Important points

- Bitcoin's Bollinger Bands are at historically tight levels, indicating that the market is likely to move significantly.

- Tough Bollinger Band periods in the past have preceded significant bull markets.

Share this article

Bitcoin's Bollinger Bands are showing the tightest formation in history, and Bitcoin is bracing for big price swings. When the band is at its tightest level, it is sometimes referred to as a “Bollinger squeeze” and indicates a period of low volatility that can set the stage for a strong price breakout.

“Big moves are coming,” technical analyst Tony Severino said in a recent post. He said Bitcoin's Bollinger Bands, an indicator used to assess price volatility and determine trend direction, were “one of the three tightest in history” on the two-week time frame. He pointed out that there is.

Historically, this contraction has led to significant price fluctuations for Bitcoin.

A similar pattern was observed in April 2016, when Bollinger Bands tightened significantly for the first time. After this period, Bitcoin prices began to rise dramatically for several months, marking the beginning of a bullish trend.

Another significant case occurred in July 2023, when Bollinger Bands reached extreme tightness again. As in April 2016, this tightening was preceded by a significant price increase.

A tightening of the band indicates the possibility of a major move, but does not predict the direction of that move. The result could be a significant uptrend or a severe downtrend. For example, a similar pattern was observed in 2018, leading to a sharp decline in Bitcoin prices.

Historical data shows that Bitcoin has risen after a tight band 7 out of 9 times.

Bitcoin whales accumulate coins at historic speed

As previously reported by Crypto Briefing, Bitcoin whales have accumulated 670,000 BTC, the highest whale holdings in history. Historically, large accumulations have been followed by large price increases.

While the whale accumulation is a positive sign, the current sideways trend suggests that a major price move may not be imminent. If Bitcoin fails to reach new highs by late November, it could signal a challenge to the ongoing bullish cycle.

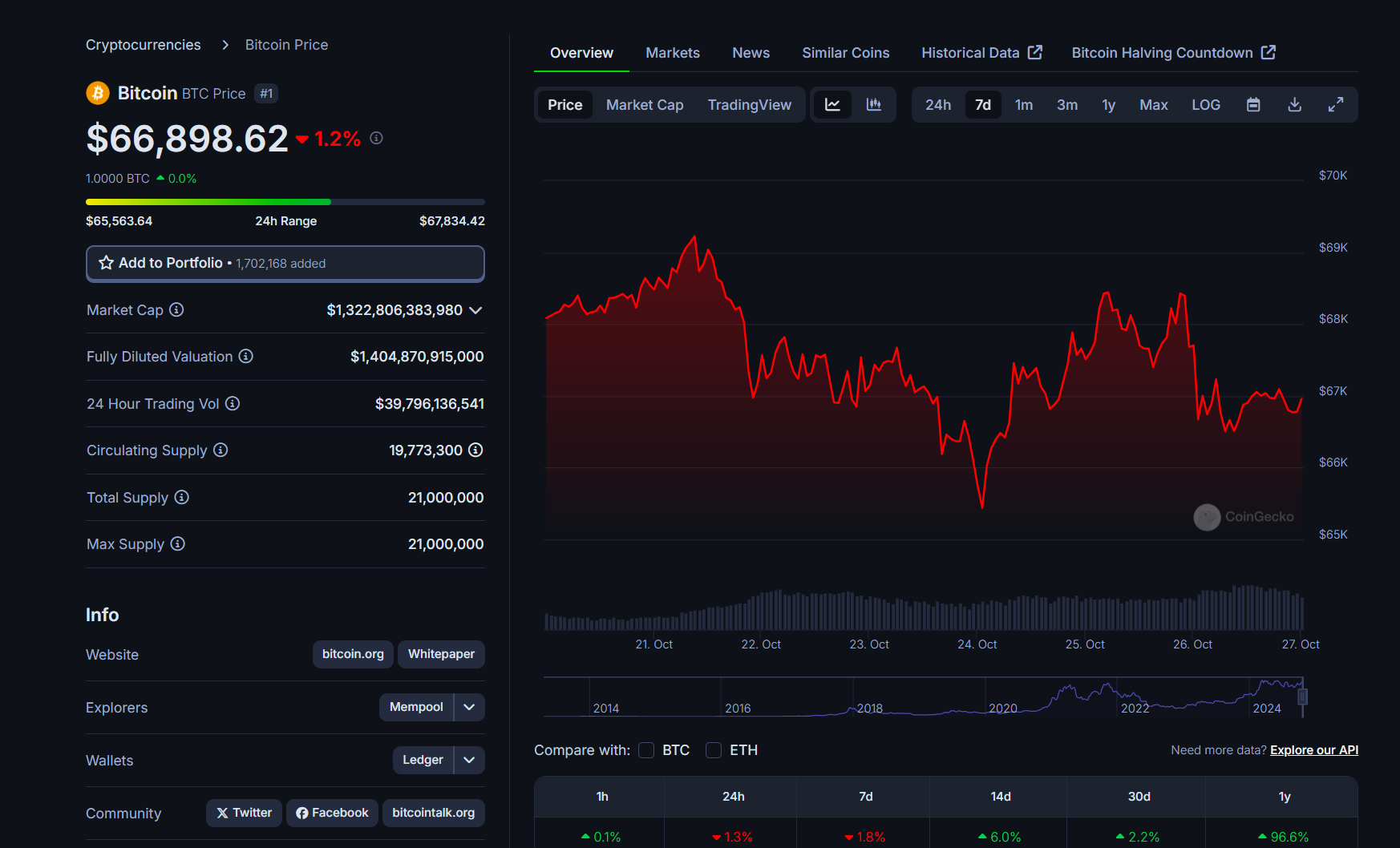

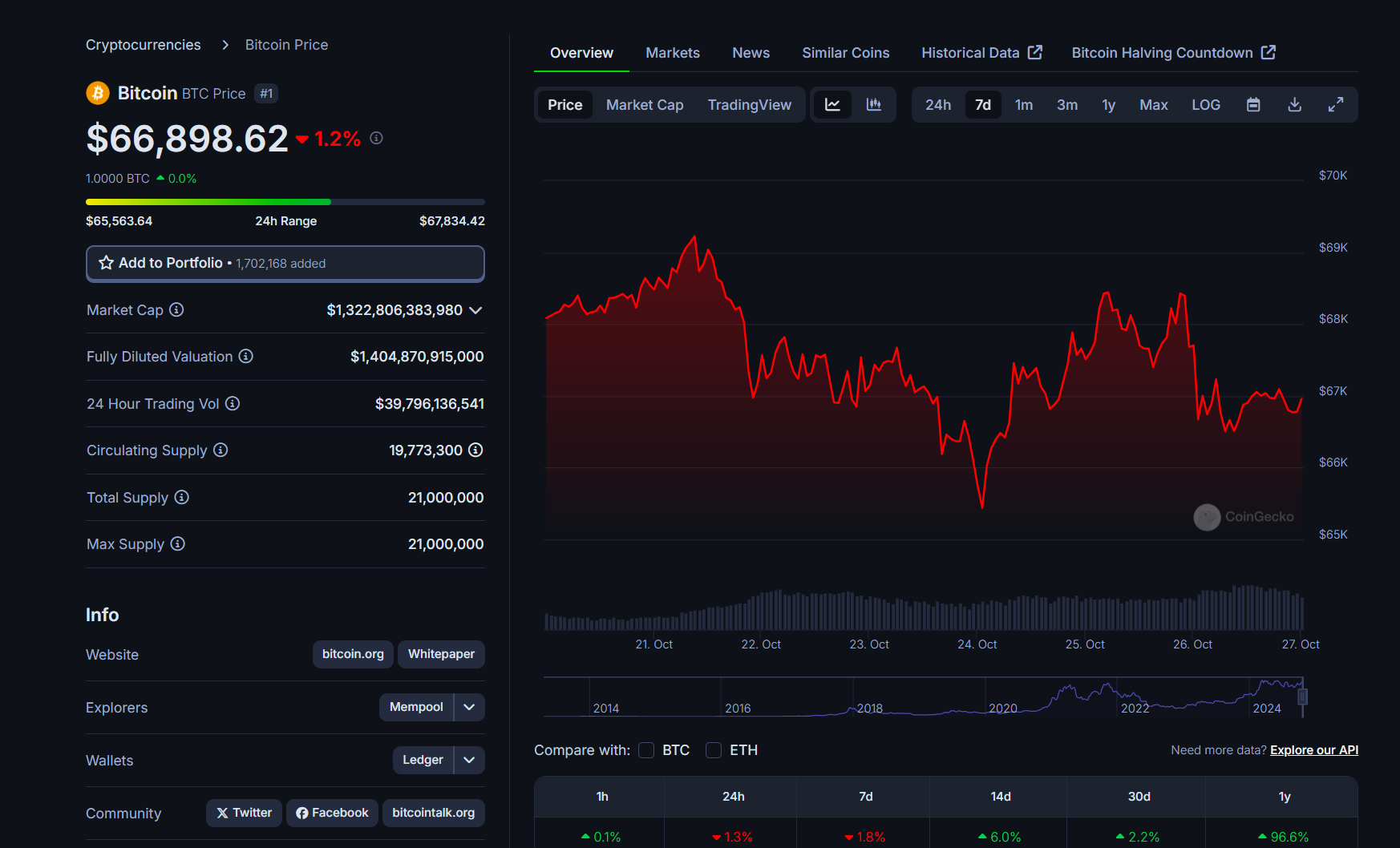

Bitcoin recently fell below $65,500 following reports of a criminal investigation into Tether, the world's largest stablecoin.

The Wall Street Journal, which broke the news, reported that federal prosecutors in Manhattan are investigating Tether's involvement in facilitating drug trafficking, terrorist financing, and hacking activities.

Tether categorically denied all allegations. Tether CEO Paolo Ardoino declared the accusations “patently false” and criticized the report for what he described as “stale noise”.

Rising tensions in the Middle East, particularly between Israel and Iran, also contributed to market volatility. On October 26, Israel announced a direct attack on Iran in retaliation for the massive missile barrage launched by Iran on October 1.

Bitcoin prices are susceptible to geopolitical turmoil, often with rapid declines followed by periods of consolidation or recovery. At the time of writing, Bitcoin was trading at around $66,800, down 1.3% in the past 24 hours, according to CoinGecko.

Share this article