As major digital assets continue their bullish momentum, crypto market sentiment is undergoing a major shift.

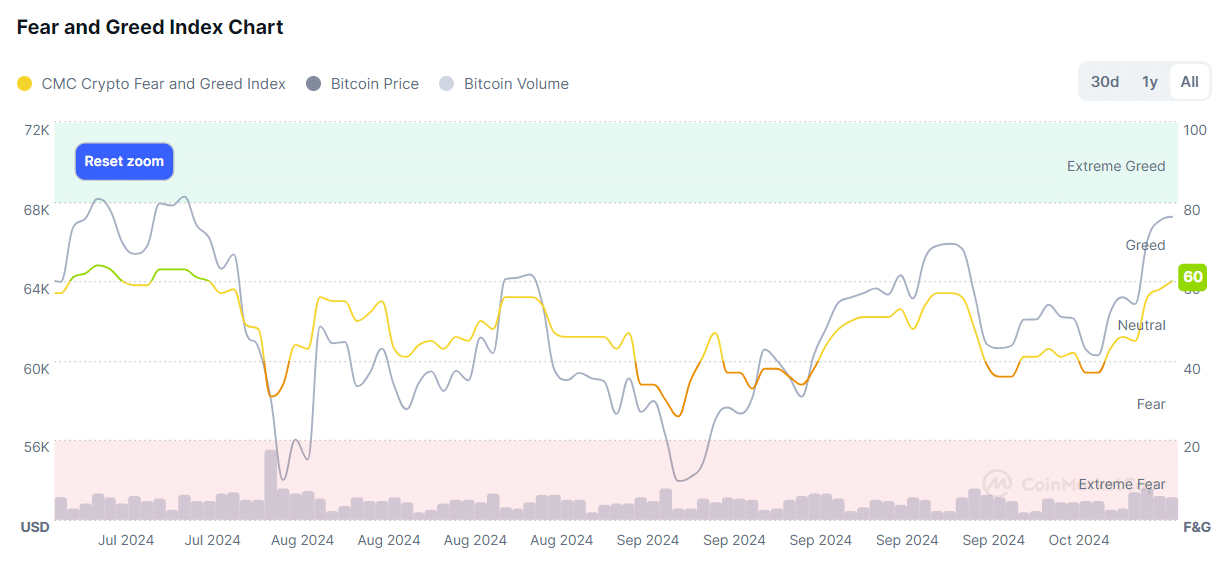

According to data provided by CoinMarketCap, the cryptocurrency fear and greed index entered the 60 zone today, indicating a somewhat greedy market situation.

This is the first time in six weeks that the crypto market has reached the greed zone, the last time it was seen on July 31st. The big drop occurred in early August, when Bitcoin (BTC) price fell below $54,000.

The recent market-wide rally occurred on the back of Bitcoin's bullish momentum. BTC prices have been rising continuously since October 10th, registering a 12% increase over the past week, and Bitcoin briefly hit a two-month high of $68,375 on October 16th. did.

Despite the slight correction, Bitcoin is still up 0.3% over the past 24 hours and is trading at $67,350 at the time of writing.

According to data from IntoTheBlock, 95% of Bitcoin holders are currently profitable, 3% are close to their initial investment, and 2% are in losses.

At this point, short-term profit-taking will likely become the norm due to the increase in profit-taking holders.

Meanwhile, the number of daily active addresses leading to profits decreased from 112,780 to 91,160 unique wallets between October 15th and 16th. This decline indicates that some investors may be looking for further price increases rather than locking in profits right away.

One of the main reasons behind Bitcoin's bullish momentum is the increased demand for spot BTC exchange traded funds in the US. As reported by crypto.news, these investment products recorded net inflows of over $1.6 billion over the past four days, amounting to $458.5. Millions of people arrived on October 16th alone.