Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. Financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Please contact a financial professional and conduct your own research before making any investment decisions. Although we believe all content is accurate as of the date of publication, certain offers mentioned may not be currently available.

MicroStrategy's aggressive Bitcoin acquisition strategy significantly contributed to the company's stock reaching all-time highs. As the company continues to purchase large amounts of cryptocurrencies, the increase in the value of Bitcoin has directly benefited shareholders.

The market is gaining confidence in MicroStrategy's plans to include Bitcoin on its balance sheet, especially as evidenced by the impressive rise in the company's stock chart over the past 12 months. Notably, after the company decided to purchase Bitcoin, MicroStrategy's stock price, which had been flat for many years, began to soar.

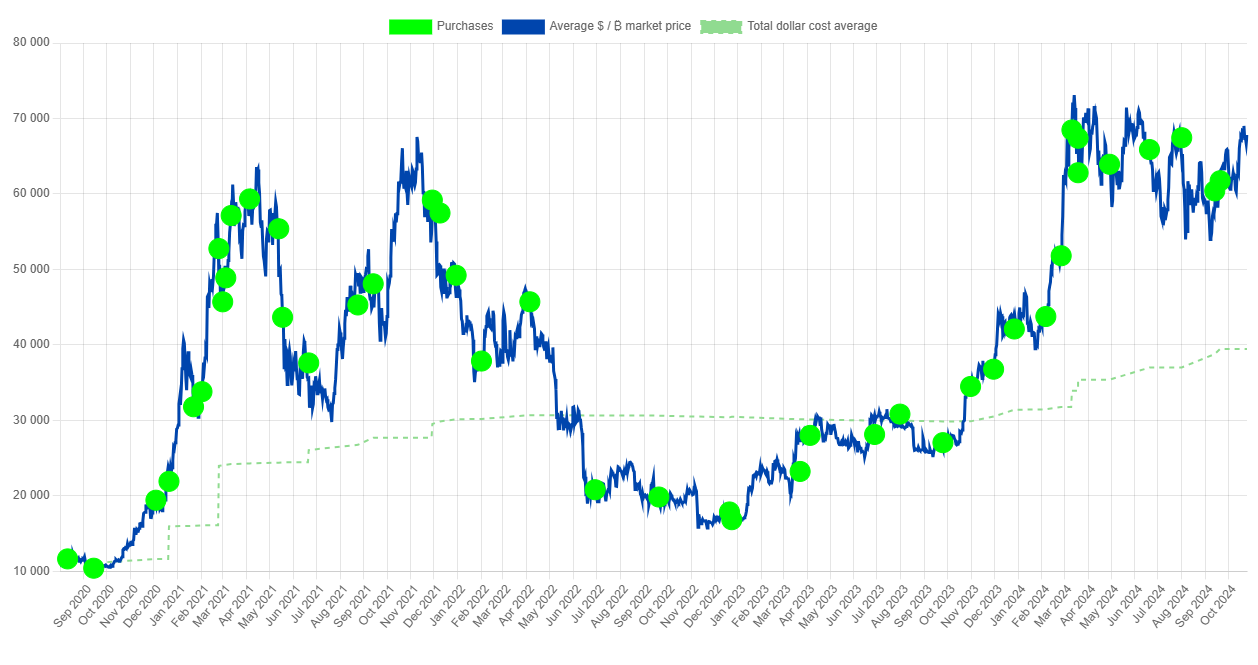

We are once again observing this rise as the value of Bitcoin increases and the value of MicroStrategy's holdings increases. MicroStrategy CEO Michael Saylor is a frequent Bitcoin buyer and has repeatedly reaffirmed his company's commitment to Bitcoin. Based on the company's portfolio tracker, MicroStrategy has purchased over $17 billion in Bitcoin at an average purchase price of approximately $39,000 per coin.

With Bitcoin's current price above $67,000, this strategy has increased portfolios by over 72% and demonstrated significant return on investment. Recent purchases by MicroStrategy include purchasing over 74,000 Bitcoin on September 20, 2024 at an average price of $61,750 per Bitcoin, demonstrating the company's hoarding. The recent stock price surge was the result of this calculated move.

Portfolio trackers and on-chain data both show consistent increases in MicroStrategy’s Bitcoin holdings over the past few months, confirming Saylor’s long-held belief that cryptocurrencies are a store of value and an inflation hedge. It became.

In summary, MicroStrategy's Bitcoin buying spree is directly responsible for the company's stock hitting a new all-time high. As long as Bitcoin's value holds or rises, the company's stock price will likely continue to rise. This confirms MicroStrategy's position as a leader in enterprise Bitcoin adoption.