- Solana price momentum is approaching a key resistance level as whale accumulation intensifies.

- Increased open interest and large liquidations suggest more market volatility ahead for Solana.

Solana [SOL] In a surprising move, it overtook Ethereum and took the top spot in seven-day DEX (decentralized exchange) trading volume with $11.8 billion compared to Ethereum's $9.2 billion. The surge has many wondering if Solana is gearing up for a major bull market.

Therefore, we need to take a deeper look into Solana's price trends, whale activity, liquidation data, and open interest levels to understand whether this could be a defining moment for the crypto market.

Will Solana be able to overcome her resistance and bounce back?

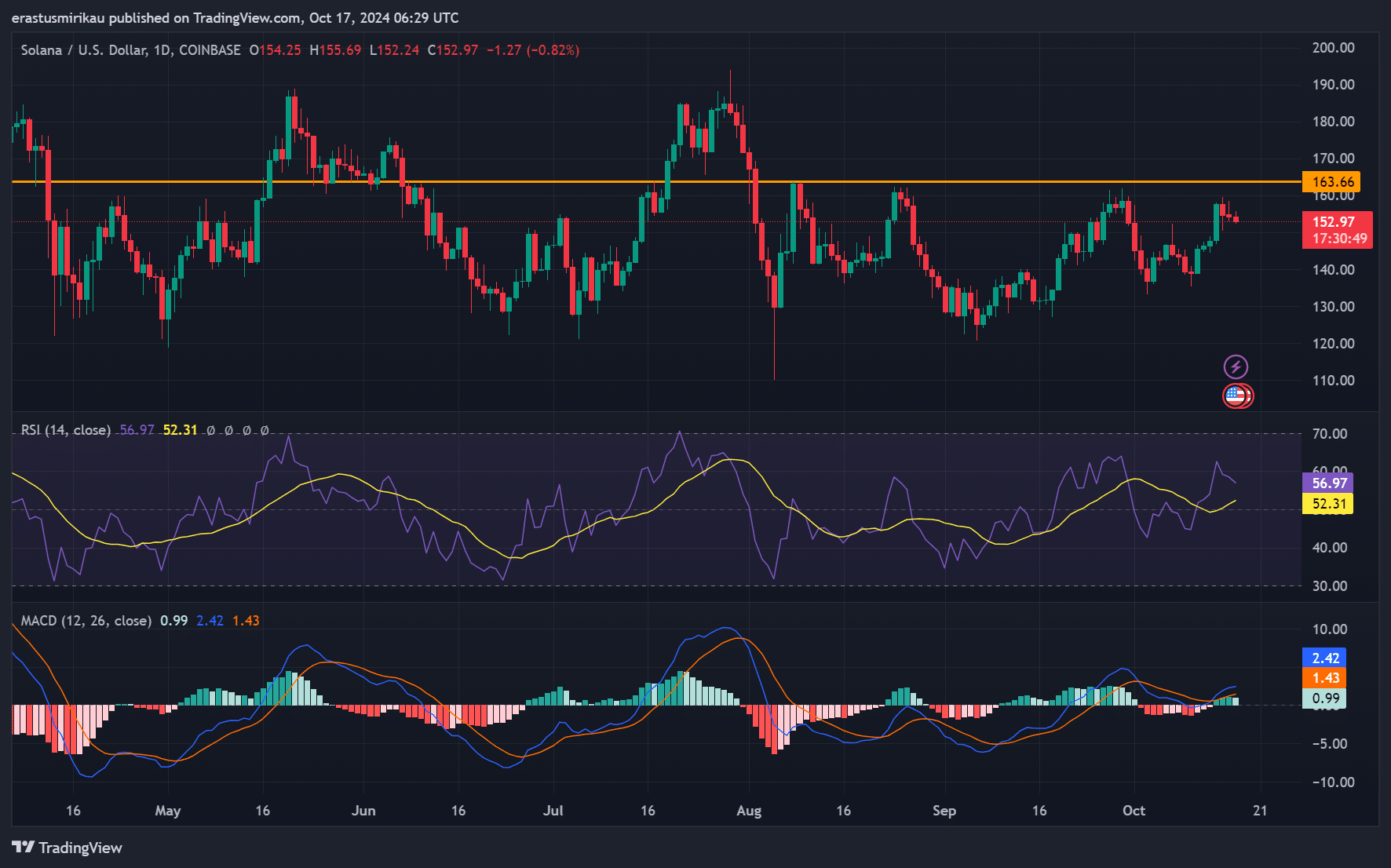

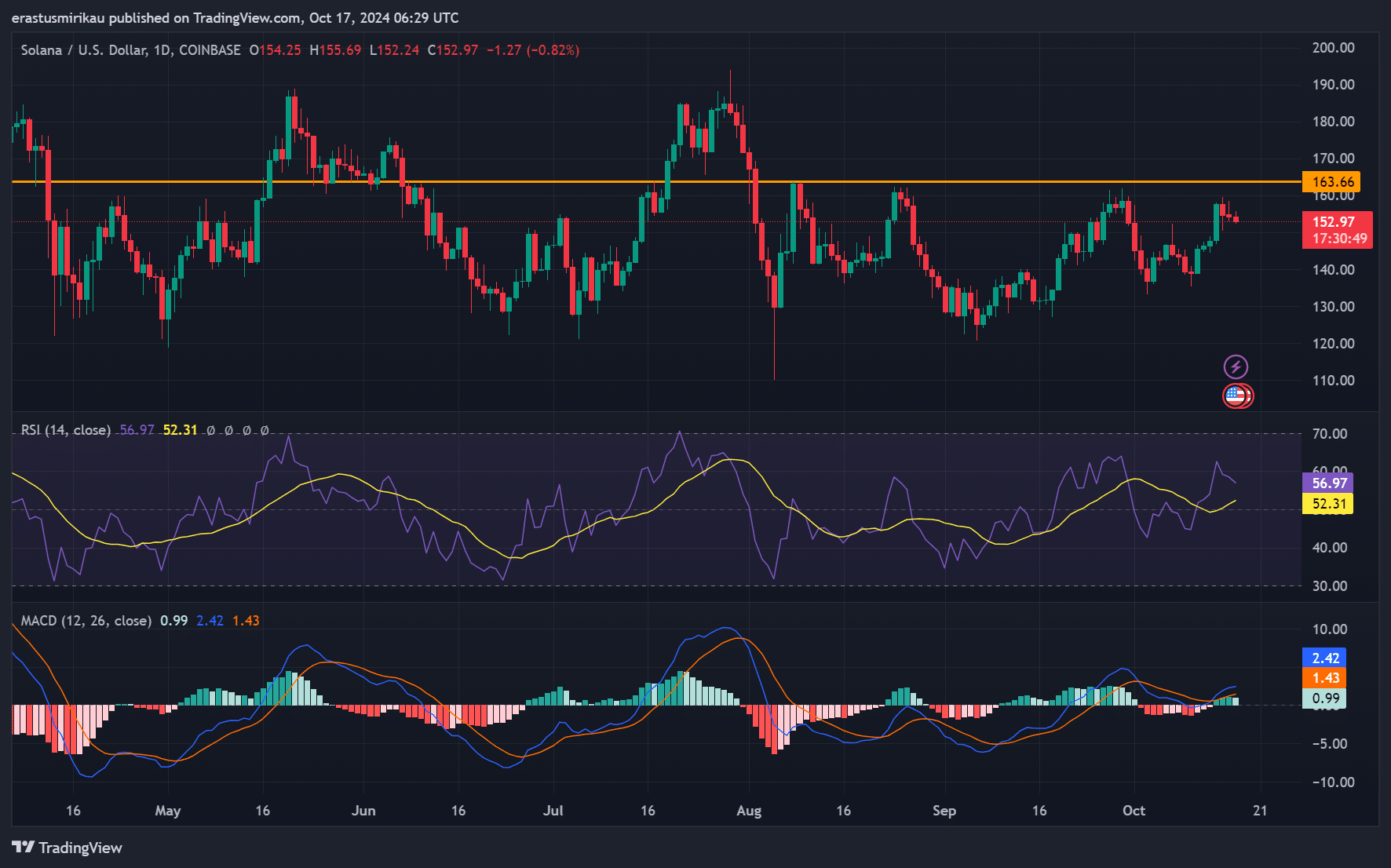

At the time of writing, SOL is trading at $153.09, reflecting a decline of 0.99% over the past day. However, despite the slight decline, prices are still on an upward trajectory.

More importantly, the $163.66 level is a major resistance point. If Solana breaks through this level, the rally could continue.

Additionally, the RSI reading of 52.31 indicates neutral momentum, while the MACD suggests possible bullish strength building. All eyes will therefore be on whether Solana can maintain its momentum and push it even higher.

Source: TradingView

SOL whale accumulation suggests potential surge

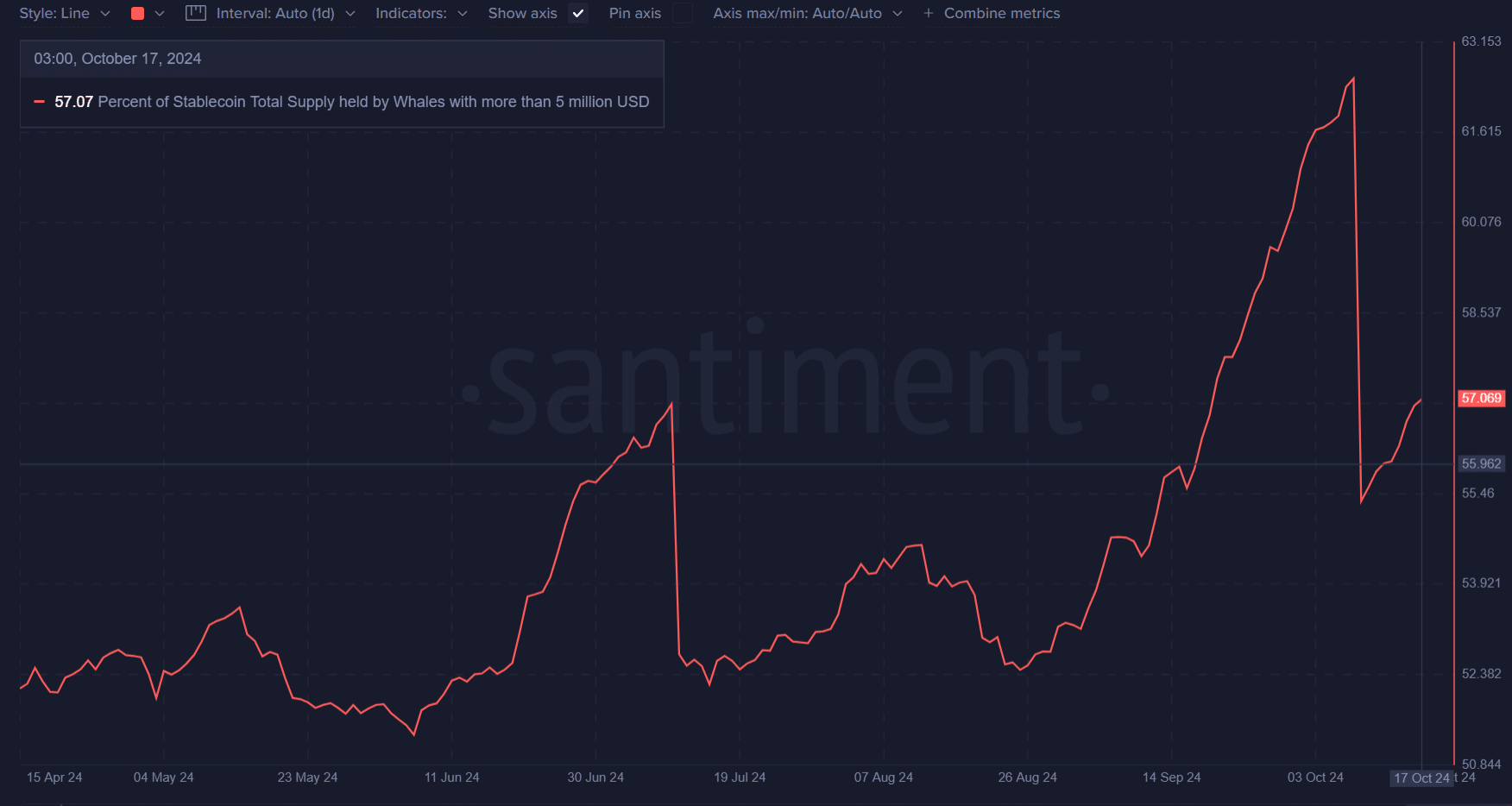

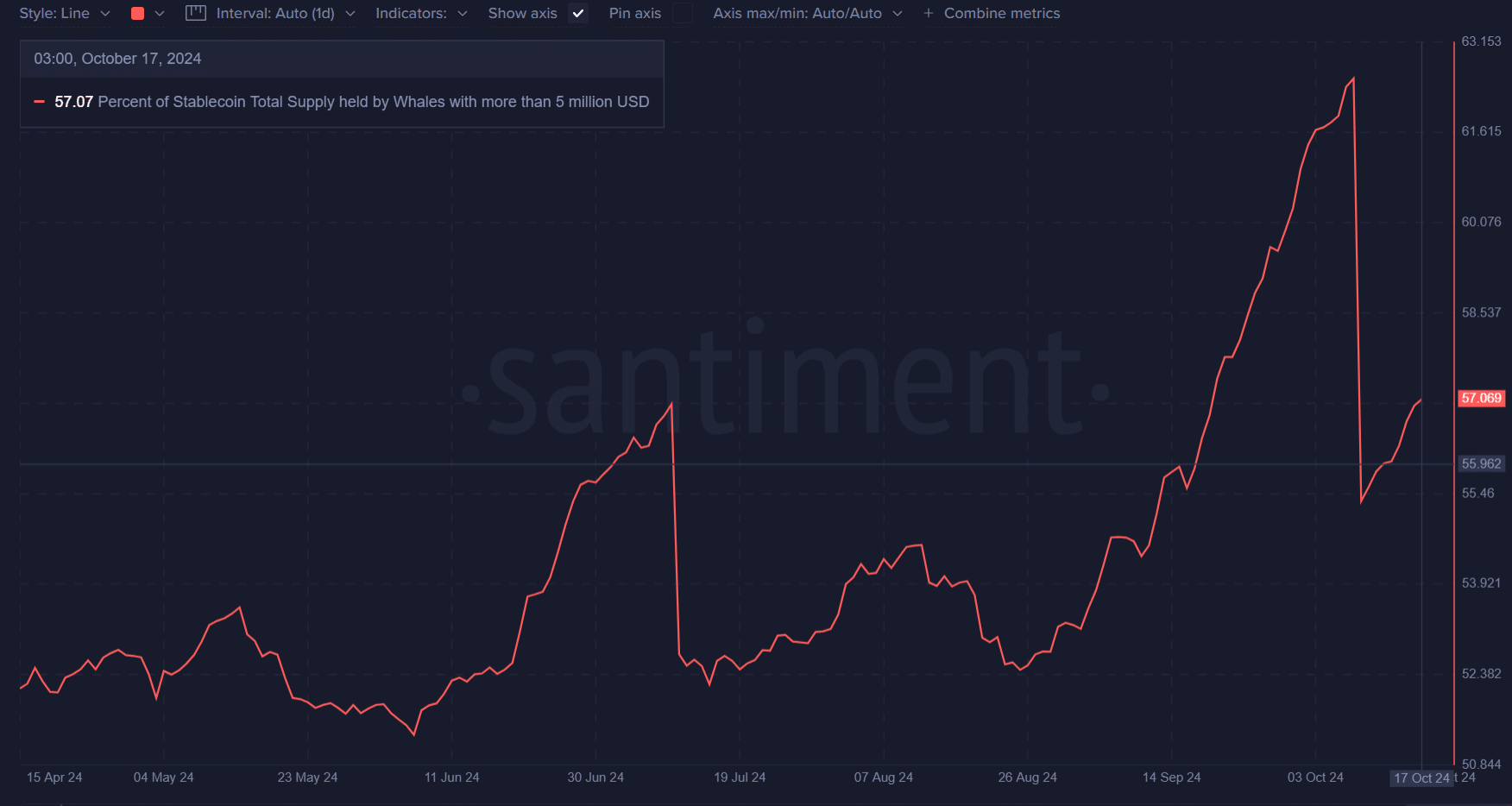

Interestingly, Solana’s top holders (holders with $5 million or more) currently control 57.07% of the stablecoin’s supply. This increased concentration of whales suggests strategic accumulation. Historically, these actions by large holders have often preceded price increases.

As a result, this rally raises expectations that SOL could soon see a big rally. The whales are likely poised for a strong push, demonstrating confidence in Solana's long-term prospects.

Source: Santiment

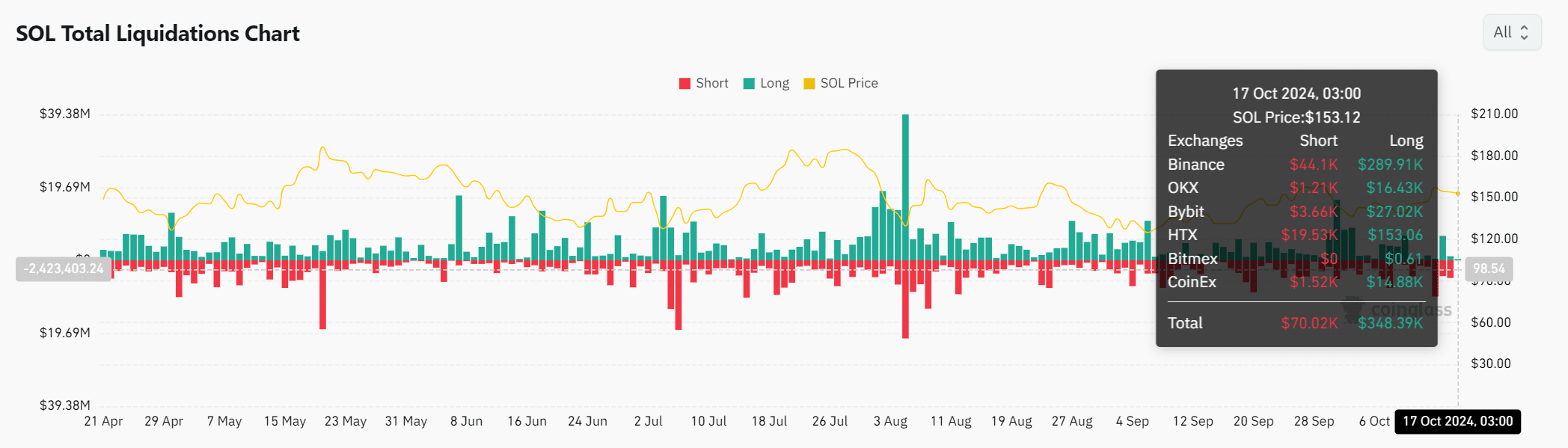

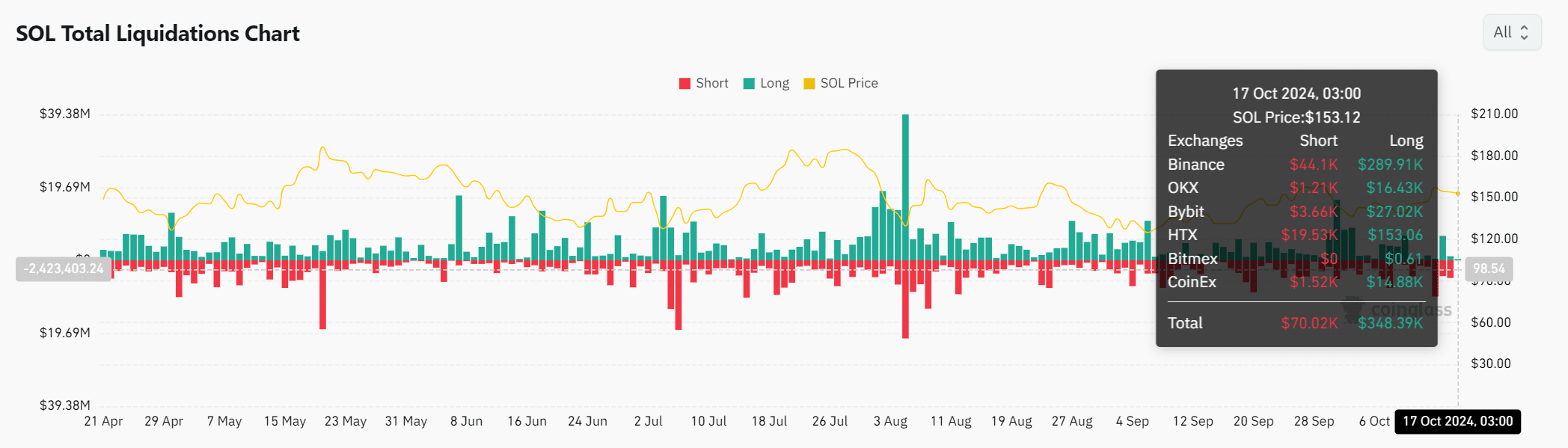

Is SOL liquidation setting the stage for more volatility?

According to liquidation data, long positions worth $348.39,000 were liquidated and short positions worth $70.02,000 were liquidated in the past 24 hours. This high liquidation level of long positions indicates that traders are betting on continued upside.

However, this also indicates that the market is highly leveraged, which could backfire if key resistance levels fail to hold. As a result, further price movements may occur if the market moves against the overextended trader.

Source: Coinglass

Increase in open interest suggests market optimism

SOL's open interest increased by 2.26% to $2.45 billion. This rise indicates increased interest from traders and expectations for increased volatility in the near future.

Additionally, with Solana dominating DEX trading volume, traders are betting on its potential to outperform the overall market.

Source: Coinglass

Is your portfolio green? Check out the Solana Profit Calculator

Given SOL's strong performance and whale accumulation, a bull market is undeniable. If prices break through resistance and avoid further liquidations, the market could move higher quickly.

However, traders should proceed with trades with caution due to the risk of liquidation. Nevertheless, Solana is well-positioned to lead the next major crypto rally.