- Over 300,000 ETH has been withdrawn from exchanges in the past week alone.

- ETH price continues a slight upward trend.

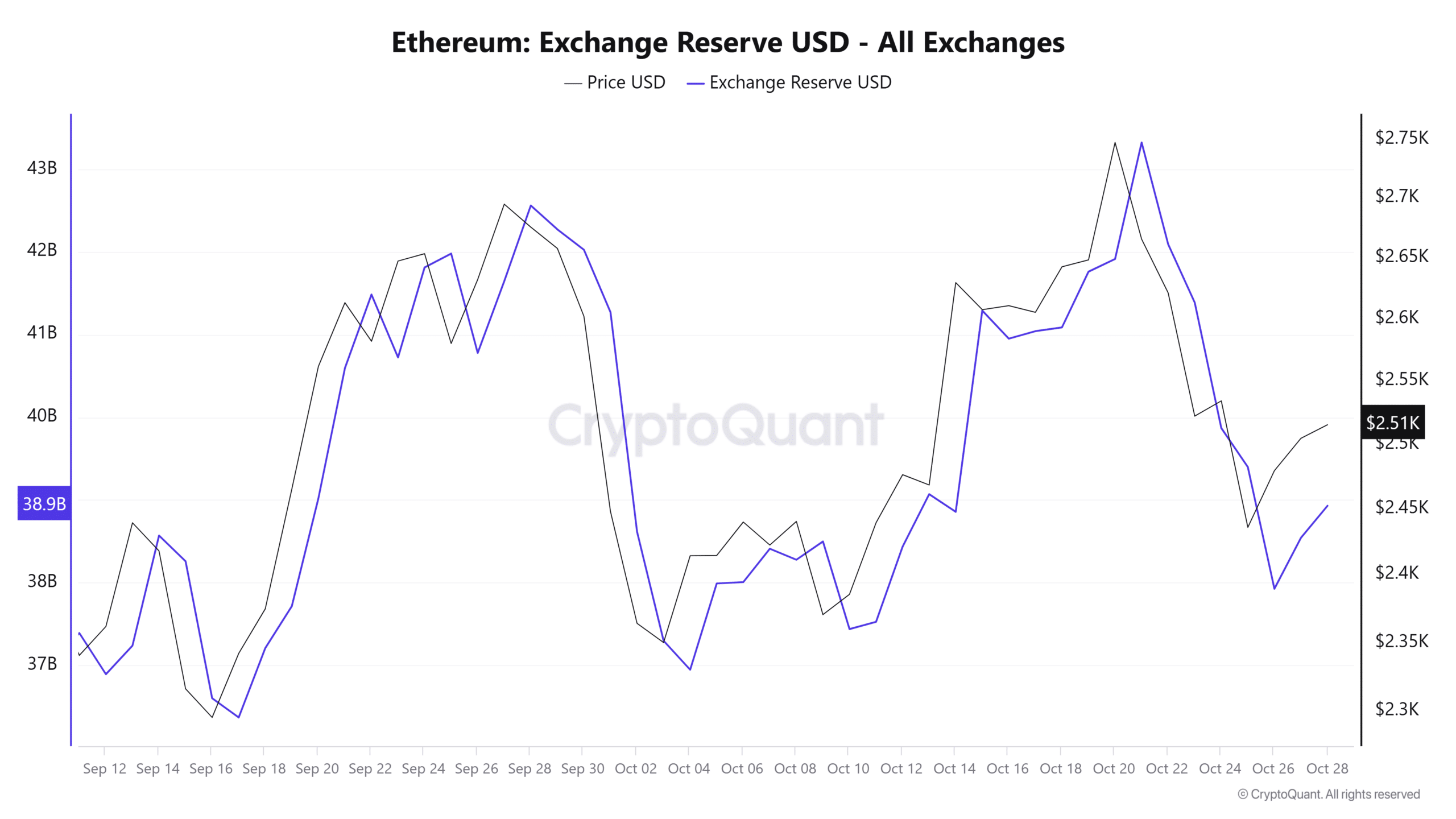

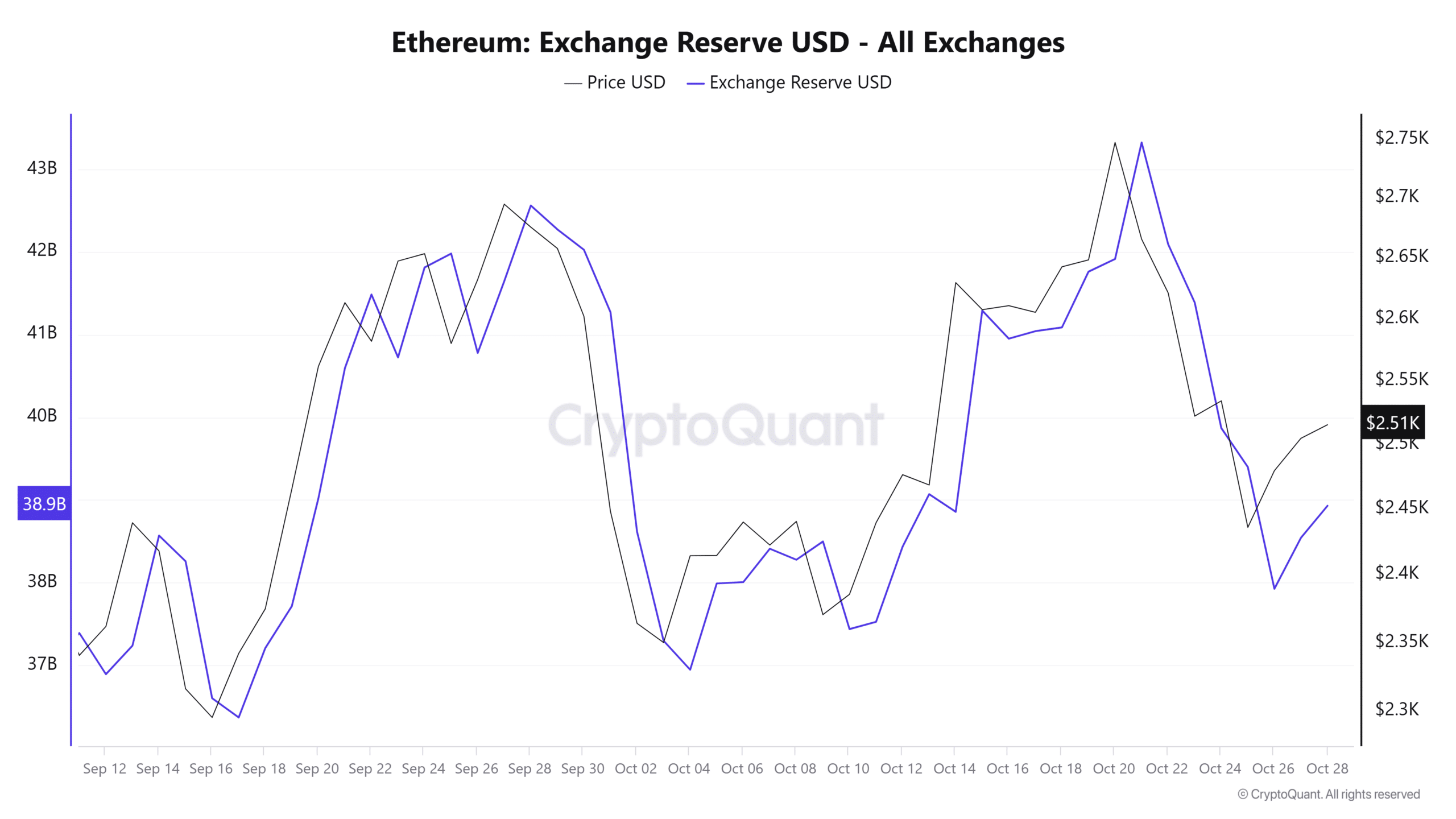

ethereum [ETH] The recent price movement around $2,500 has occurred in response to a significant decline in foreign exchange reserves. The decline highlights a potential shift in investor sentiment.

A decline in foreign exchange reserves often indicates that investors are moving their holdings off exchanges. This movement typically indicates a long-term holding strategy rather than an intent to sell. This change could be essential in stabilizing the price of ETH and shaping its future performance.

Over $4 billion of Ethereum to be withdrawn from exchanges

According to CryptoQuant data, Ethereum’s foreign exchange reserves have decreased significantly. It fell from more than $42 billion to about $38.9 billion within weeks, according to the data. This means over $4 billion worth of ETH is being moved off exchanges.

Source: CryptoQuant

This move suggests that many investors are shifting their strategies to holding rather than short-term trading. This trend appears when the price of Ethereum fluctuates between $2,400 and $2,700.

Ethereum withdrawal coincides with price stabilization

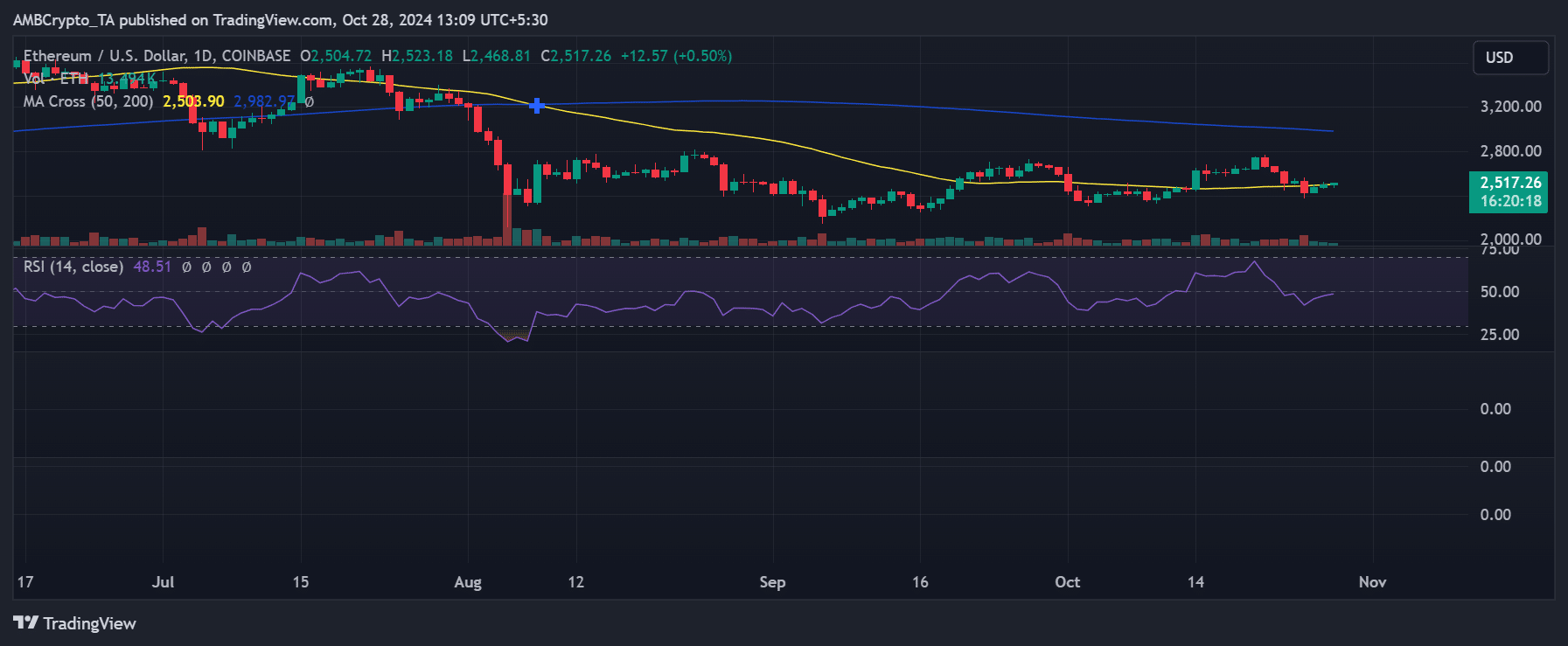

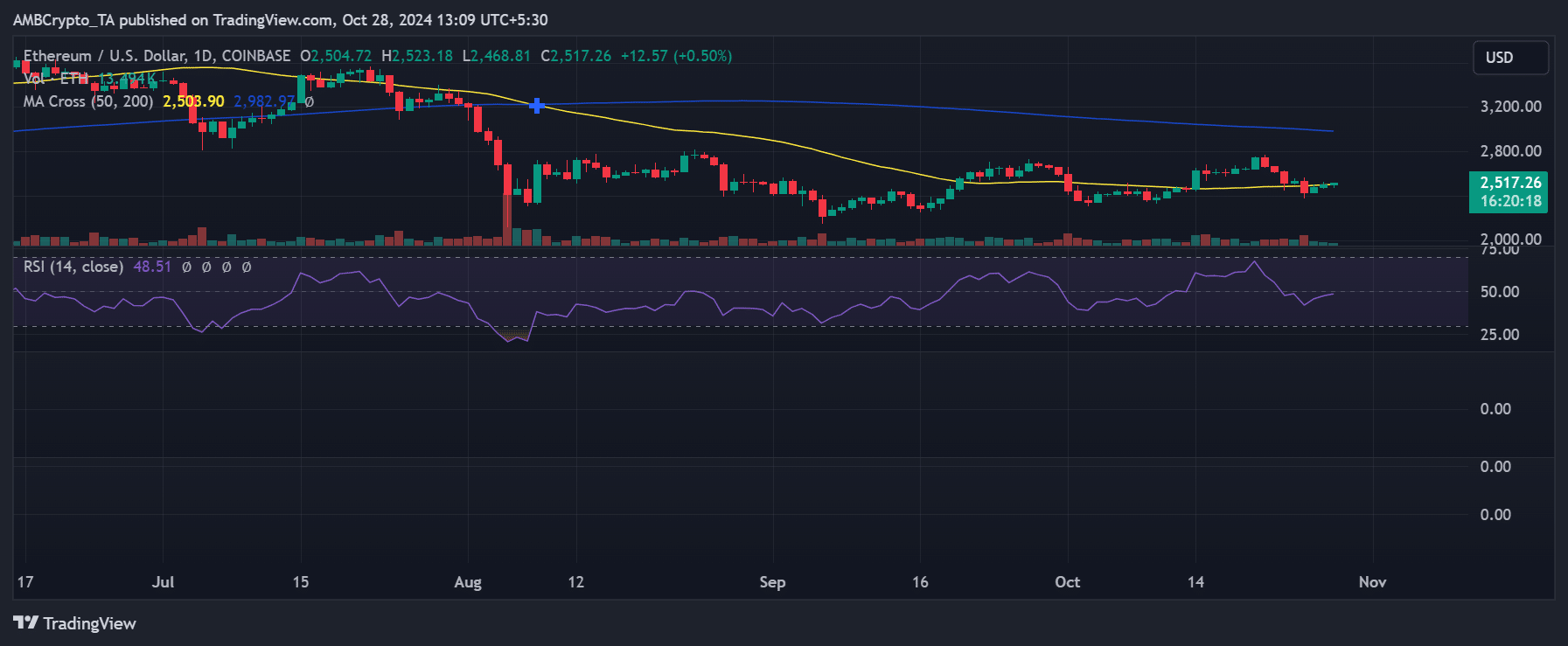

This withdrawal trend is consistent with Ethereum’s recent struggle to break above resistance levels around $2,600. By moving their holdings off exchanges, investors may be demonstrating confidence in their long-term value.

Source: TradingView

This move could reduce selling pressure and consolidate and stabilize prices, especially if foreign exchange reserves continue to decline in the coming days. Especially if demand is stable, fewer tokens will be available for instant trading and the price may stabilize.

Impact of decrease in Ethereum reserves on price stability

A reduction in foreign exchange reserves often results in a reduction in available liquidity. If demand is consistent, this could help stabilize or increase prices. With fewer tokens readily available on exchanges, a surge in buying interest could have an even greater impact on price.

These exchange outflows signal a shift in sentiment as Ethereum looks to regain momentum after its recent selloff. This indicates that holders are more likely to hold on, reducing the risk of a large selloff.

However, stable demand levels are important. If demand weakens, ETH could continue to struggle with resistance levels, potentially leading to an even longer consolidation period.

Ethereum’s short-term outlook

The current decline in foreign exchange reserves suggests that prices may remain firm and gain upward momentum. Maintaining the $2,500 support level and steadily decreasing reserves could help lay the foundation for a sustainable recovery.

Read Ethereum (ETH) price prediction for 2024-25

If market conditions favor increased demand, there could be more buying interest in Ethereum, allowing for further price appreciation.

Nevertheless, ETH could still face pressure at the resistance level if market conditions change and demand decreases. The latest data suggests cautious optimism as long-term holders demonstrate resilience to continued market volatility.