- DEEP soared over 550% in its debut week.

- Can Sui-based altcoins trend up amidst mixed signals?

On October 14th, DeepBook version 3 (V3), a new and revolutionary DEX (decentralized exchange), was released. Sui [SUI] network.

Its native token, DEEP, also launched on the same day and rose more than 550% last week. of altcoin The price skyrocketed five times from $0.016 to $0.09, but as of this writing, it was holding at $0.08.

Source: CoinMarketCap

According to the team's announcement, announcementone of the positive price catalysts for DEEP could be its wide range of use cases within the Sui DeFi system.

This is the protocol's governance token, but can also be staked for rewards and trading fee rebates.

“DEEP can be used to pay trading fees, and the more users trade, the more they receive fee discounts, encouraging more participation. transactions become more efficient.”

Additionally, DeepBook DEX utilizes CLOB (Central Limit Order Book) to keep fees low and leverages Sui's high-performance design.

every teamthis is comparable to popular DEXs that leverage AMM (Automated Market Maker) like Uniswap.

“AMM has given DeFi a head start, but with CLOB we are here to improve the DeFi game. Built to last, with low slippage, deep liquidity, and precision in mind. Just like that.”

Will DEEP's rally continue?

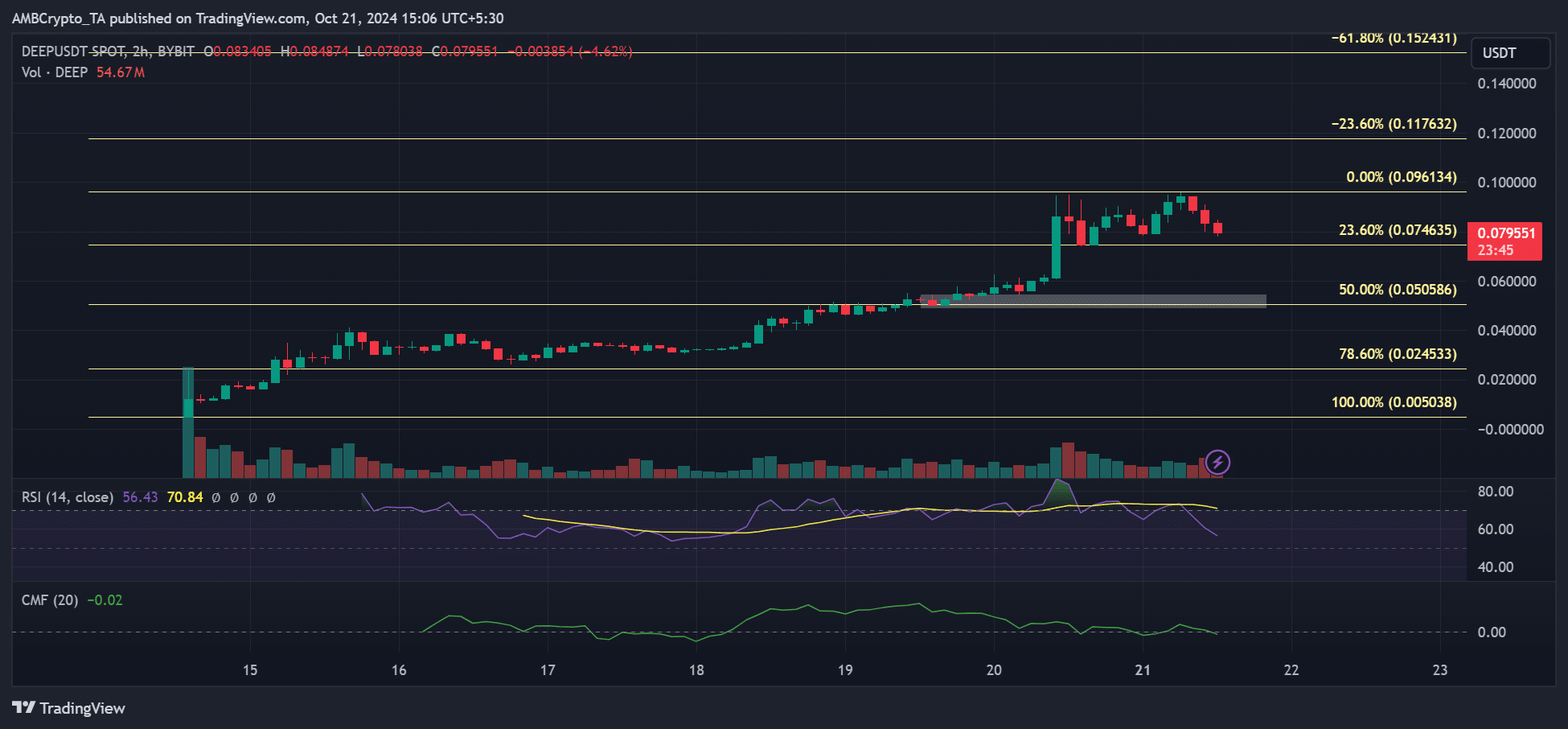

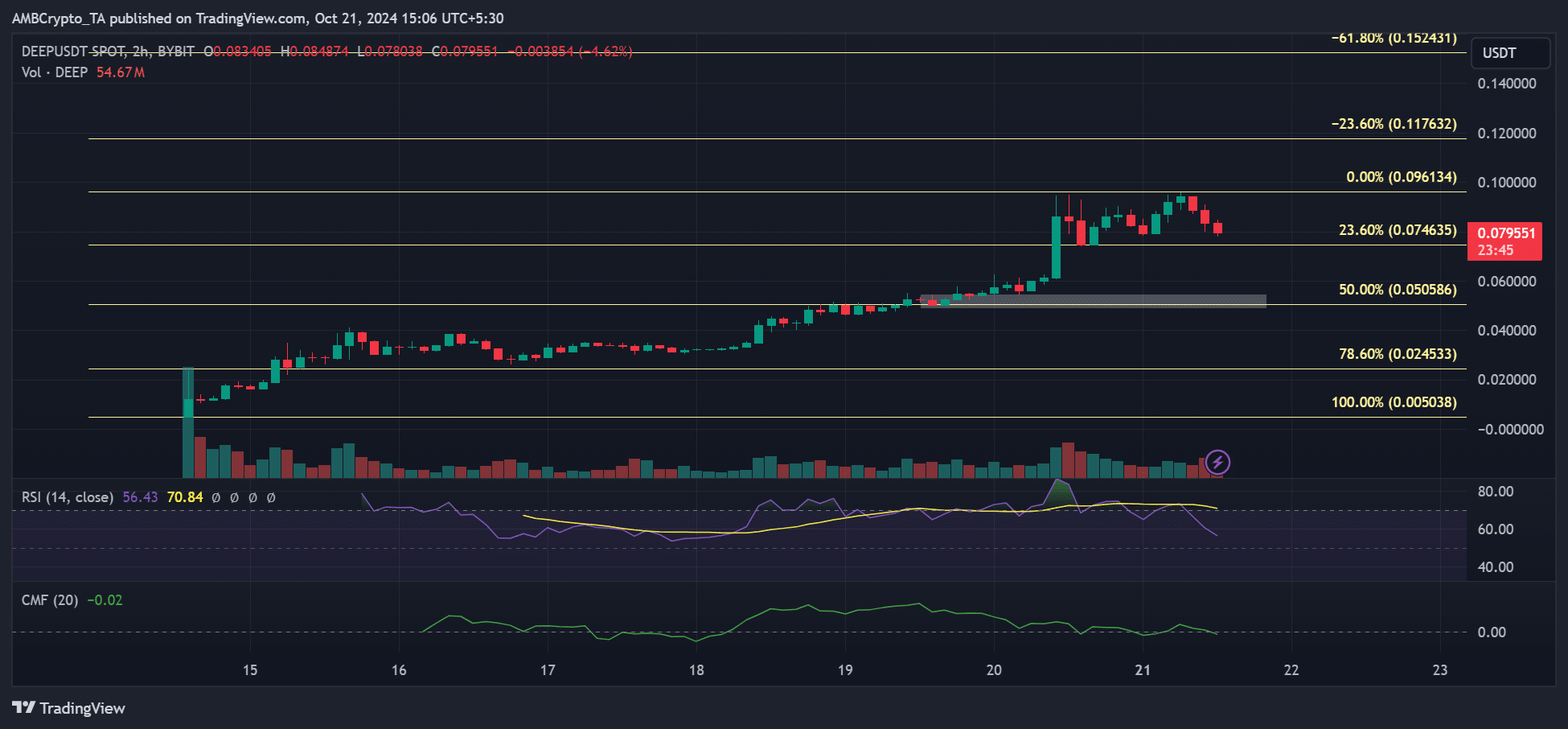

On October 20th, the token exploded up 49%, building on its impressive debut week performance.

Despite the slight pullback, crowd sentiment on CoinMarketCap was overwhelmingly bullish on the token at the time of writing.

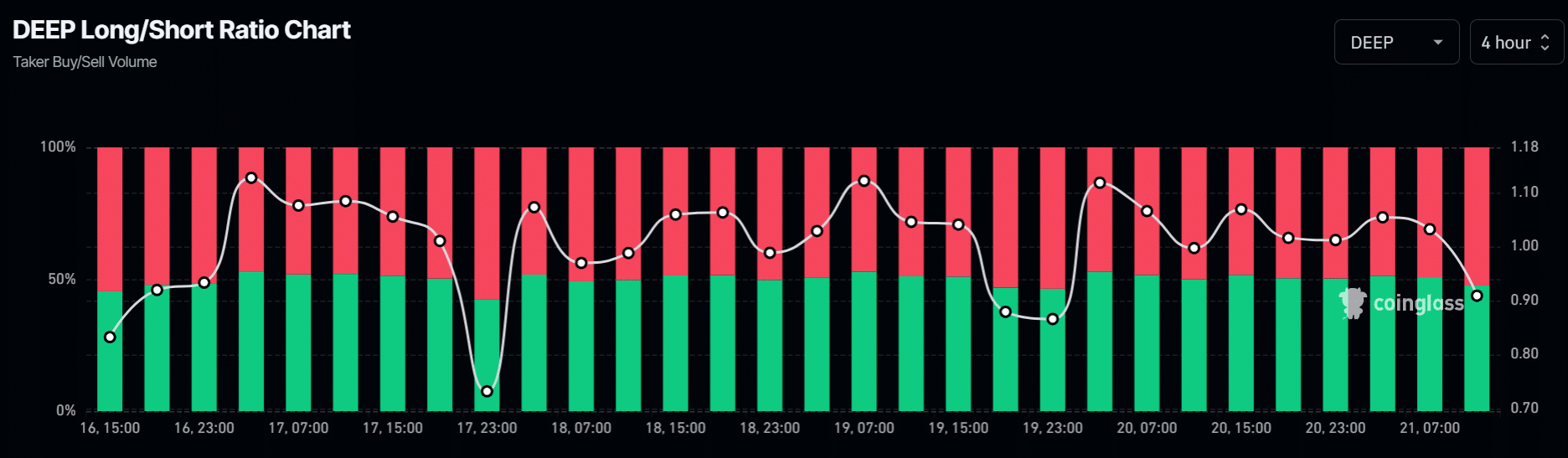

However, traders' positioning indicates that a significant number of speculators are shorting the asset. According to Coinglass’s long/short ratio, 52% of positions are short DEEP, reinforcing a slightly bearish trend.

Source: Coinglass

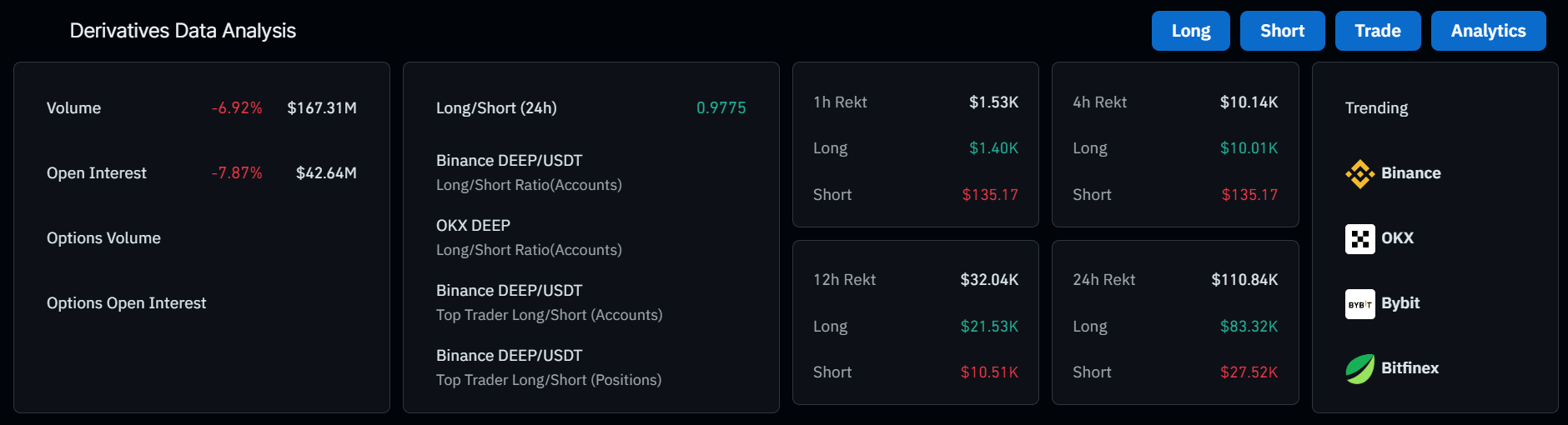

Similar near-term bearish sentiment was evident as evidenced by the decline in open interest (OI).

The stock fell by nearly 8%, as capital outflows from the DEEP futures market intensified.

Furthermore, a decline in OI indicates less interest in the asset among speculators. This could accelerate the rebound and cause DEEP prices to fall.

Furthermore, there were more liquidations of long positions than short positions, further supporting the bearish outlook in the short term.

Source: Coinglass

read deep book [DEEP] Price prediction for 2024-2025

If the bearish trend continues in the short term, DEEP could fall towards $0.05 (50% of the Fib level), especially if it breaks below $0.08.

However, if the rally continues further, it could approach $0.11. Therefore, $0.05 and $0.11 were important levels to track in the short term.

Source: DEEP/USDT, TradingView