In just the past week, over $750 million worth of Ethereum has been withdrawn from major cryptocurrency exchanges.

This trend often suggests that investors are choosing to hold for the long term rather than preparing to sell. Altcoin daily trading volume also surged by more than 80%, according to data from CoinMarketCap.

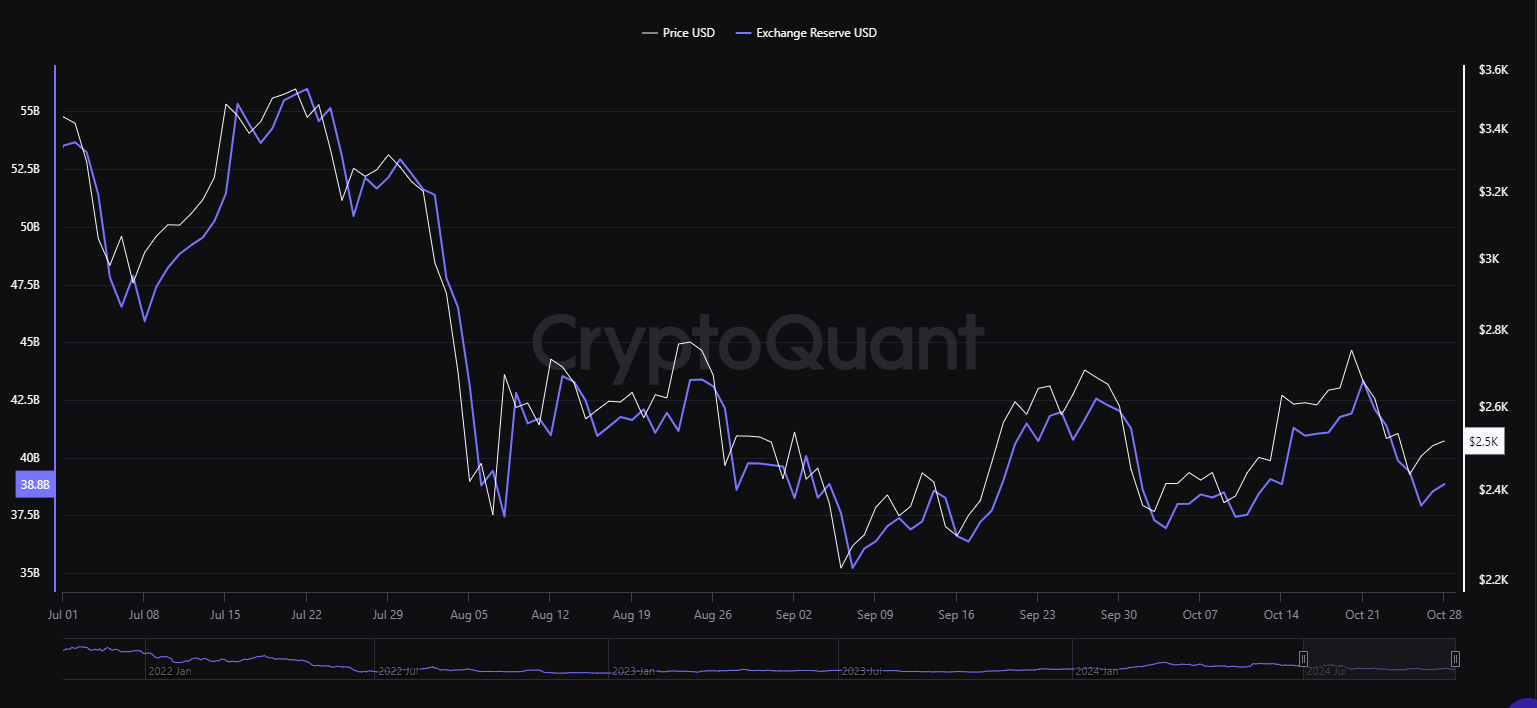

Ethereum’s exchange reserves continue to decline

CryptoQuant data highlights the sharp decline in Ethereum's foreign exchange reserves, which have recently fallen from more than $42 billion to around $38.9 billion. This move reflects over $4 billion of ETH being withdrawn from exchanges.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The decline in Ethereum reserves on this exchange will tighten liquidity, and if purchasing demand stabilizes, the price could stabilize or rise. With fewer tokens available for immediate purchase, increased purchasing activity can impact price more directly.

Ethereum has seen limited momentum in recent months. The second-largest cryptocurrency by market capitalization fell nearly 6% in October, while its biggest competitor Solana rose 12%.

Ethereum’s recent rise in profit-taking also reached a two-month high, with multiple holders capitalizing on previous gains. This trend has fueled recent price movements as some investors have chosen to cash out.

Ethereum is undervalued. A portion of the profits are converted into ether. There are some resistance levels at $2,901.63, suggesting a potential move higher if the price breaks out further. Weekly support is at $2,107.48, providing a strong demand zone. Price could bounce off the pivot towards upward momentum or revisit weekly support before gaining momentum,” influencer Crypto Caesar wrote in a post on X (formerly Twitter).

Regardless of market trends, networks have focused on improving scalability. Ethereum co-founder Vitalik Buterin recently announced “The Purge,” a planned upgrade focused on streamlining data storage and reducing protocol complexity.

This upgrade is critical to the network's long-term goals of increasing scalability, security, and sustainability.

Read more: Who is Vitalik Buterin? Learn more about the Ethereum co-founder

Additionally, Buterin also addressed why the Ethereum Foundation chose to sell some of its holdings rather than stake them. There is growing community concern about the Foundation's management of resources.

Buterin emphasized that staking could allow the foundation to take an official position on certain network upgrades during a hard fork, which could hinder decentralization.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.