- Bitcoin’s successive “super signals” have signaled an explosive rally, the last seen before a 10,000% rally.

- Volume trends indicate a strong bullish mood going forward, with more than 94% of Bitcoin holders making profits.

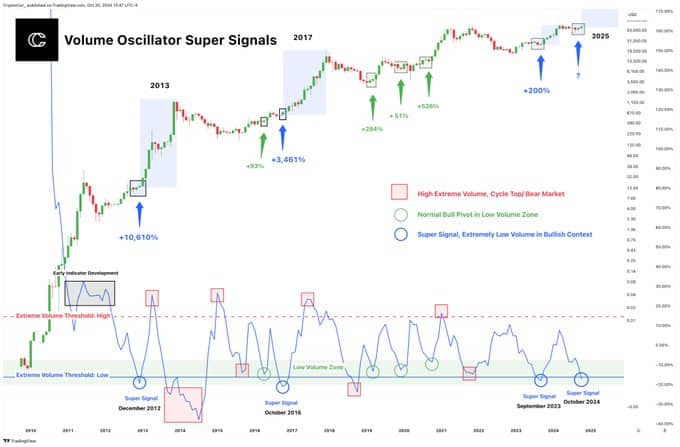

Bitcoin's [BTC] The volume oscillator recently signaled a series of “super signals,” a rare event that only occurs during large bull markets.

Historically, such signals have preceded large rallies, including gains of more than 10,000% in 2012 and more than 3,000% in 2016.

The most recent event in September 2023 was a +200% rise in Bitcoin price, followed by another supersignal in October 2024.

Source: X

A “super signal” appears when trading volume is extremely low in a bull market. analyst suggest These situations can be considered to indicate accumulation, as the number of sellers decreases while buying interest remains stable.

The lack of significant volume spikes in the past further supports the bullish outlook and distinguishes this stage from bearish low volume patterns.

Bitcoin price rise and market data

At the time of writing, Bitcoin's price was $68,378.05, the market capitalization was $1.35 trillion, and the 24-hour trading volume was $24.5 billion.

It is up 5.96% over the past 7 days, indicating a steady increase. The circulating supply of Bitcoin is 20 million BTC.

Open interest in Bitcoin futures increased by 2.39% to $40.69 billion at the time of writing, indicating increased trading activity and underlying bullish sentiment.

CoinGlass data showed Trading volume increased by 90.33% to $42.62 billion, and option trading volume increased by 182.07% to $1.6 billion.

Options open interest also increased by 2.29% to $24.31 billion. The alignment of these indicators with Bitcoin's price movements suggests growing optimism among traders.

bullish sentiment

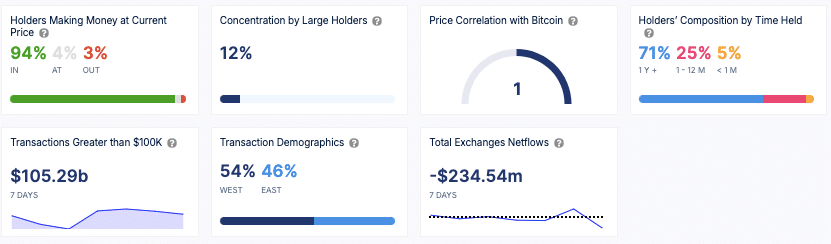

According to data from IntoTheBlock, 94% of Bitcoin holders are profitable at current prices, indicating positive market sentiment.

The analysis also reveals that 71% of Bitcoin holders have held their positions for more than a year, suggesting strong long-term holding behavior.

Meanwhile, 12% of Bitcoin's supply is held by large holders, indicating a moderate concentration of ownership among whales.

Source: Into the Block

Additionally, there has been a net outflow of $234.54 million from the exchange over the past week, indicating that investors may accumulate assets by moving them into cold storage.

More than $105.29 billion in trades occurred last week, with more than $100,000 traded, led by institutional investors and large traders.

read bitcoin [BTC] Price prediction for 2024-2025

The geographic distribution of trade is fairly balanced, with 54% in the Western region and 46% in the Eastern region.

Overall, the existence of a continuous super represents a unique event in Bitcoin's history, creating expectations for potential price movements similar to previous bull cycles.