Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. Financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Please contact a financial professional and conduct your own research before making any investment decisions. Although we believe all content is accurate as of the date of publication, certain offers mentioned may not be currently available.

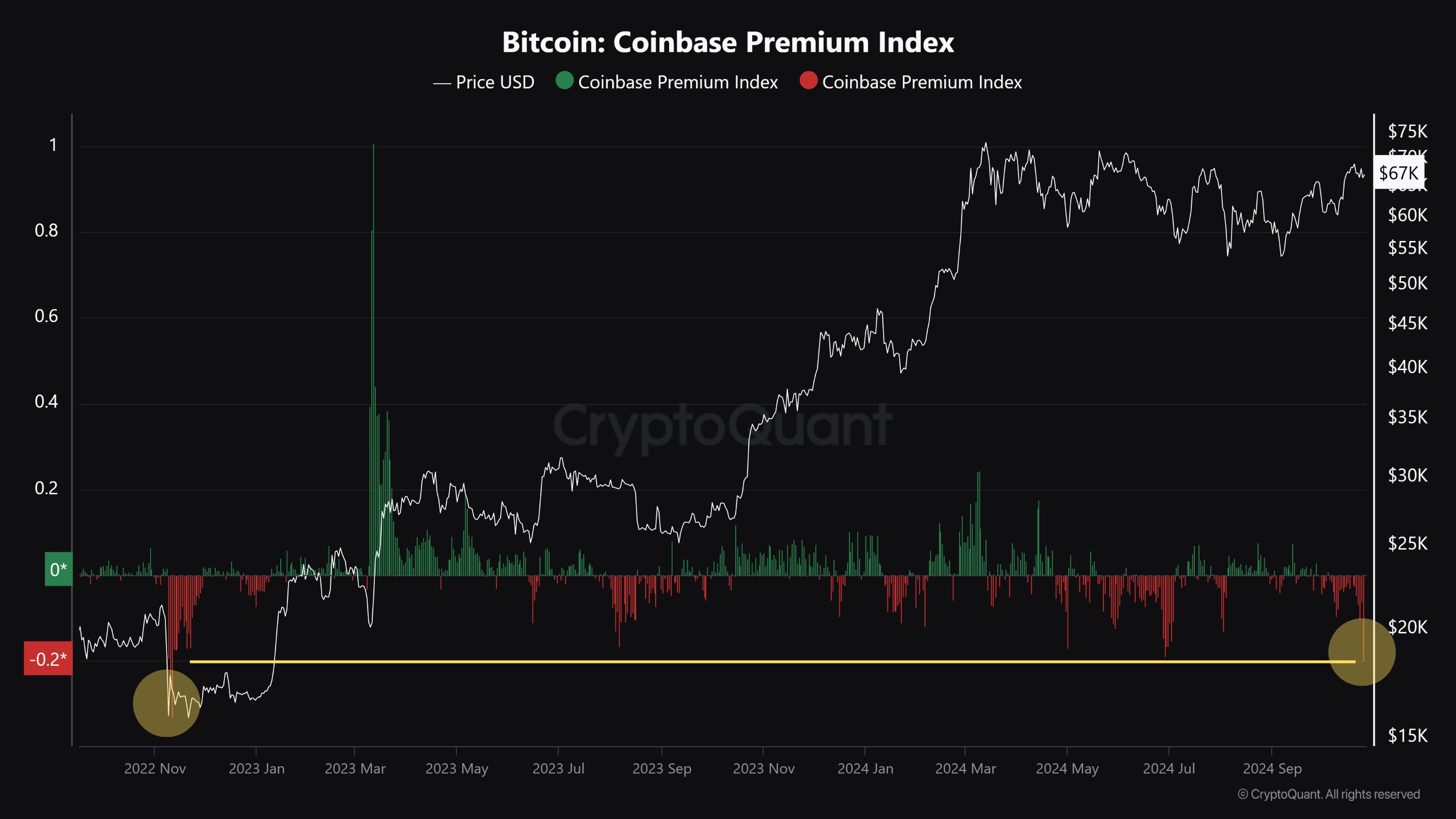

The difference in the price of Bitcoin between Coinbase and other exchanges is measured by the Coinbase Premium Index, which recently fell to -0.2%, its lowest level in two years. Institutional interest in Coinbase is measured by the Premium Index. For now, the value of the indicator suggests that US-based trading platforms such as Coinbase may be on the decline.

It is common to think that US buyers sell more frequently compared to buyers in other regions, but this may indicate that US institutional demand is declining. There is. In the past, a positive Coinbase Premium signaled that institutional investors had significant purchasing power, which typically drove the price of Bitcoin higher. On the other hand, if the trend persists, a negative premium could indicate an impending price change or even a decline.

This low premium could signal that Bitcoin's resurgent upward momentum in recent months is stalling, especially if significant institutional interest in the asset does not resurface. There is. After breaking out of the previous downtrend channel, $65,500 is an important support level for Bitcoin, which is currently trading close to the critical level.

If selling pressure continues to build, a decline below this level could push Bitcoin lower and test the $63,000 range, another key support level from recent trading activity. On the plus side, Bitcoin could aim for $72,000, which many analysts believe is the next key resistance level if buyers regain control and Coinbase premium turns positive. are.

Even if Bitcoin shows resilience around current price levels, a reversal in the premium index would signal a return to institutional investor confidence. For now, traders should keep an eye on the $65,500 and $63,000 support levels. That's because that breakdown could be a harbinger of a larger correction.