- Increased net flows and leverage into Ethereum derivatives indicate potential volatility and market risk.

- Despite recent price challenges, retail interest in Ethereum remains high, with active addresses reaching new highs.

Ethereum [ETH] It has faced difficulties in recent weeks, struggling to regain highs above $3,000. The cryptocurrency has been trading below this level ever since, dropping by 5.8% over the past week.

At the time of writing, Ethereum was trading at $2,478, down 2.7% in the past 24 hours. This price performance has caused mixed reactions within the Ethereum community, with analysts offering different outlooks on this price performance. Short-term trajectory of assets.

Increase in ETH netflow

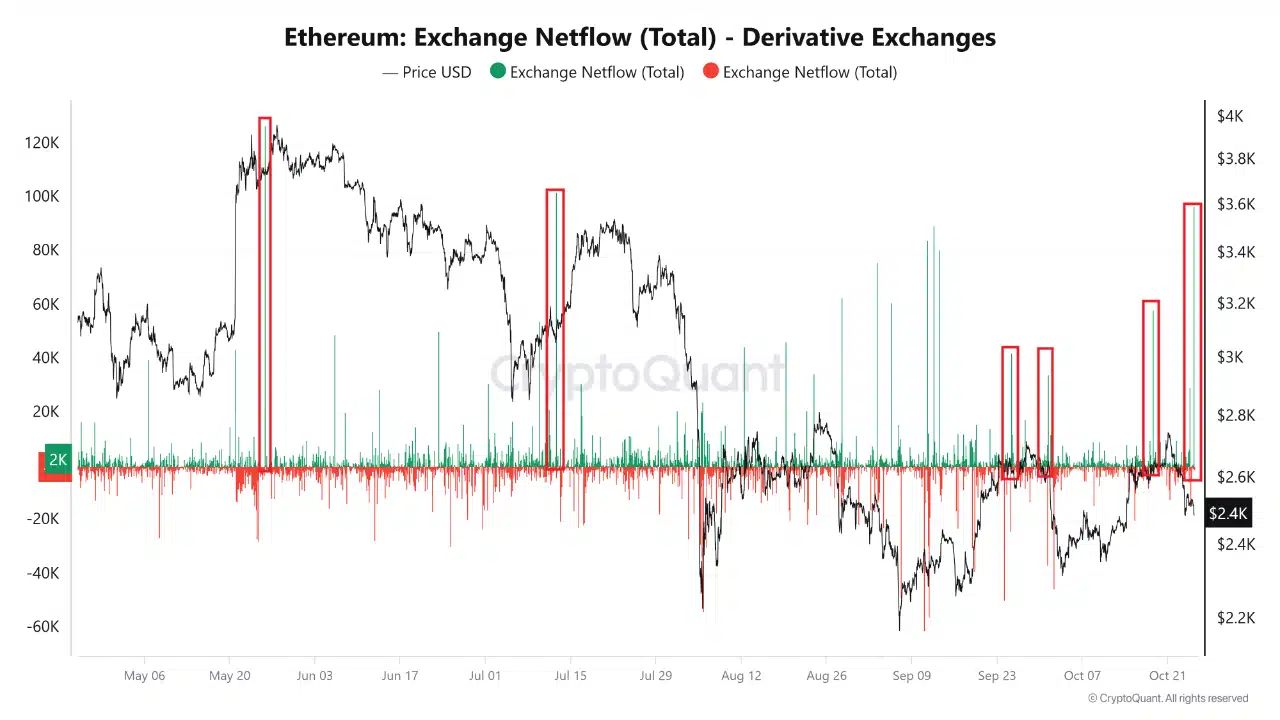

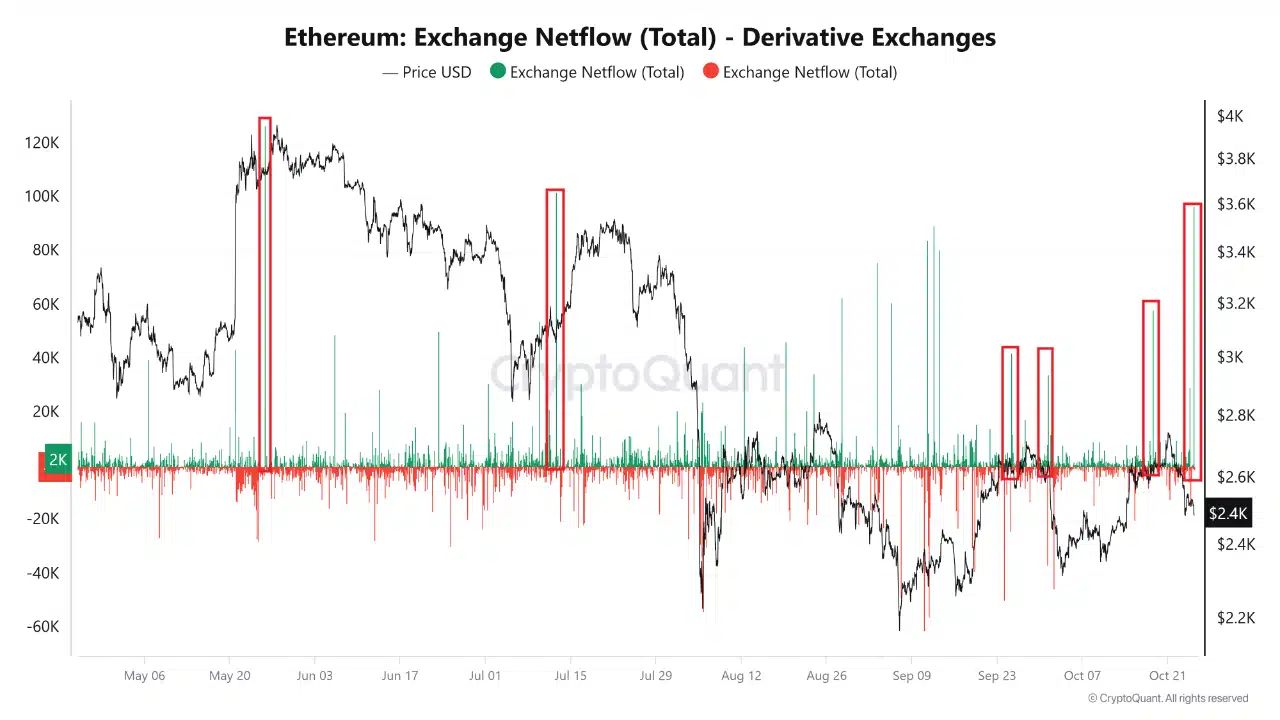

According to Amr Taha, an analyst at CryptoQuant, the recent surge in net Ethereum flows to derivatives exchanges signals a potential increase in market activity. Taha highlighted The derivatives exchange saw a significant inflow of 96,000 ETH, making it the largest net inflow in recent times.

Historically, spikes in netflows like those observed in May and July have coincided with increased volatility and subsequent price corrections in Ethereum. This move suggests that traders may be bracing for a potential decline in asset prices.

Source: CryptoQuant

Taha noted that the latest net flows could indicate increased volatility, adding that trader sentiment within the derivatives market often serves as an early indicator of Ethereum's future price movement. Ta.

Beyond net flows, Taha examined Ethereum futures sentiment, noting a series of peaks in the sentiment index that could serve as contrarian indicators. These peaks have historically marked local market highs, as bullish futures sentiment often precedes price pullbacks.

This trend suggests that growing optimism among futures traders may indicate a potential price correction for Ethereum.

Taha added that spikes in sentiment, marked in red on the futures sentiment chart, reflect moments when the market is leaning overly optimistic, creating an environment prone to market reversals.

Ethereum retail interest rate and leverage ratio

Meanwhile, Ethereum's other on-chain indicators provide additional insight into current market dynamics.

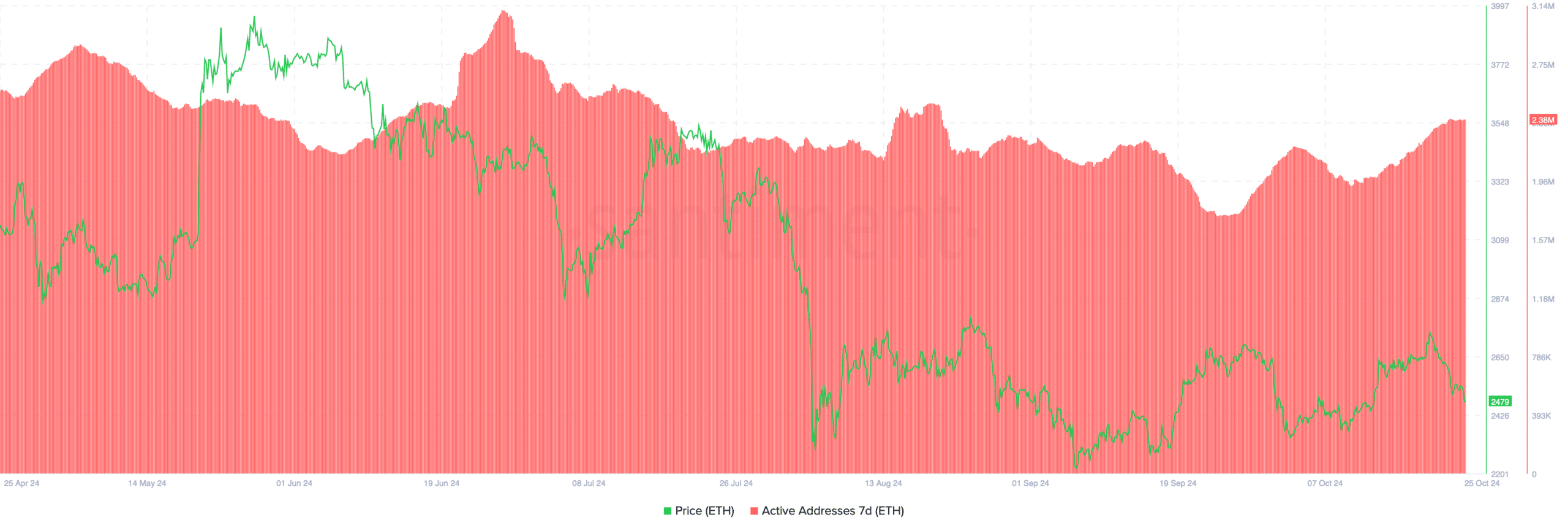

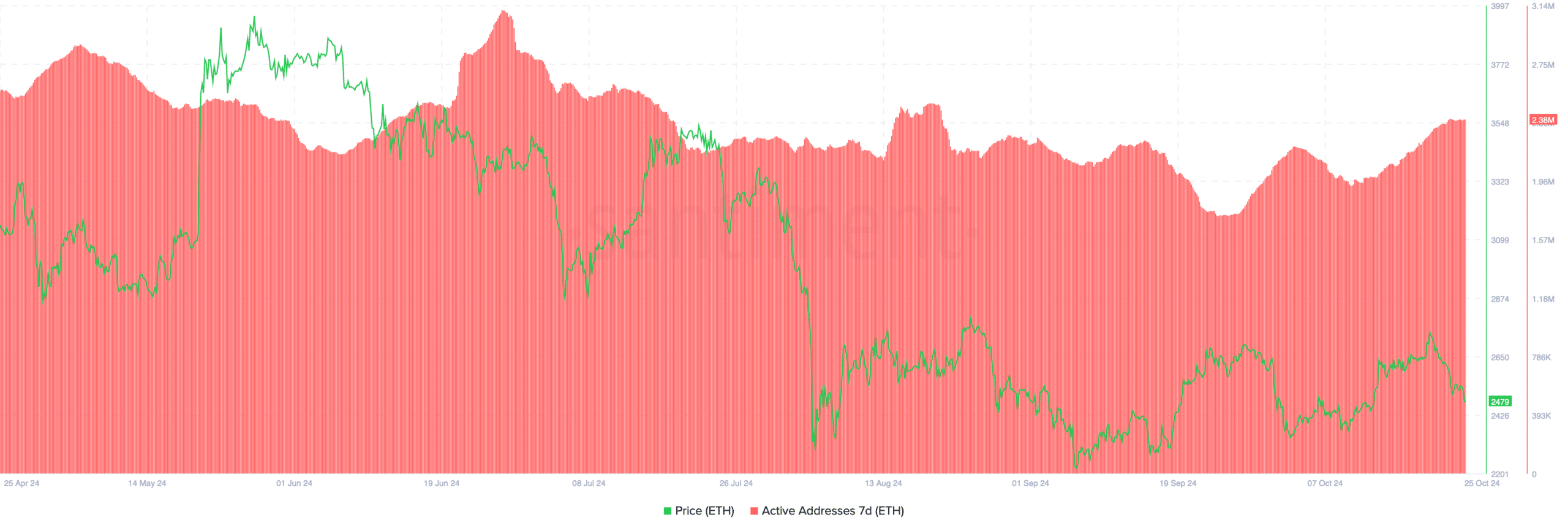

According to data Interest in Ethereum retail has increased in recent weeks, with the number of active addresses increasing from less than 1.8 million last month to around 2.38 million now, according to Santiment.

Source: Santiment

This increase in active addresses reflects growing interest in Ethereum from retail investors and may indicate increased demand in the spot market.

An increase in active addresses is often seen as a positive indicator of asset liquidity and market engagement, suggesting continued interest in Ethereum despite the recent price drop. .

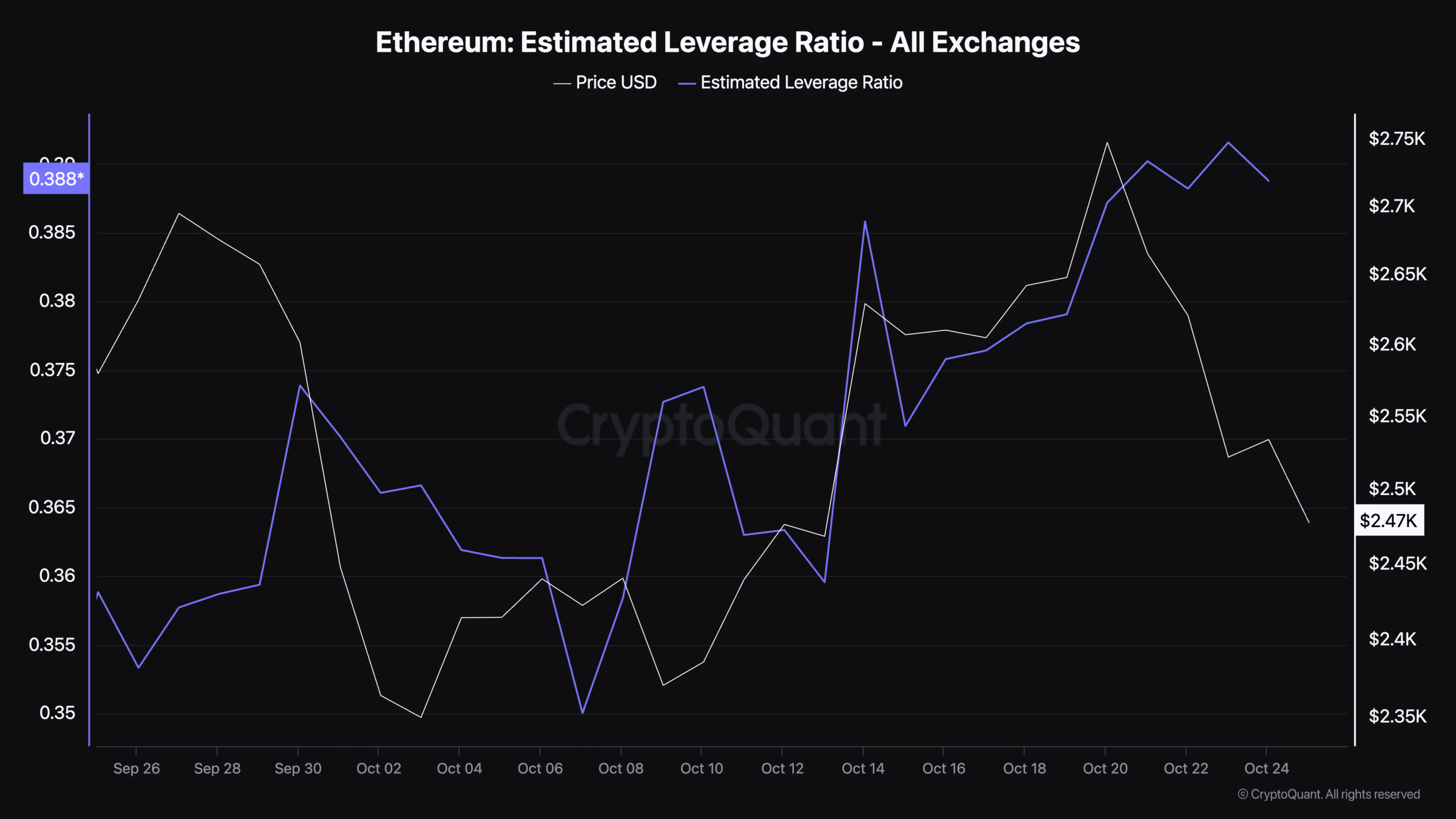

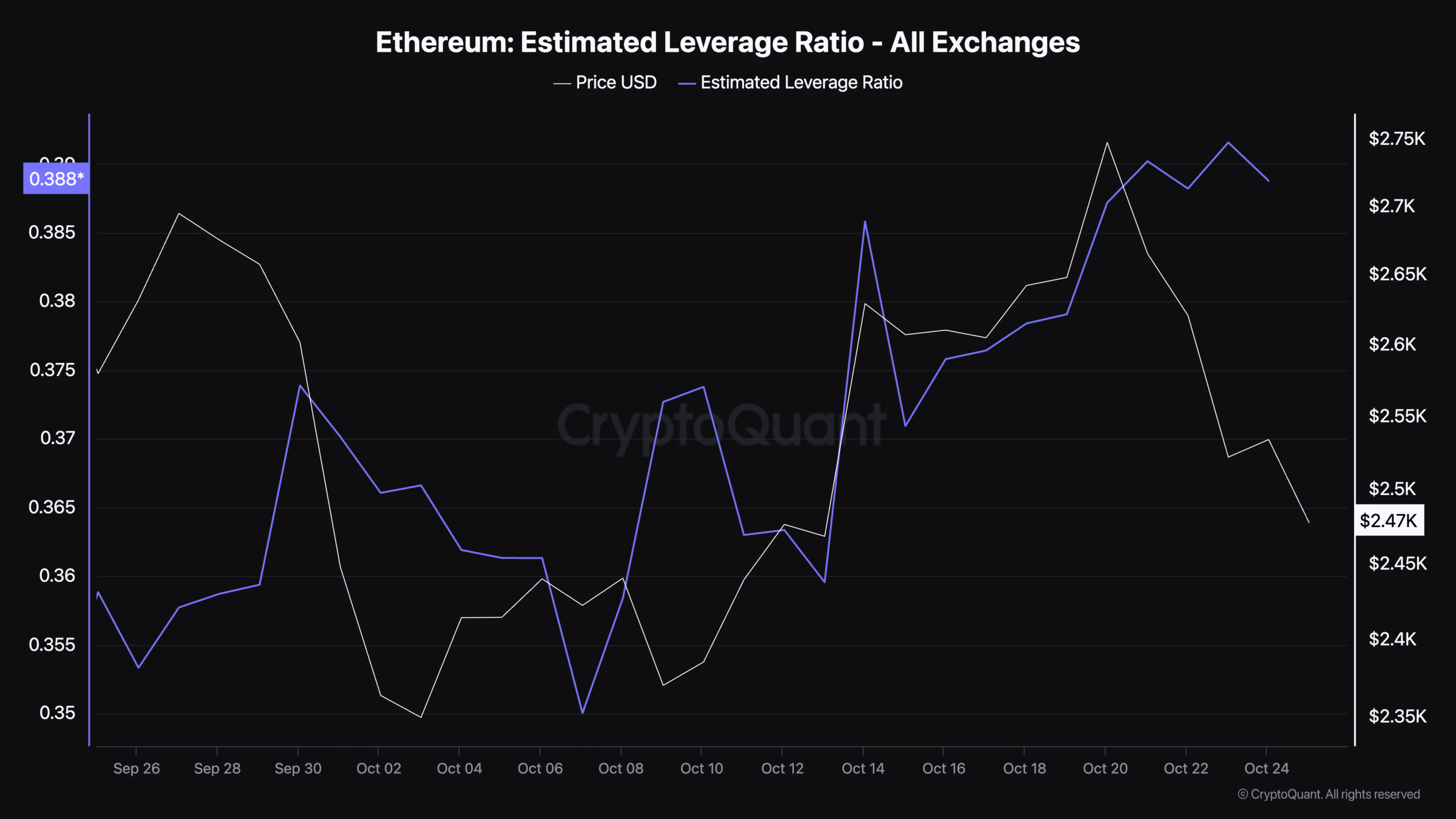

Adding to the retail interest, the estimated leverage ratio has also increased recently, with that metric currently sitting at 0.38.

This ratio is cryptoquantcan measure the degree of leverage used in Ethereum trading and indicate the level of risk within the market.

read ethereum [ETH] Price prediction for 2024-2025

A high leverage ratio suggests that traders are increasingly using borrowed funds to expand their positions.

Source: CryptoQuant

This can lead to higher returns in bullish markets, but magnifies losses and increases market risk in downtrends. Current leverage ratios indicate that traders may be increasing their exposure in anticipation of market movements.