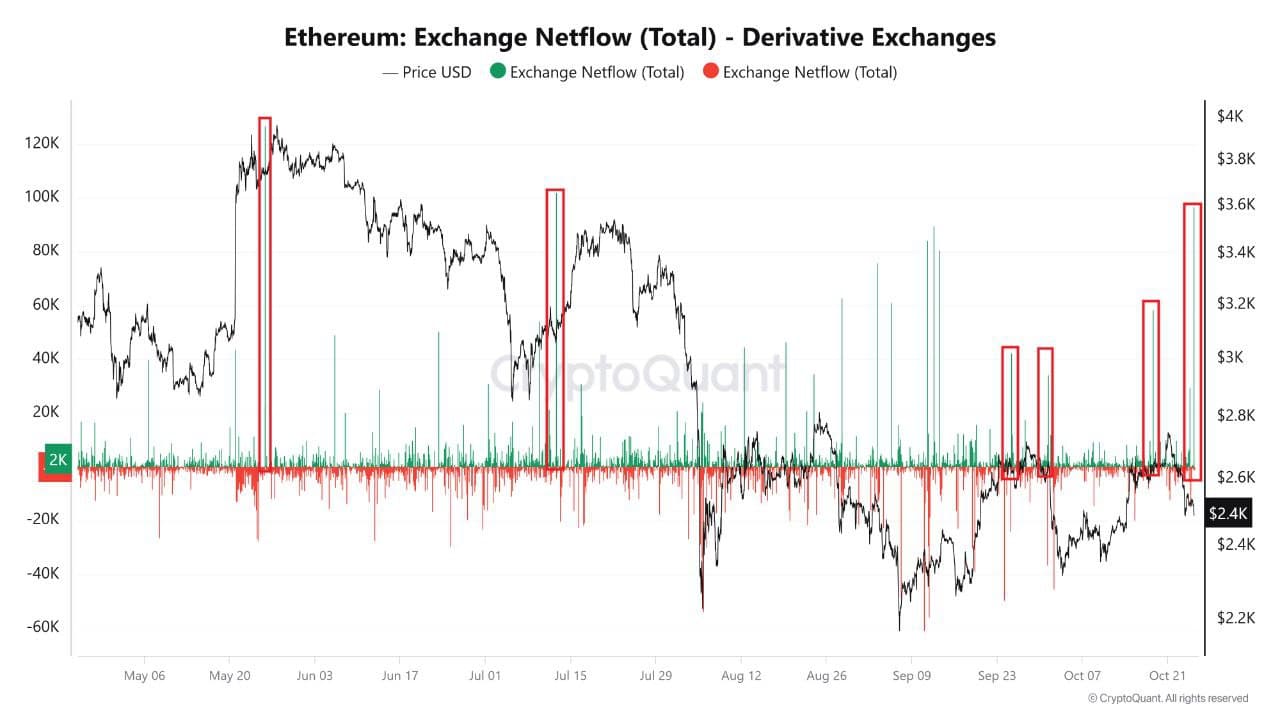

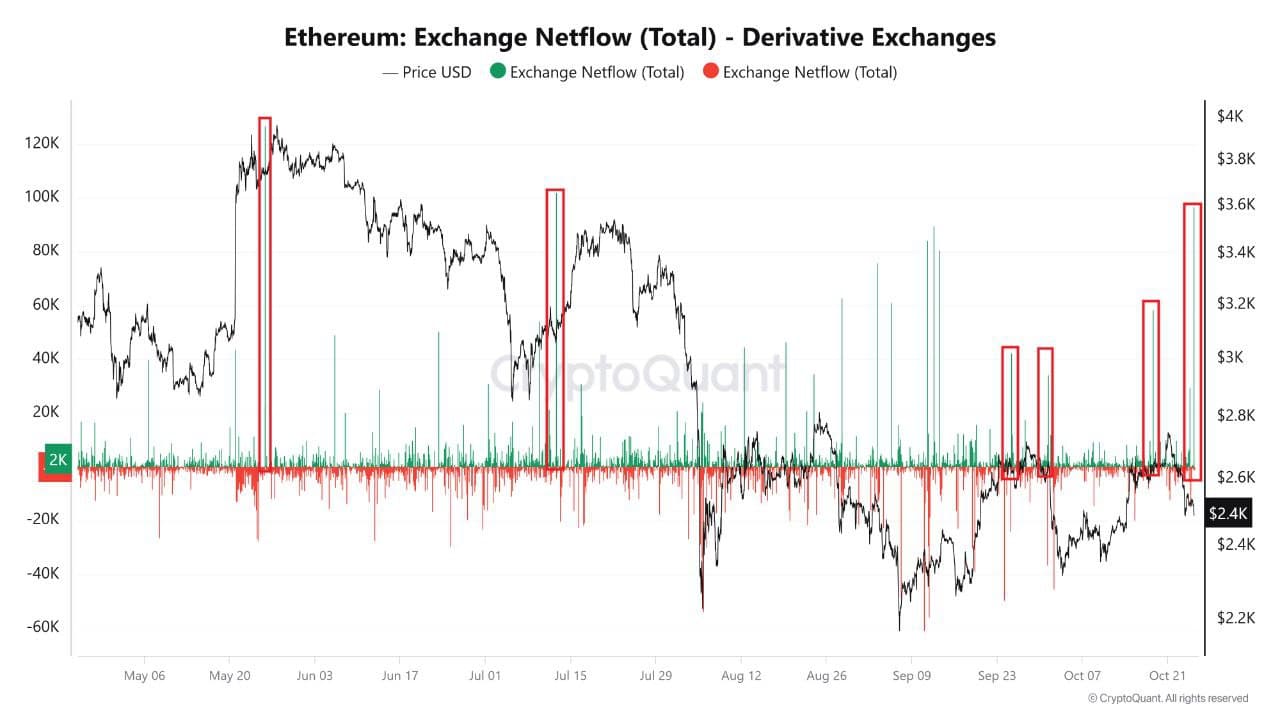

- In the market, Ethereum has flowed into derivatives exchanges.

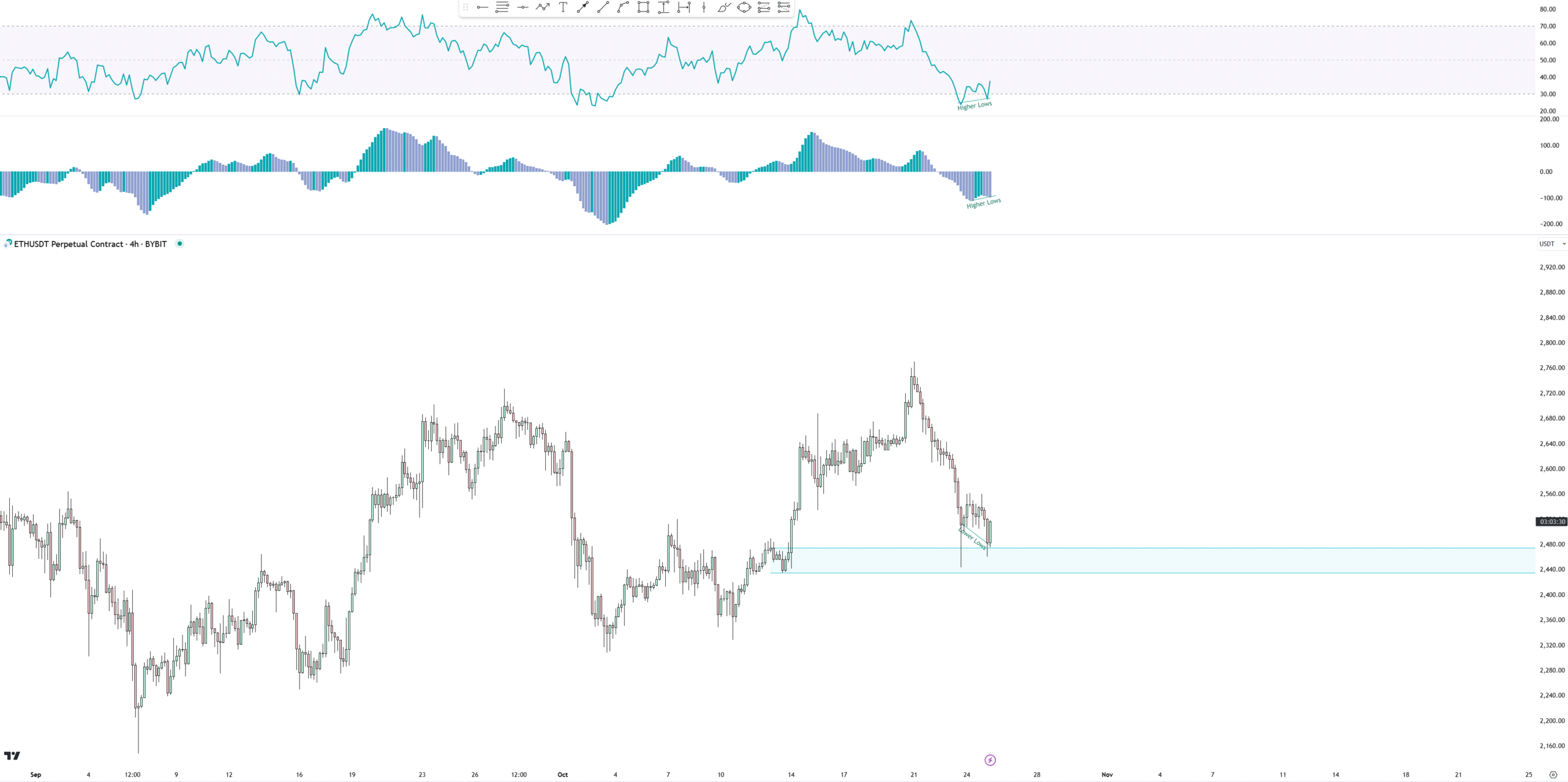

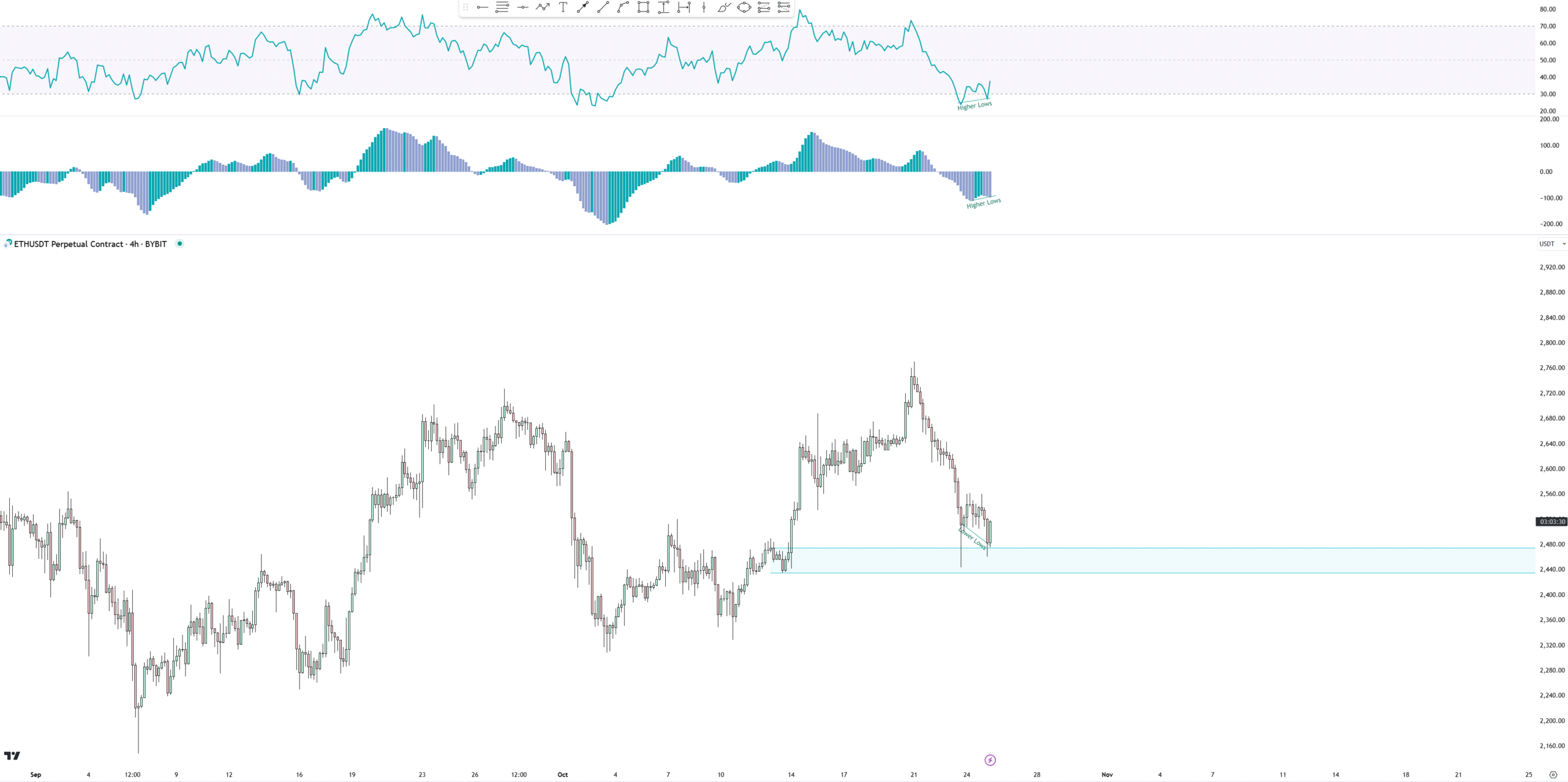

- Recent charts showed that ETH is likely for a bullish divergence in 4 hours.

Ethereum [ETH]is one of the leading cryptocurrencies and has been the subject of discussion as the recent inflow of 96000 ETH into derivatives exchanges indicates a notable increase in market activity.

Historically, similar inflows have caused ETH prices to fluctuate or decline, as seen in May and July of this year. This increase could signal further price correction or result in a major change in the market.

As the final quarter of this year unfolds, Ethereum's performance is likely to largely follow Bitcoin's recent break from a long period of consolidation, which has sparked optimism across the crypto market.

Source: CryptoQuant

US election with divergent signals

Ethereum price movements during past US election cycles also support this trend. During the 2020 elections, ETH skyrocketed and came out of consolidation.

With the election just days away, a similar pattern could emerge.

If history repeats itself, Ethereum could rebound, especially as many expect a positive policy towards cryptocurrencies under a potential change in the US administration.

However, this outcome remains speculative as the overall economic and cryptocurrency landscape has evolved since 2020.

Source: TradingView

In support of a possible bullish reversal in ETH, recent charts show a possible divergence of just over 4 hours, indicating a shift in demand.

Although the structure of this demand level looked irregular, Ethereum showed a reaction that could indicate strength.

The divergence structure was clear and showed double divergence with clean arc formation, giving a positive outlook.

Source: TradingView

Most of the negative delta appears on the first leg of this pattern, which typically indicates less selling pressure on the second leg.

However, analysts signaled caution and advised traders to wait for a strong blue candlestick confirming a reversal before assuming the bearish outlook is invalidated.

ETH/BTC tests 2016 highs

In another important development, Ethereum tested its 2016 highs against Bitcoin. ETH is currently trading below a long-term descending wedge pattern, which represents a higher timeframe support level.

Many traders expect that ETH could continue to correct against Bitcoin, especially if it struggles to break out of this level.

Although Ethereum has shown resilience in the recent market, investor interest remains low and future price trends remain uncertain.

Source: TradingView

If ETH honors this support, it could attract new market interest and begin a market shift in the remaining months of this year or early next year.

read ethereum [ETH] Price prediction for 2024-2025

However, until ETH confirms a breakout, a cautious outlook remains prudent for investors.

While heavy capital inflows, election-year trends, and the possibility of a bullish breakaway fuel upside expectations, ETH must overcome key resistance levels against Bitcoin.