Bitcoin is preparing to come out of stagnation. After seven months of sideways trading, is Bitcoin finally on the brink of a major breakout?

The famous investment company Bernstein We have published a comprehensive report We outline why Bitcoin could reach an all-time high of $200,000 by the end of 2025. This prediction is based on Bitcoin's current price of around $68,000, implying an increase of almost 200%.

Bitcoin has been flat since March. BNC Bitcoin Liquid Index

Bernstein analysts wrote that they believe Bitcoin will reach $200,000 by the end of 2025. And that's called “conservative.” “With accelerating institutional adoption, Bitcoin is expected to triple from here, reaching a cycle-high price of $200,000 by the end of 2025,” the report said.

The report sparked a frenzy among billionaire investors who are rapidly increasing their Bitcoin holdings. Hedge fund managers and tech entrepreneurs lead this attack, believing Bitcoin is headed for a big rally After the 2024 presidential election. The growing interest among the ultra-wealthy has raised questions about whether Bernstein's optimistic predictions are accurate.

Michael Saylor, MicroStrategy's executive chairman, stands out as a prominent billionaire champion of Bitcoin. in Bitcoin Conference in NashvilleTennessee, Saylor predicted this summer that Bitcoin could reach $13 million by 2045. His commitment to Bitcoin is unwavering, with MicroStrategy holding over 1% of all Bitcoin in circulation today. This aggressive investment strategy confirms his confidence in Bitcoin's long-term potential.

Billionaire investments in Bitcoin

Other tech industry heavyweights, including Mark Cuban and Block CEO Jack Dorsey, are also increasing their investments in Bitcoin. In addition, prominent venture capitalists from Silicon Valley have also entered this field, and some investors are actively working on it. Join the 2024 Presidential Election Campaign. Jack Dorsey has boldly predicted that the price of Bitcoin could rise to $1 million by 2030, demonstrating his strong belief in the potential of cryptocurrencies.

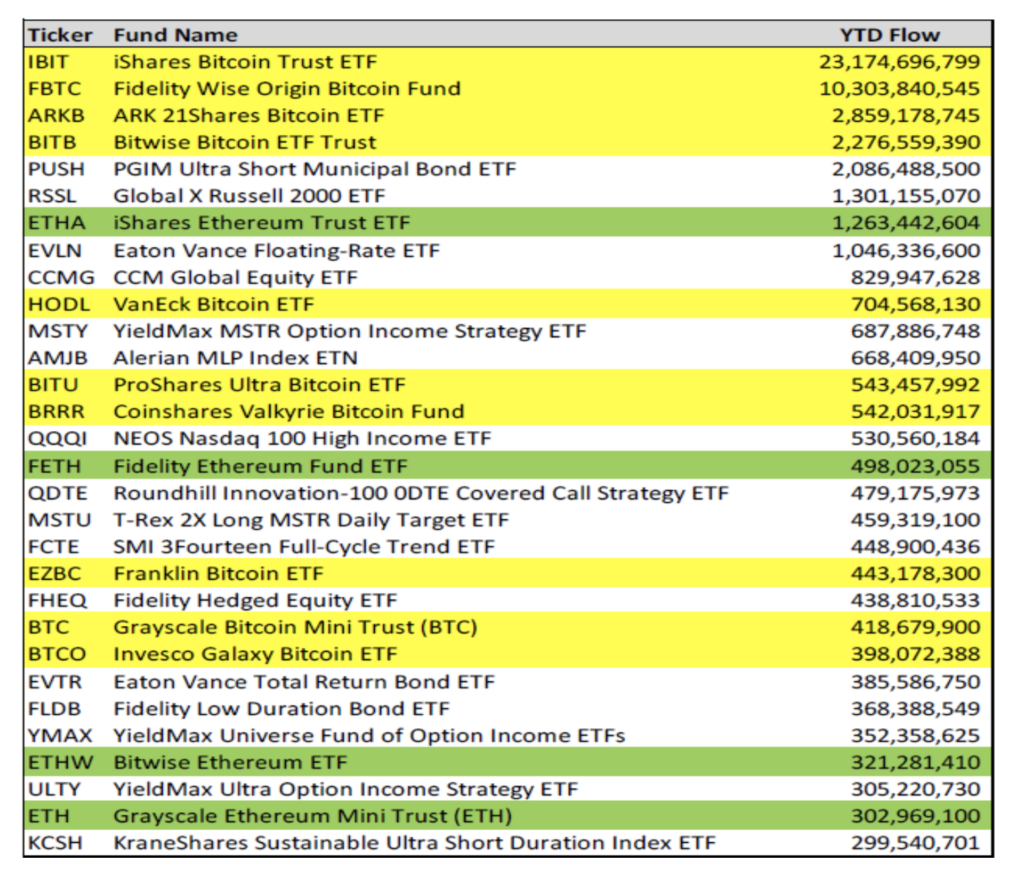

Summarized by VanEck's Matthew Sigel Bernstein's 160-page “Black Book” This claims that consolidation among Bitcoin miners is underway. The report also found that 10 global asset managers currently manage approximately $60 billion in assets through regulated exchange-traded funds, a significant increase from $12 billion in September 2022. It is pointed out that there are.

Source: Farside Investors

Moreover, this trend also includes institutional investors. Billionaire hedge fund managers are now eyeing a new Bitcoin exchange-traded fund (ETF).ETF). Data from the Securities and Exchange Commission reveals that major funds, including Israel Englander's Millennium Management, have invested heavily in Bitcoin ETFs. Millennium Management launched a $2 billion investment this year. More than 600 investment firms hold significant stakes in Bitcoin ETFs, underscoring widespread institutional confidence in the cryptocurrency.

Bernstein also emphasized that the billionaire's surge in investments stems from expectations of significant short-term price increases. Commonly known in the cryptocurrency world as “number go up,” this strategy involves buying Bitcoin in the hope that its value will increase, regardless of underlying economic indicators. Contains. But Bernstein points out that billionaires' reasons for investing in Bitcoin are not just speculative, but also driven by deeper strategic considerations.

Institutional era increases trust in Bitcoin

Bernstein highlights the main factors leading to Bitcoin's significant price increase. A transformative institutional era is upon us as professional investors embrace cryptocurrencies as a legitimate asset class. Spot Bitcoin ETFs create seamless market access, allowing Wall Street firms and wealthy investors to accumulate large holdings. Valuations may then rise due to large capital inflows.

Increasing economic pressures are driving the adoption of Bitcoin as a strategic hedge. Investors are seeking protection from the risks of hyperinflation, the growing U.S. federal debt of more than $35 trillion, and escalating conflict in the Middle East. Additionally, JPMorgan Chase advocates a “downgrade trade” strategy, recommending positions in Bitcoin and gold to counter dollar weakness and global instability. Current forecasts indicate that momentum could continue through 2025, increasing the value of both assets.

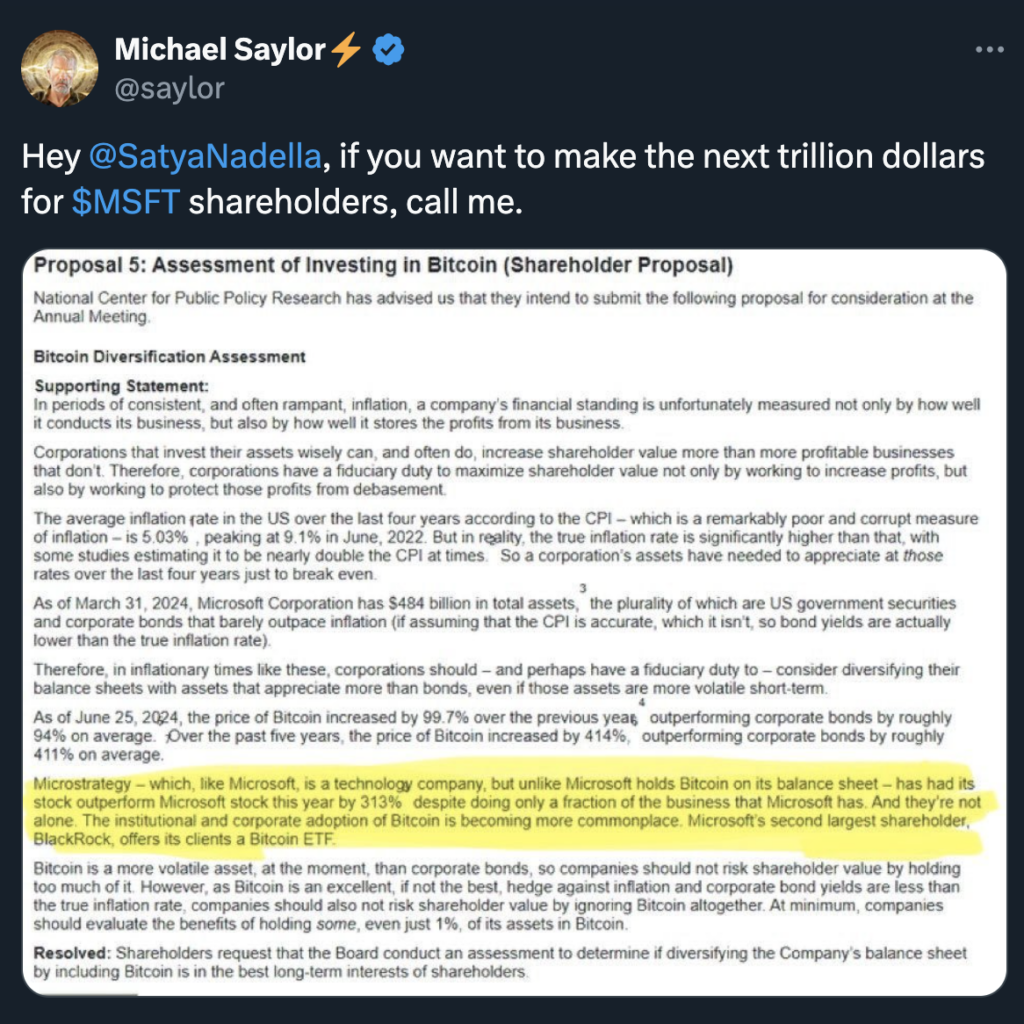

microsoft annual General meeting of shareholdersThe debate, scheduled for December 10th, has a hot topic: a proposal advocating for tech giants to diversify their stock holdings by investing in Bitcoin. filed with the SEC, suggestion It suggests that Bitcoin could increase shareholder value, act as a hedge against inflation, and outperform Microsoft's current investment in corporate bonds.

The proposal, titled “Evaluating an Investment in Bitcoin,” argues that corporate bond yields return slightly above inflation, suggesting that Bitcoin is a strong alternative. According to the proposal, “during periods of inflation, companies have an obligation to consider assets that are more likely to appreciate in value than bonds, even if they have higher short-term volatility.”

MicroStrategy CEO Michael Saylor is ready to give Microsoft CEO Satya Nadella the orange pill. XSailor's tweet called out Nadella, saying, “@SatyaNadella, if you want to make the next $1 trillion for MSFT shareholders, call me.”

Source:X

Bernstein emphasizes the role Bitcoin plays in a market that has evolved beyond speculative trading. Its unique position as both a growth opportunity and a protected asset attracts portfolio diversification. Market analysis suggests that the deployment of capital by institutional investors will boost Bitcoin through increased demand while reinforcing its position as a shield against economic uncertainty.

Large-scale ETF investment suggests strong future prospects

A surge in Bitcoin ETF investments by hedge funds further underlines the positive sentiment surrounding Bitcoin. Millennium Management’s $2 billion investment in a Bitcoin ETF is a testament to the confidence institutional investors have in the future of cryptocurrencies. Over 600 investment firms currently hold significant positions in Bitcoin ETFs, and the market is seeing significant inflows that could propel Bitcoin to new heights.

This trend is not limited to just a few investors, but is widespread across many sectors of the financial industry. The increased adoption of Bitcoin ETFs by institutional investors indicates that cryptocurrencies are becoming more widely accepted and integrated into the mainstream financial system. As more businesses realize Bitcoin's potential as a valuable asset, demand may increase and the price rise in the process.

Bernstein's report also highlights that this new institutional era is creating a positive feedback loop for Bitcoin. As more institutional funds flow into the market, increased demand will drive up prices and attract more institutional investors. This cycle could potentially result in significant price increases, confirming Bernstein's prediction that Bitcoin will hit $200,000 by the end of 2025.