Important points

- Microsoft shareholders to vote on Bitcoin proposal as Michael Saylor touts multi-trillion dollar opportunity.

- Microsoft board withdraws Bitcoin investment proposal, urges shareholders to vote against it

Share this article

MicroStrategy CEO Michael Saylor today directed Microsoft CEO Satya Nadella to post about He suggested that we should consider adding .

Hey @SatyaNadellaif you want to make the next trillion dollars. $MSFT Shareholders, please call. pic.twitter.com/NPnVvL7Wmj

— Michael Saylor ⚡️ (@saylor) October 25, 2024

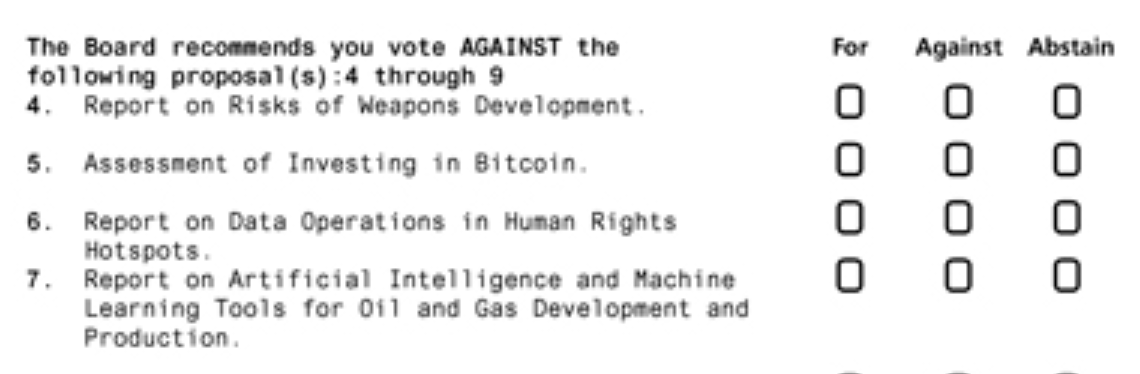

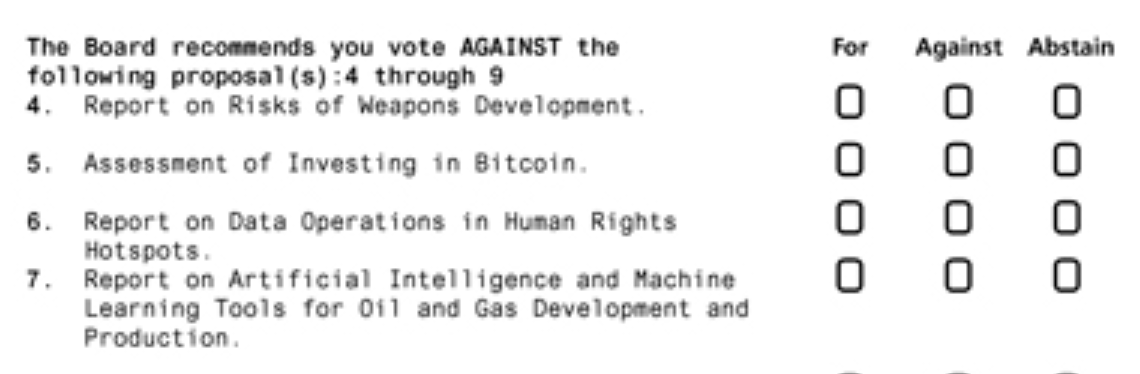

Saylor's comments follow an update from Microsoft SEC filingwhich outlines a shareholder proposal entitled “Evaluating an Investment in Bitcoin” that is scheduled to be voted on at the company's annual general meeting in December.

Based on recent performance, MicroStrategy's Bitcoin-focused portfolio has helped the company's stock outperform Microsoft's stock by 313% this year, despite being a relatively small player in the tech industry.

Microsoft acknowledged this in its report, noting that some companies are profiting greatly from holding Bitcoin.

Microsoft's board of directors acknowledges Bitcoin's recent outperformance, but insists that shareholders vote against the proposal.

In its filing, the board said conducting a Bitcoin investment valuation was unnecessary, stressing that Microsoft's management is “already giving careful consideration to this topic.”

The Board of Directors acknowledges that Microsoft's global treasury and investment services team regularly evaluates its diverse assets with a focus on maintaining liquidity and minimizing financial risk while ensuring long-term shareholder returns. He emphasized that.

Although Microsoft has acknowledged that Bitcoin has been taken into account in past evaluations, its portfolio is currently dominated by U.S. government and corporate bonds, a strategy aimed at stability and steady returns. .

Microsoft's warning is consistent with the volatility associated with Bitcoin, a point highlighted in the filing. They pointed out that corporate finance application assets need to be predictable and stable to effectively support operations.

Share this article