Ethereum whales surged above the $2,600 mark, triggering mixed signals and accumulating assets despite a notable increase in forex inflows.

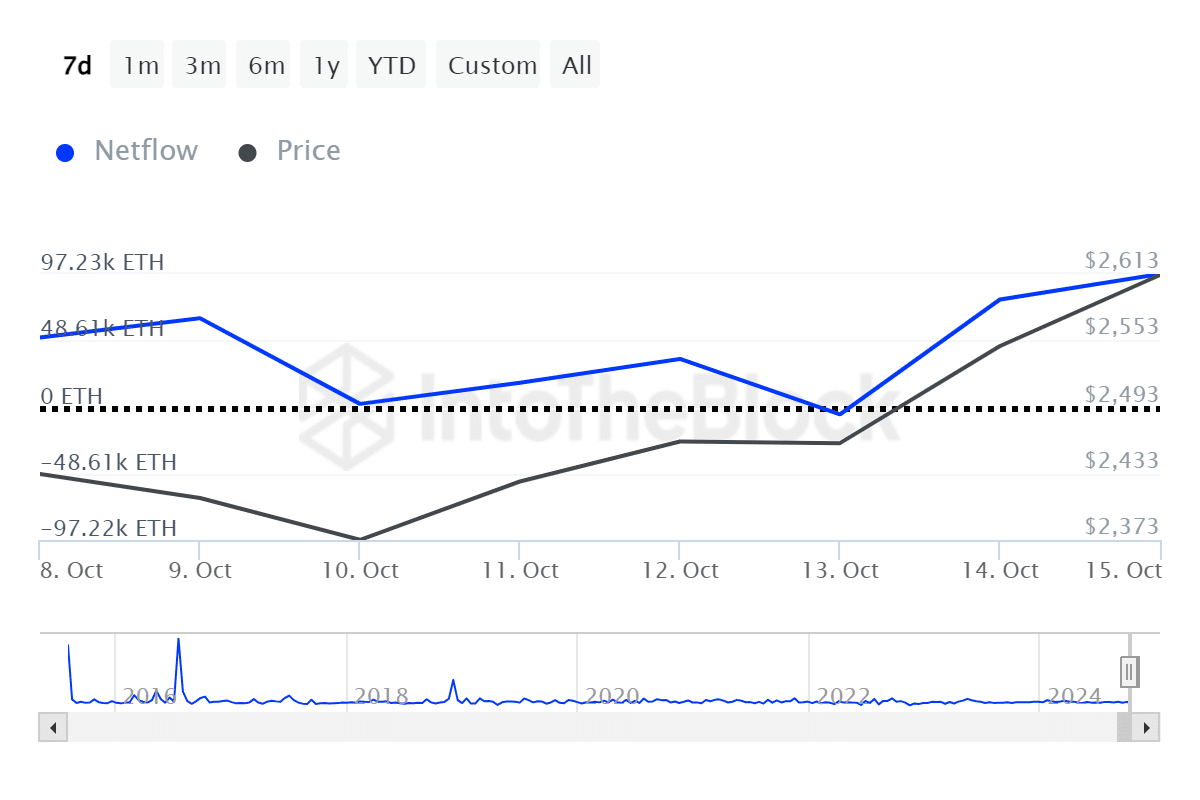

Ethereum (ETH) large holder inflows have nearly doubled in the past week, with a net inflow of 97,220 ETH on October 15th, compared to the current amount, according to data provided by IntoTheBlock. This equates to approximately $254 million in price.

Per ITB, an increase in the whale net flow of assets indicates accumulation and vice versa.

Meanwhile, the net inflow on the Ethereum exchange also changed from a net outflow of 5,700 ETH on October 13th to a net inflow of 15,000 ETH yesterday. The move shows investors are looking for short-term gains.

According to on-chain data, ETH recorded $8.88 million in net inflows from exchanges last week.

This change is considered normal given that ETH price rose from the 2,400 zone and crossed $2,600 after two weeks of bearish consolidation.

This chart shows significant profit-taking momentum between 14:00 UTC and 15:00 UTC on Tuesday as Ethereum quickly plummeted from a local high of $2,685 to $2,540. Approximately $16.6 billion was wiped from the ETH market cap within an hour.

Despite increasing short-term profit taking, ETH is still trading above $2,600 at the time of writing. The major altcoins have a market capitalization of $313 billion and a daily trading volume of $22 billion.

Ethereum still lacks a strong catalyst to continue its upward momentum. The performance of the US-based Spot ETH exchange-traded fund has also been weak. On October 15th, these investment products recorded net outflows of $12.7 million, while the Spot Bitcoin (BTC) ETF had net inflows of $371 million.

Australia-based Monochrome Asset Management launched the country's first Spot ETH ETF on Tuesday, crypto.news reports. The fund currently has total net assets of only $272,908.