Bitcoin open interest has been the subject of debate over the past week, with various on-chain platforms highlighting its recent record surge. However, investment analysis firm Alpharaktal disputed that BTC's open interest reached an all-time high.

Interestingly, a prominent crypto analysis platform released new data on Bitcoin open interest, revealing that the indicator has indeed hit record highs over the past week. The potential impacts on the price of BTC are:

Are Bitcoin traders taking more risks?

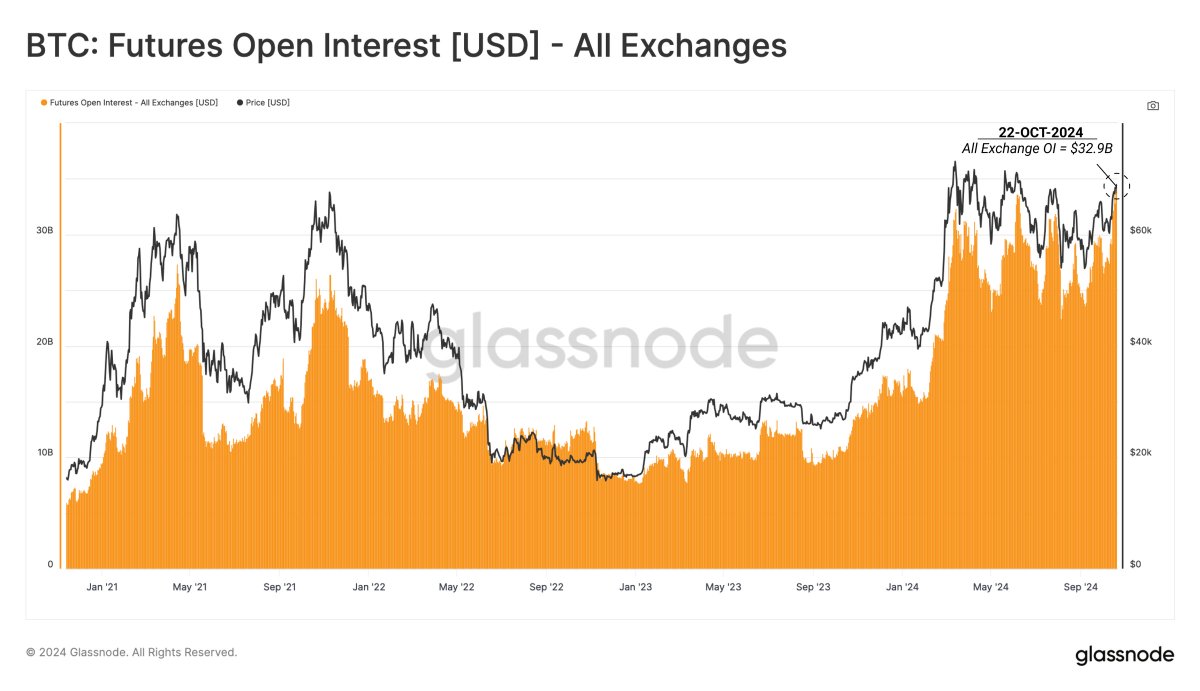

In a new post on the X Platform, Glassnode revealed that Bitcoin open interest across all exchanges has reached an all-time high.

Glassnode wrote on X:

Open interest in perpetual and fixed-term futures contracts hit a new ATH of $32.9 billion this week, suggesting a notable increase in total leverage entering the system.

For context, open interest is a metric that measures the total amount of futures or derivative contracts for a particular cryptocurrency (in this scenario, BTC) in the market at a particular point in time. It typically gives you an insight into how much money is invested in Bitcoin futures at the moment. Rising open interest also signals a change in investor sentiment and heightened market speculation, with many traders bracing for market moves.

Source: Glassnode/X

Bitcoin open interest soared to an all-time high of $32.9 billion last week, showing an influx of new money into the crypto industry's most valuable market. This indicator does not provide information on whether these new futures positions are bearish or bullish, but it does indicate the potential for increased market volatility.

As highlighted by Glassnode in X, the total leverage entering the Bitcoin derivatives market has increased significantly. From a historical perspective, markets tend to see large spontaneous price movements whenever risk-taking behavior by traders increases.

This market outlook will be an interesting development in the coming weeks for Bitcoin prices, which had no noticeable impact in October. After forming strong bullish momentum last week, the top-tier cryptocurrency failed to capitalize on it over the past few days.

BTC price overview

At the time of writing, Bitcoin price is just below the $67,000 level, reflecting a 2.1% decline over the past 24 hours. Meanwhile, the premier cryptocurrency has fallen by roughly the same amount on a weekly basis, according to data from CoinGecko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from iStock, charts from TradingView