Gary Gensler's reign as chairman of the US Securities and Exchange Commission (SEC) has been marked by fierce opposition to the crypto industry, making him the sector's leading opponent.

However, with his term set to expire in 2026 and the upcoming 2024 election potentially leading to a change in leadership, many in the crypto industry are anticipating a shift away from his law enforcement-focused approach. There is.

Mr. Gensler's tenure began in 2021, during which he made the pivotal decision that no new rules were needed to regulate cryptocurrencies. Instead, he considered existing securities laws, especially howie test Starting in the 1940s, the government began cracking down on virtual currency companies through legal means. Critics say this creates an enforcement-oriented regulatory style that leaves the industry in the dark, fostering confusion and stifling innovation. Mr. Gensler's refusal to adjust regulations for digital assets has frustrated both industry players and lawmakers.

Congress is also involved, with the House passing a bill creating crypto-specific rules, but the Senate has yet to pass it. Meanwhile, the SEC faces resistance from lawmakers, including a majority vote in the Senate to overturn the SEC's crypto accounting policies. Next year's Congress is likely to become even more involved in cryptocurrency issues, especially since its members receive significant financial support from the industry.

Trump likely to show Gary the door

If Donald Trump wins the 2024 election, Gensler's departure could be accelerated. President Trump has vowed to fire him.. Even if Gensler does not resign immediately, a Trump victory could ultimately lead to a more crypto-friendly commissioner like Hester Peirce, a strong advocate for the industry, replacing Gensler. I will be serving. Conversely, if Vice President Kamala Harris wins, Gensler's resignation may not be as urgent, but her administration is expected to take a less hostile approach to cryptocurrencies.

At Bitcoin Nashville earlier this year, Trump said: President Trump said, “On the first day, I will fire Gary Gensler and appoint a new SEC Chairman,'' to the excitement of the audience. “I didn't know he was that unpopular. Let me say it again: I'm going to fire Gary Gensler on day one.”

sauce: ×

To Gary's credit, he (reluctantly) provided us with a crypto ETF.

Despite the controversy surrounding Gensler's approach, it is considered a significant move for the digital asset's mainstream acceptance, especially after his role in approving the Spot Bitcoin Exchange Traded Fund (ETF). Some see Gensler as a key figure in the legitimation of cryptocurrencies. His accomplishments in the world of cryptocurrencies may ultimately reflect both his strict regulatory stance and his unexpected contribution to mainstream industry adoption.

SEC January ETF Approvalwhich was expected due to legal and market pressures, was still something of a surprise given the agency's historical wariness towards crypto investments. Since taking office, SEC Chairman Gary Gensler has been particularly vocal about the risks associated with investing in crypto assets, frequently linking the crypto asset class to scams and scams.

Despite public skepticism, Gensler was one of three committee members to approve the Spot BTC ETF offering. Gensler was the deciding vote, likely passing the bill 3-2. Commissioners Hester Peirce and Mark Ueda joined Gensler in approving the ETF, while Caroline Crenshaw and Jaime Lizarraga opposed it. This shows how close the ETF came to being rejected.

In a statement released after the ETF approval:Despite the approval, Gensler clarified that the SEC does not “approve or support” Bitcoin.

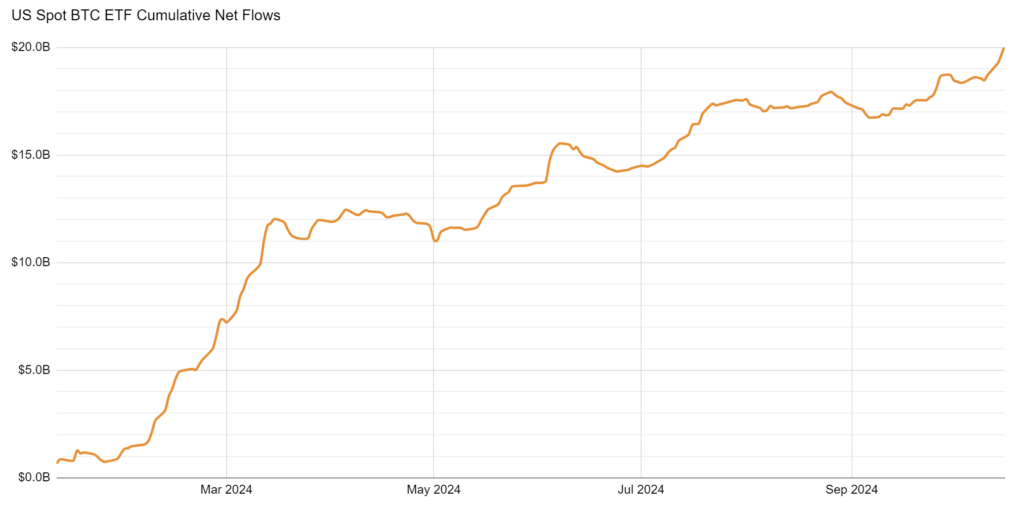

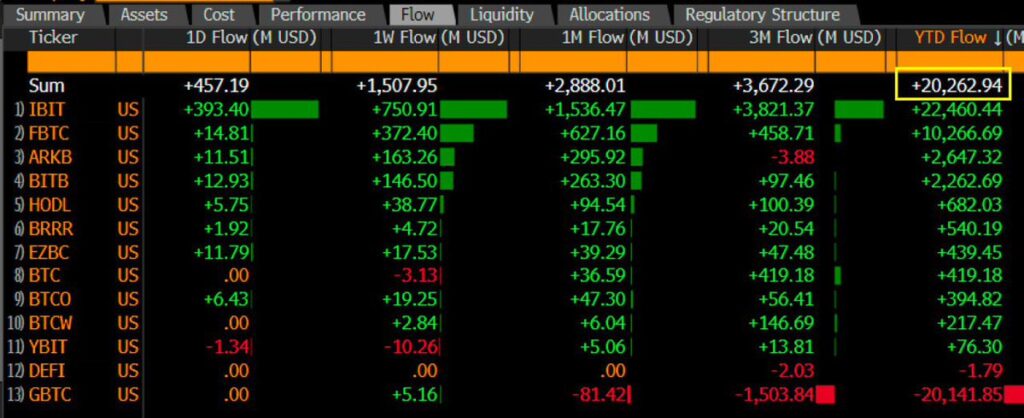

Since then, ETFs have become one of the most popular. success The number of ETFs launched so far has reached 20 billion.

Source: X

uncertain future

The future of SEC cryptocurrency regulation is uncertain, and new regulatory frameworks may emerge under different leadership. Both Congressional action and changes in SEC leadership could significantly change the way digital assets are regulated in the United States in the coming years. But whoever succeeds Mr. Gensler will still have the challenge of enacting new laws and dealing with ongoing litigation.

Since taking over the SEC in 2021, Gary Gensler's stance on cryptocurrencies hasn't been straightforward. His approach often leaves the industry feeling ambiguous. In a recent interview with Bloomberg Business on Oct. 22, Gensler avoided direct questions about the regulation of digital assets, instead stating that in commemoration of the release of his 2008 white paper, he said: He paid homage to Bitcoin's 16th birthday.

Gensler reiterated the SEC's commitment to the current enforcement-based regulatory framework, citing the importance of protecting investors from potential risks in volatile crypto markets. “For 90 years, we have relied on strong laws and agency rules passed by Congress to protect investors and promote capital formation. We intend to change that now. “No,” Gensler declared.

Gensler declined to comment when asked about Donald Trump's chances of winning the 2024 presidential election and the former president's vow to remove him from office on his first day in office. Mr. Trump has promised to replace the SEC chairman and launch the World Liberty Financial Project if elected, but Mr. Gensler has remained mum about his future under a potential Trump administration. There is even.

The interview came shortly after the SEC's Division of Examination announced it would focus on crypto assets as a top priority in 2025, signaling continued oversight of the industry. Mr. Gensler's hard-line stance has been widely criticized by business leaders and lawmakers, but he shows no signs of backing down.

At the moment, Bitcoin is trading at $67,462, enjoying a 6% price increase over the past month, but still failing to break above $70,000.

Source: Brave New Coin bitcoin liquid index