- Ethereum has been facing rejection from the $270,000 resistance zone since August

- Rising leverage ratio indicators highlighted why a breakout is unlikely

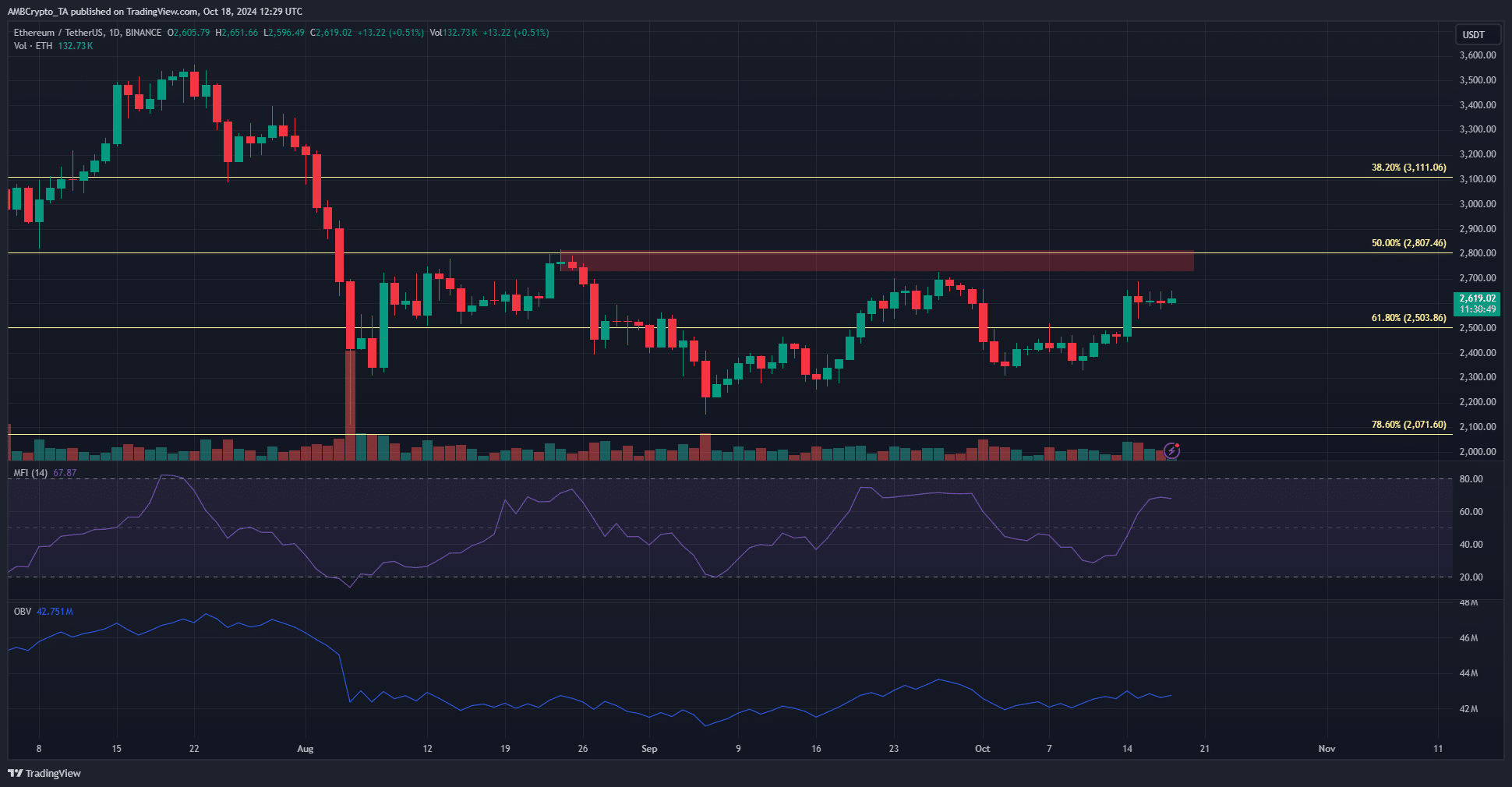

Ethereum [ETH]At the time of writing, it was trading within a range of $2.8k to $2.2k. In particular, the $2.8k region has been functioning as a stable supply zone since early August. It also merges with the 50% Fibonacci retracement level.

Verify price trends of interest

The ETH/BTC chart has been trending south for a little over 18 months. While Bitcoin [BTC] is trading 8% below ATH and Ethereum is 46.3% off ATH. The performance of altcoins must be seen in the context of Vitalik Buterin’s vision for the next possible upgrade, “The Surge.” In particular, some of the goals are around maximizing transactions per second and interoperability between L2s.

Source: ETH/USDT on TradingView

Asset performance provides clear insight into how the market believes the asset is worth and what it is likely to be. In some cases, these beliefs can be distorted by hype or misinformation, leading to over- or under-valuation of assets.

Ethereum's performance can be partially explained by inflation concerns since the Dencun upgrade, but that is only one part of the puzzle. Proposed improvements to the Proof of Stake system and upgrades being considered for the entire network, if implemented, could potentially address network revenue, user growth, adoption, and other issues.

This could increase demand. As things stand, the ETH price chart may be in for a difficult situation.

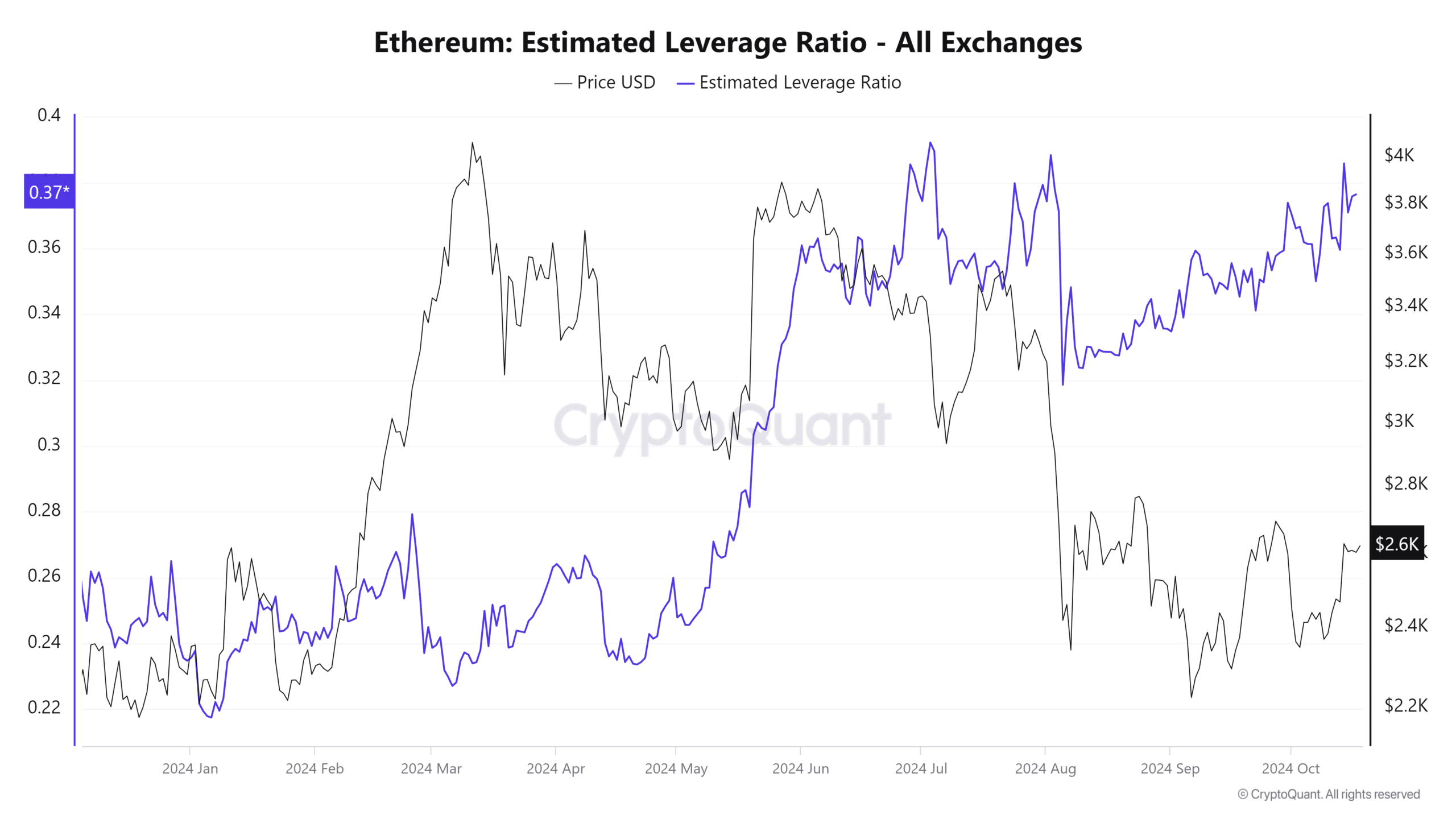

Clues from the derivatives market

Source: CryptoQuant

Estimated Leverage Ratio (ELR) is calculated by dividing open interest by the exchange's coin reserves. Coinglass data also revealed that ETH open interest has increased from $10 billion to $13 billion since the second week of August.

This helped explain the rise in ELR. However, this could be interpreted as a warning sign for traders as the price is trading below a major resistance level.

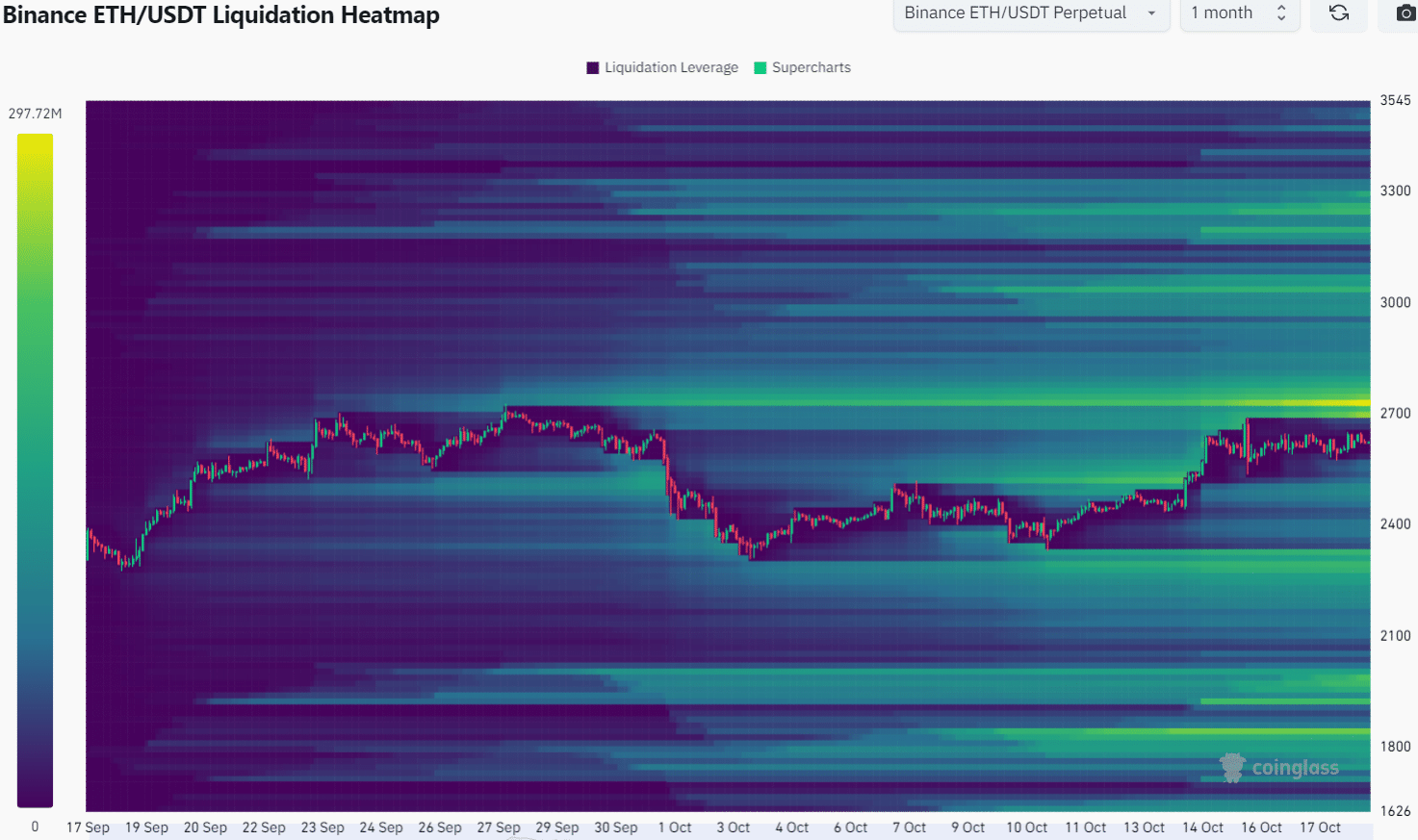

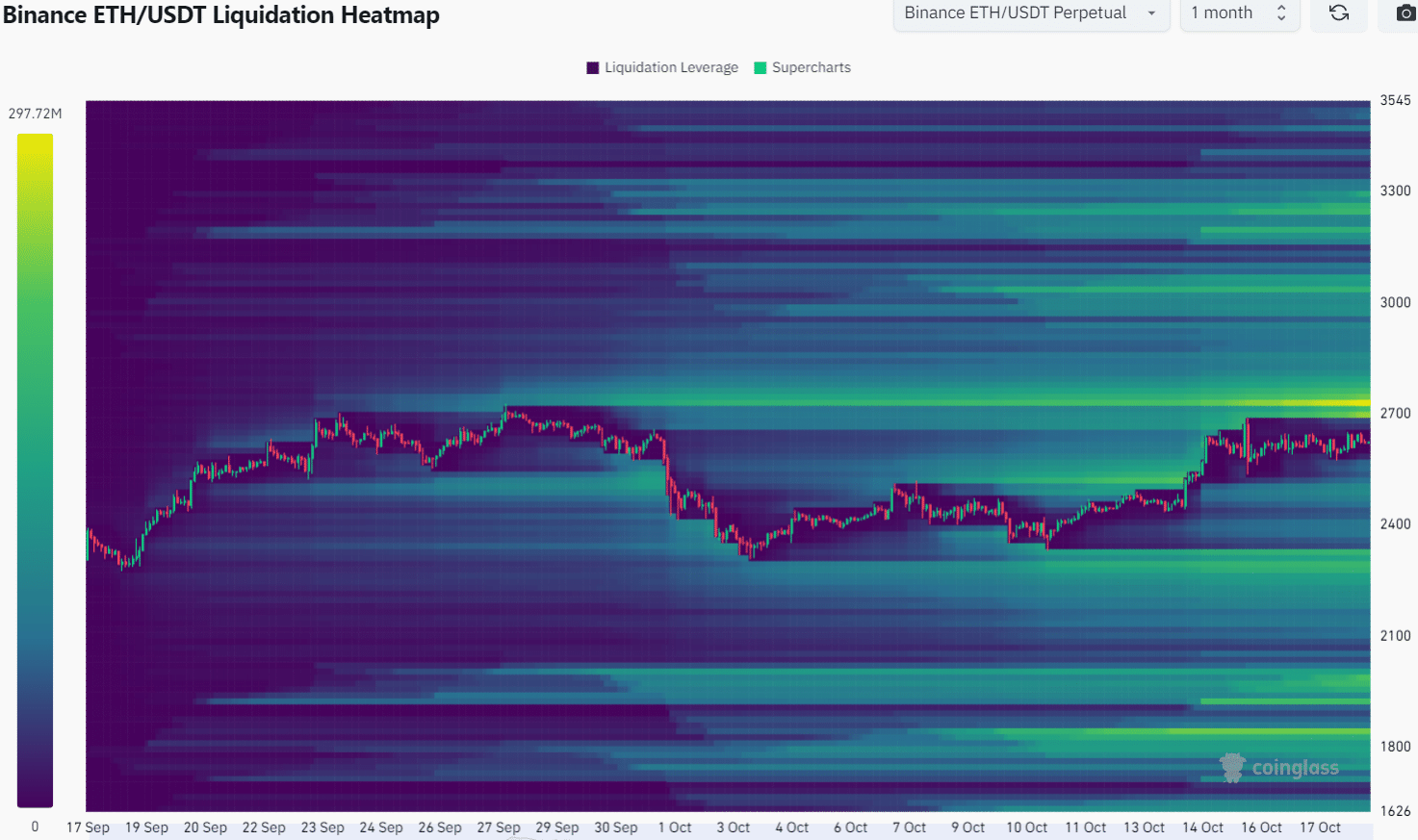

Source: Coinglass

A liquidation heatmap with a one-month lookback period shows that the $2,730 zone is crowded at liquidation levels. On the 3-month chart, we found the $2,730 to $2,850 area to be important.

Together with the price movement, we can see that a bearish reversal from these levels is possible and traders should be prepared for it.

read ethereum [ETH] Price prediction for 2024-2025

Overall, the lack of intrinsic demand and L2 gaining more participants and trading activity remains an issue for the mainnet and its investors. Technical analysis provides clues that ETH bulls may not have the power to push the cryptocurrency’s price beyond $29,000.