautious approach taken by short-term investors.

Disclaimer

All the information contained on our website is published in good faith and for general information purpose only. Any action you take upon the information you find on our website, is strictly at your own risk.