- Germany's first GDP figures for the third quarter will confirm further recession in Europe's largest economy.

- Eurozone GDP may also be dragged down by Germany's weakness, with falling inflation a sign of a worse outcome.

- Contrast with strong US growth could put further pressure on EUR/USD.

Sick Man of Europe – That not-so-flattering nickname for the German economy has resurfaced. The term was first used in the early 2000s, when the former continent's largest economy was struggling with high unemployment, low productivity, and an ongoing struggle for unification.

This time, Germany is also plagued by other problems, including overreliance on Russian gas, exports to China, and a sluggish auto industry. For the first time in its 90-year history, Volkswagen will close three factories in its home country and lay off tens of thousands of employees.

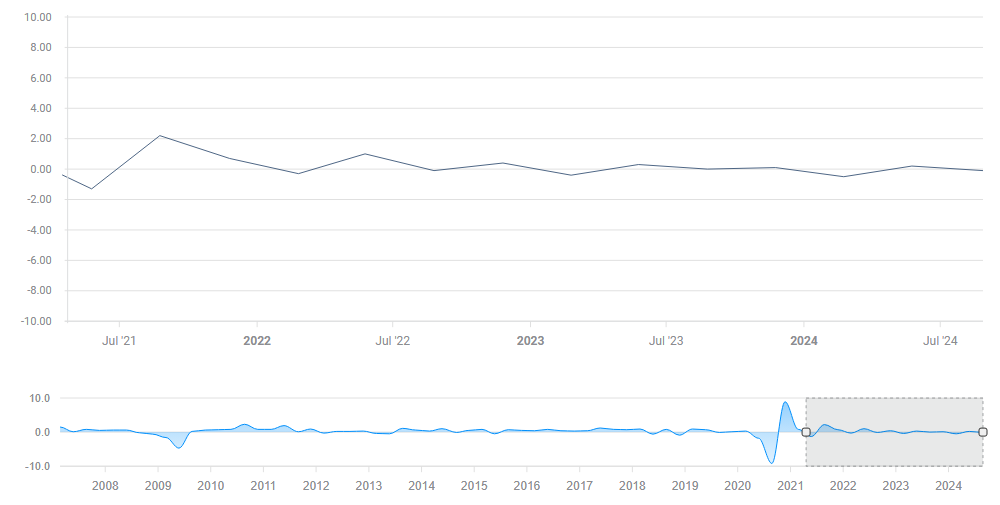

According to the economic calendar, Germany is facing two consecutive quarters of negative growth (the standard definition of a recession). This is not the first time Germany has suffered an economic contraction in the post-corona era. It turns out that there is a limit to the period of expansion.

Germany's GDP. Source: FXStreet

If output falls by 0.1%, as forecast by economists, it would weigh on the euro (EUR), even if it is in line with expectations. Narrowly avoiding an official recession is not stimulative, and even unchanged numbers will not be stimulative, as it does not change the overall picture of a struggling economy.

Germany's figures will be reflected in output figures for the 20 euro zone countries to be released immediately on Wednesday. Economists expect growth to be 0.2%, compared to 0.4% in France, the second-largest economy, 0.2% in Italy, and 0.6% in Spain, the fourth-largest economy. is driven by the forecast.

Germany is only about a quarter of the 20-strong eurozone, but its unrest has drawn attention and affected the euro. The fight against inflation led by the European Central Bank (ECB) headquarters in Frankfurt appears to be over. Price increases have largely disappeared, mainly due to slower growth.

EUR/USD has been underperforming in recent weeks due to concerns contrasting with the strength of the US economy. On the same day that German and eurozone GDP figures were released, officials in Washington also released their first estimates of US growth, sharpening the relationship between the two countries.

The US is expected to report annualized growth of 3%, roughly equivalent to a 0.7% quarter-on-quarter expansion. This would exceed the expected results for Spain, the eurozone's fastest growing large economy.

What if Germany reports surprising growth? A 0.1% expansion rate not only means no recession, but also boosts the euro. However, we expect EUR/USD upside to be limited. Skeptics will see this as a temporary bump in a broader slowdown in the Old World.

Overall, I expect German and Eurozone GDP statistics to weigh on the euro sooner or later.