Bitcoin (BTC)'s recent price surge has seen the cryptocurrency rise 10% in the past seven days, with 95% of holders standing to profit. This upward momentum suggests that Bitcoin may be on its way to a new all-time high.

Currently, the price is about to retest the $70,000 level. This on-chain analysis explains how the coin could surpass this level and what it means for investors.

Bitcoin Uptober is back on track

Bitcoin's price movement in October initially caused concern as it fell from $63,000 to less than $59,000. This cast doubt on the potential of the traditionally bullish Uptober. However, since mid-October, Bitcoin has rebounded, and its positive momentum suggests a strong end to the month.

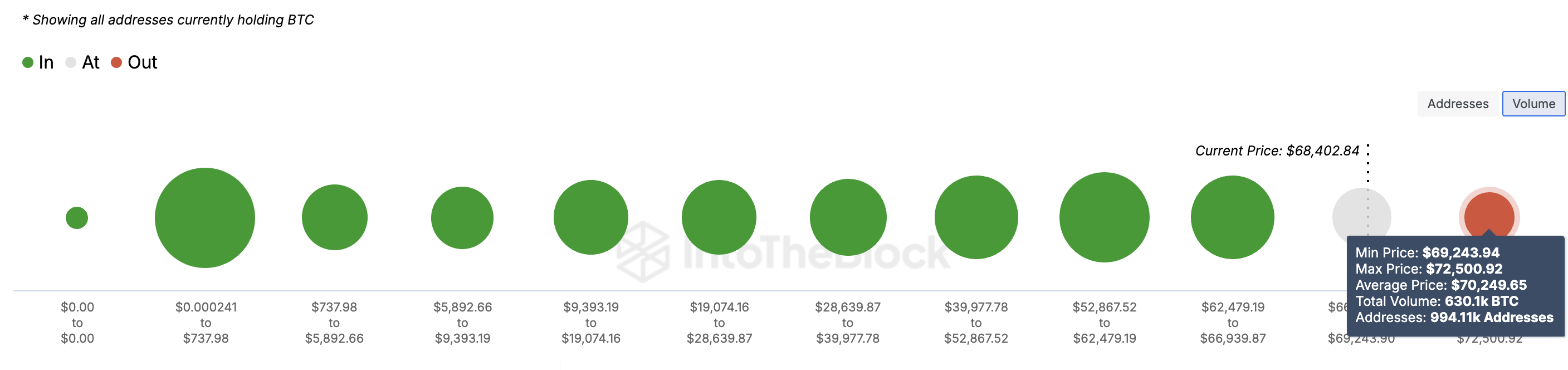

Based on Global In/Out of Money (GIOM) data, BTC is in a strong position to potentially rise further. GIOM determines the average price at which a coin was purchased and compares it to the current price. If the weighted on-chain cost base is higher than the current price, the address is incurring a loss.

Conversely, an address is profitable if the current price is higher than the purchase price. From a price perspective, the larger the cluster of addresses or volumes, the stronger the support or resistance.

Read more: 5 best platforms to buy Bitcoin mining stocks after the 2024 halving

Currently, only 994,100 addresses (holding approximately 630,000 BTC) have unrealized losses, which is significantly lower than the number of addresses that are making profits.

Historically, when a majority of holders make profits, it often correlates with a bullish trend. Therefore, this coin could exceed the average purchase price of $72,500, which is a weak supply wall.

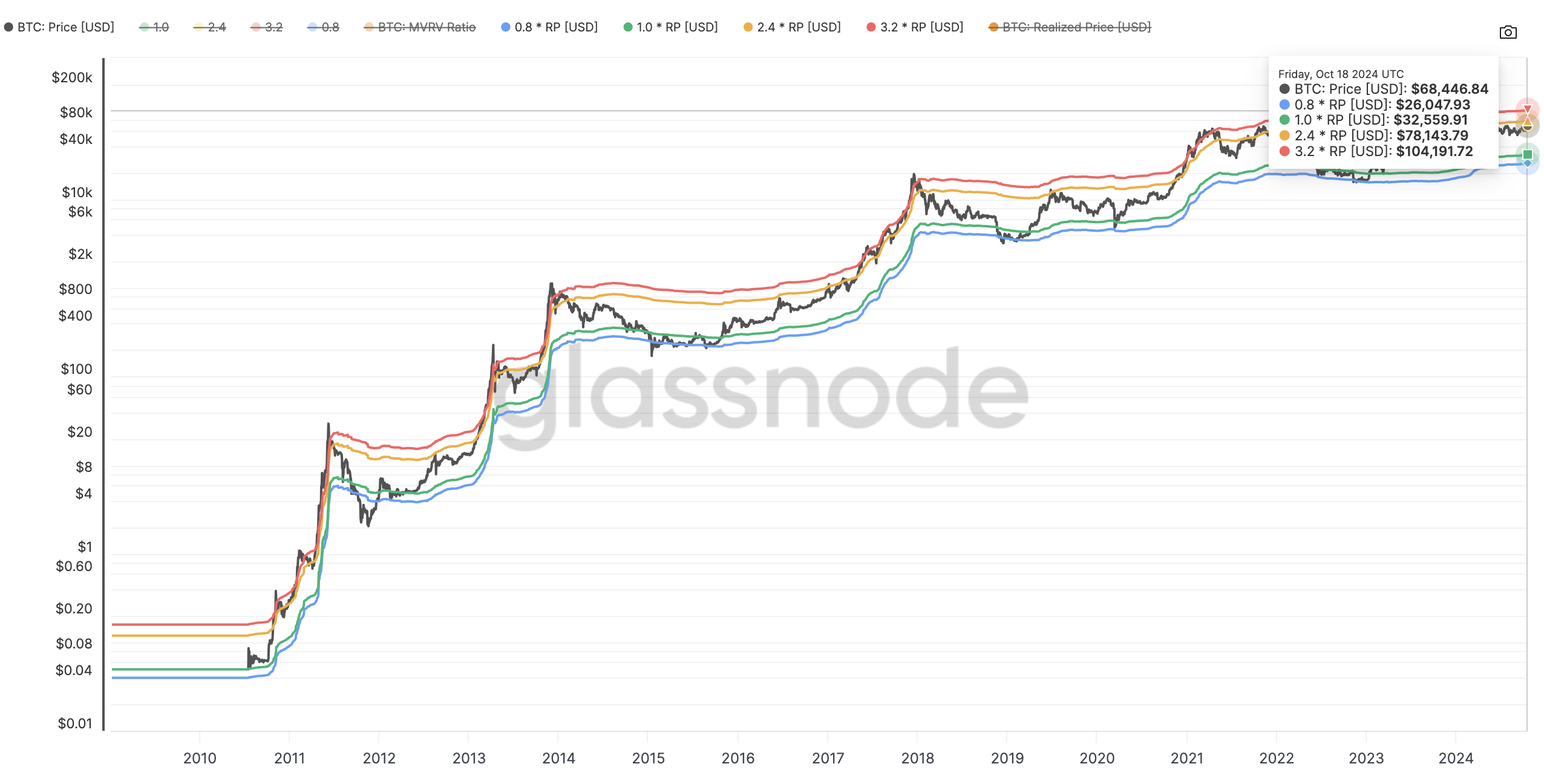

In addition to this, the Market Value to Realized Value (MVRV) price range, which estimates the price level a cryptocurrency can reach, suggests that Bitcoin price could reach $78,143 sooner than expected. Masu.

BTC Price Prediction: Rise Continues

According to the daily chart, Bitcoin has broken out of the descending channel it has been trading in since March.

The Awesome Oscillator (AO), a tool used to compare past and recent price movements to identify trends, is showing an uptick. A positive AO reading indicates increasing momentum, while a decreasing one indicates a bearish move.

Currently, the rise in AO suggests that Bitcoin’s bullish momentum remains strong.

Read more: Where to trade Bitcoin futures: A comprehensive guide

If this momentum continues, Bitcoin price could rise by 14.25% and reach $78,000. However, if there is short-term selling pressure, the coin’s value could retreat to $62,555.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.