Ethereum price today: $2,600

- Ethereum price is falling as it faces resistance near the downtrend line at $2,820.

- The total amount of ETH held in storage addresses has reached a new all-time high.

- The US Ethereum Spot ETF recorded a modest increase in inflows of $78.8 million last week.

Ethereum (ETH) fell about 3% on Monday, moving closer to the downtrend line after last week’s more than 11% rally, erasing gains recorded on Sunday. From an on-chain and technical perspective, investors in ETH have seen moderate inflows in US spot exchange-traded funds (ETFs), with the total amount of ETH held in accumulation addresses reaching $5 million. This adjustment may be short-lived, as there are signs that confidence is growing. Updated record high.

Ethereum storage addresses hit record high

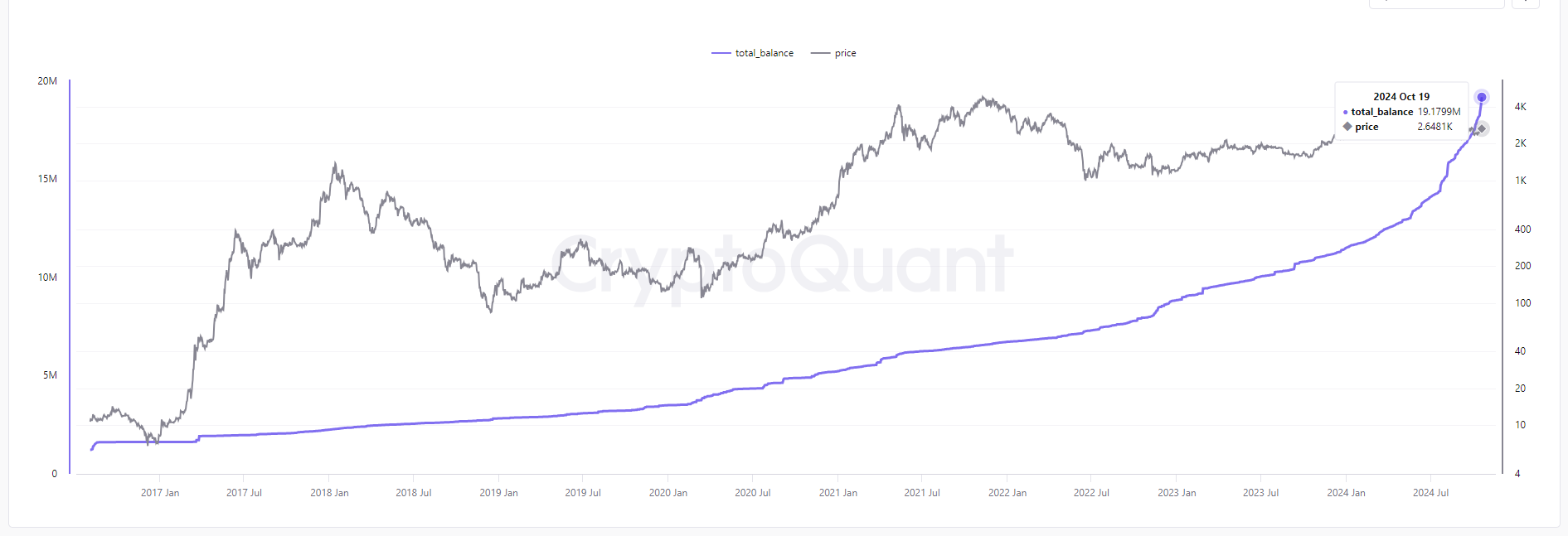

The total amount of Ethereum held in storage addresses exceeded 19.17 million ETH on Monday, setting a new all-time high and nearly doubling from just 11.5 million ETH in January, according to CryptoQuant data. This surge suggests that investor confidence in Ethereum has increased, further reinforcing its bullish price outlook.

Ethereum total balance chart. Source: CryptoQuant

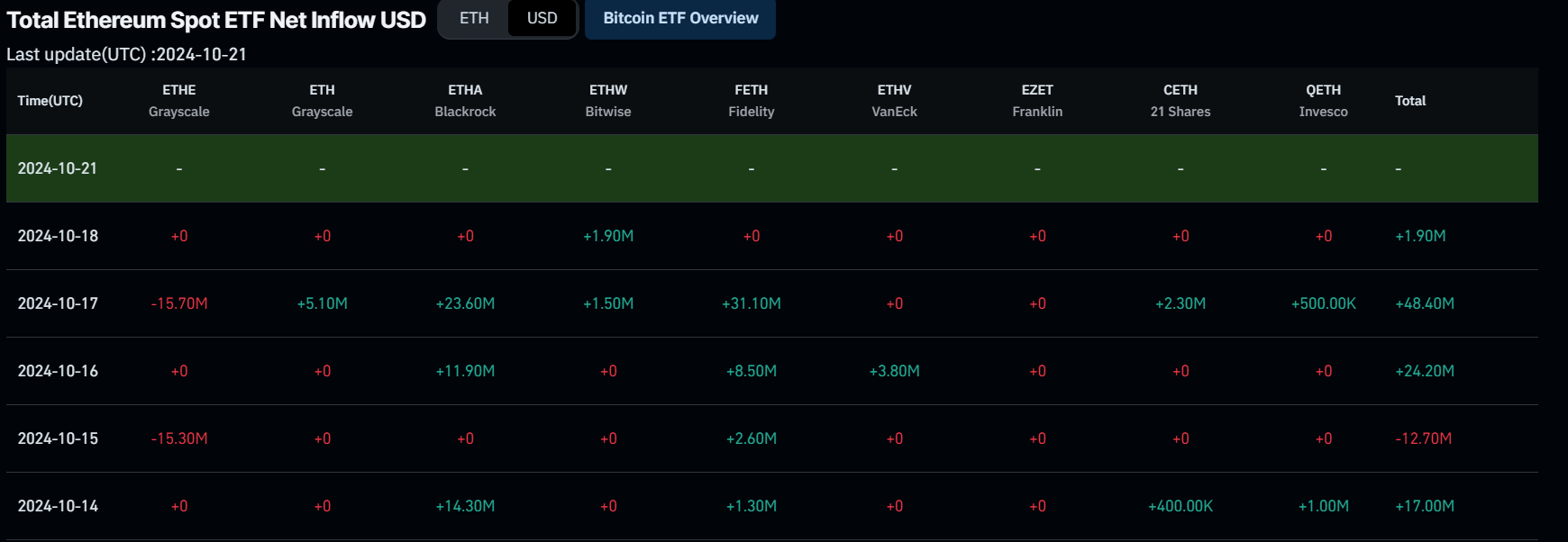

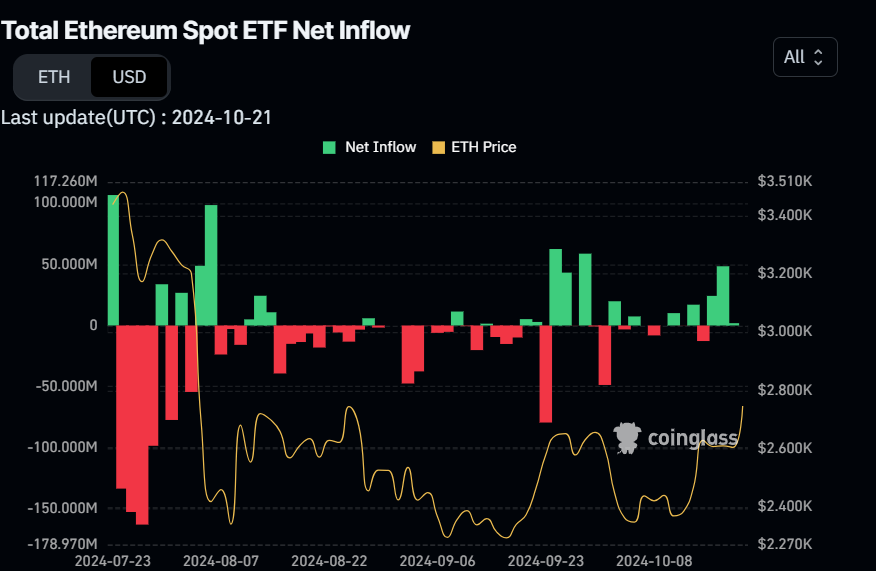

Institutional demand supported Ethereum prices last week. U.S. spot ETFs recorded a modest increase in inflows last week of $78.8 million, compared to $1.9 million the previous week, according to Coinglass data. For the price of Ethereum to rise in the future, the size of inflows will need to increase.

Net flow chart of Total Ethereum Spot ETF. Source: Coinglass

Ethereum price prediction: An increase is expected as it approaches the downtrend line and approaches the top price.

Ethereum price found support near the 50-day exponential moving average (EMA) of $2,561 on October 15th, before hitting resistance near the downtrend line (connected to multiple highs from the end of May) on Monday. facing.

If ETH closes above the downtrend line near $2,820, it could first move higher and retest the daily resistance at $2,927. A close above this level could extend the rally and retest weekly resistance at $3,236.

The Relative Strength Index (RSI) indicator on the daily chart is at 60, down from the overbought level of 70, indicating that bullish momentum is weakening. However, if the RSI rebounds and rises, the rally will likely continue. If the decline continues and it closes below the neutral level of 50, it could lead to a sharp decline in Ethereum price.

ETH/USDT daily chart

If ETH fails to close above the downtrend line, it may decline to retest the 50-EMA support at $2,561.

Ethereum FAQ

Ethereum is a decentralized open-source blockchain with smart contract capabilities. Its native currency, Ether (ETH), is the second largest cryptocurrency by market capitalization and number one among altcoins. The Ethereum network is tailored for building cryptographic solutions such as decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs).

Ethereum is a public decentralized blockchain technology that allows developers to build and deploy functional applications without the need for a central authority. To facilitate this, the network leverages the Solidity programming language and the Ethereum virtual machine, allowing developers to create and launch applications with smart contract functionality.

A smart contract is a publicly verifiable piece of code that automates an agreement between two or more parties. Essentially, these codes self-execute the coded actions if a given condition is met.

Staking is the process of earning revenue from idle crypto assets by locking them in a cryptographic protocol for a specified period of time as a means of contributing to security. Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism on September 15, 2022 in an event dubbed “Merge”. This merger was an important part of Ethereum's roadmap to achieve high levels of scalability, decentralization, and security while maintaining sustainability. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier to entry for validators by leveraging the use of cryptographic tokens as the core foundation of the consensus process.

Gas is a unit that measures the transaction fees users pay to conduct transactions on Ethereum. Gas can be very expensive when the network is congested, leading validators to prioritize transactions based on fees.