- Bitcoin's recovery has triggered a rally in crypto stocks.

- Despite its growing popularity, the president of the Federal Reserve Bank of Minneapolis deemed BTC worthless.

After “”Uptober” Bitcoin's [BTC] Despite falling below the critical $60,000 level last week, King Coin is currently making an impressive comeback.

On October 14th, Bitcoin hit a high of $66,500, its highest level since July.

This price increase triggered double-digit gains in publicly traded crypto companies in the US.

Clean Spark (CLSK)— Bitcoin mining company posted the highest return of 12.72% as shown below. Google Finance. This was closely followed by Coinbase (COIN). I'm grateful Increased by 11.32%.

Other notable gainers include LM Funding America (LMFA), up 10.94%, Terrawolf (WULF), up 6.65%, and Marathon Digital Holdings (MARA), up 5.60%.

At the time of writing, Bitcoin is trading at $65,657, up 9.04% in the last month and over 144% in the last year.

Why is BTC rising?

The rally in crypto stocks comes as Bitcoin benefits from increased investor interest, fueled in part by expectations surrounding the upcoming U.S. presidential election.

Notably, both Republicans and Democrats have adopted pro-cryptocurrency positions.

This increases the likelihood that Bitcoin will rise further regardless of whether Donald Trump or Vice President Kamala Harris secures the presidency.

Trump, who had previously expressed skepticism about cryptocurrencies, has rebranded himself as a pro-cryptocurrency candidate and launched crypto-related projects. reported By AMBCrypto.

Meanwhile, Harris is increasingly positioning herself as a cryptocurrency supporter. her recent suggestion It focuses on cryptocurrencies, which play an important role in promoting economic empowerment.

Questions arise over the value of BTC

Despite increasing acceptance and support from the larger community, BTC continues to face skepticism from traditional financial leaders and institutions.

On October 14, Minneapolis Fed President Neil Tushar Kashkari said that Bitcoin remains worthless even after 12 years.

Kashkari emphasized that despite the long lifespan of digital assets, cryptocurrencies have not been able to establish themselves as viable currencies.

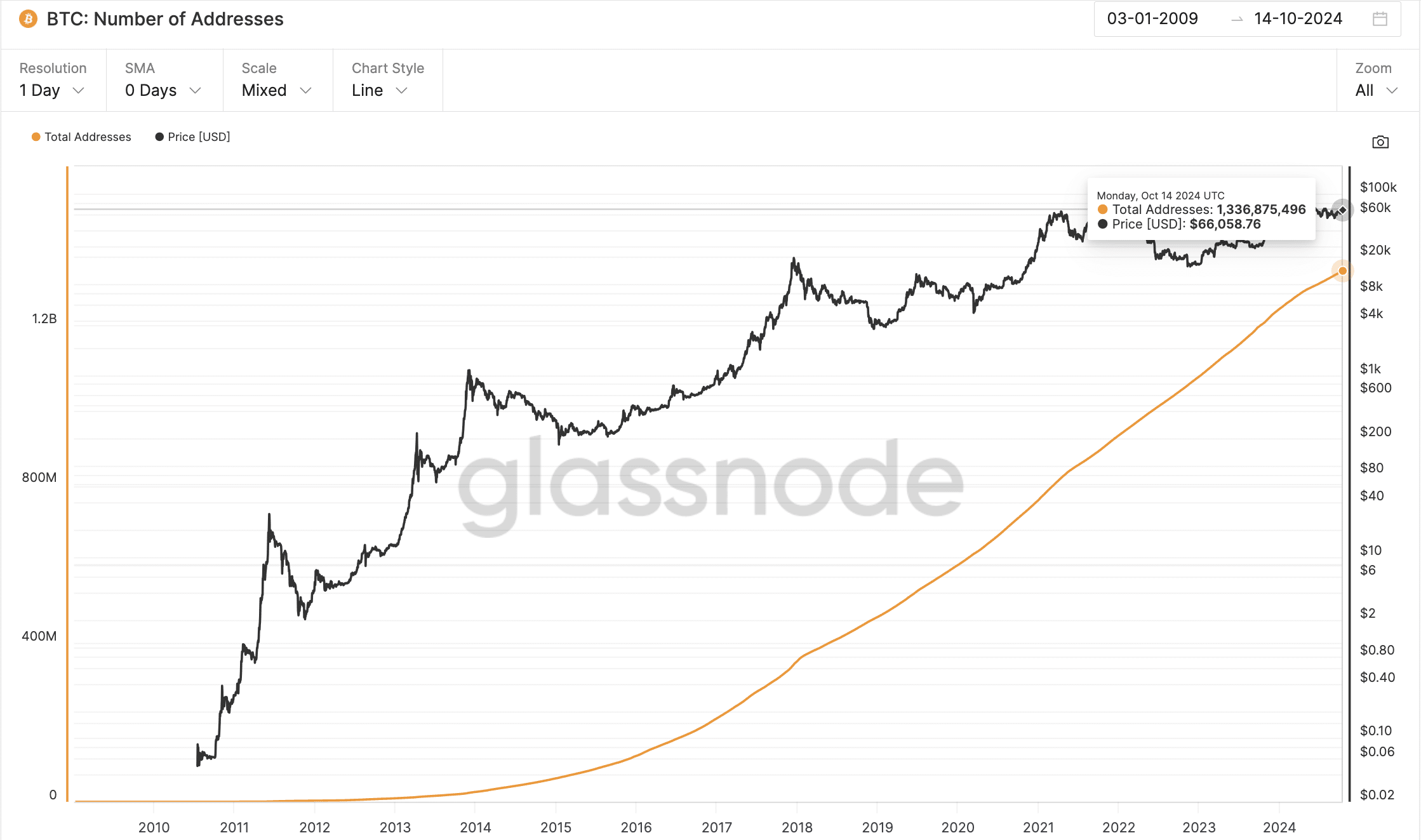

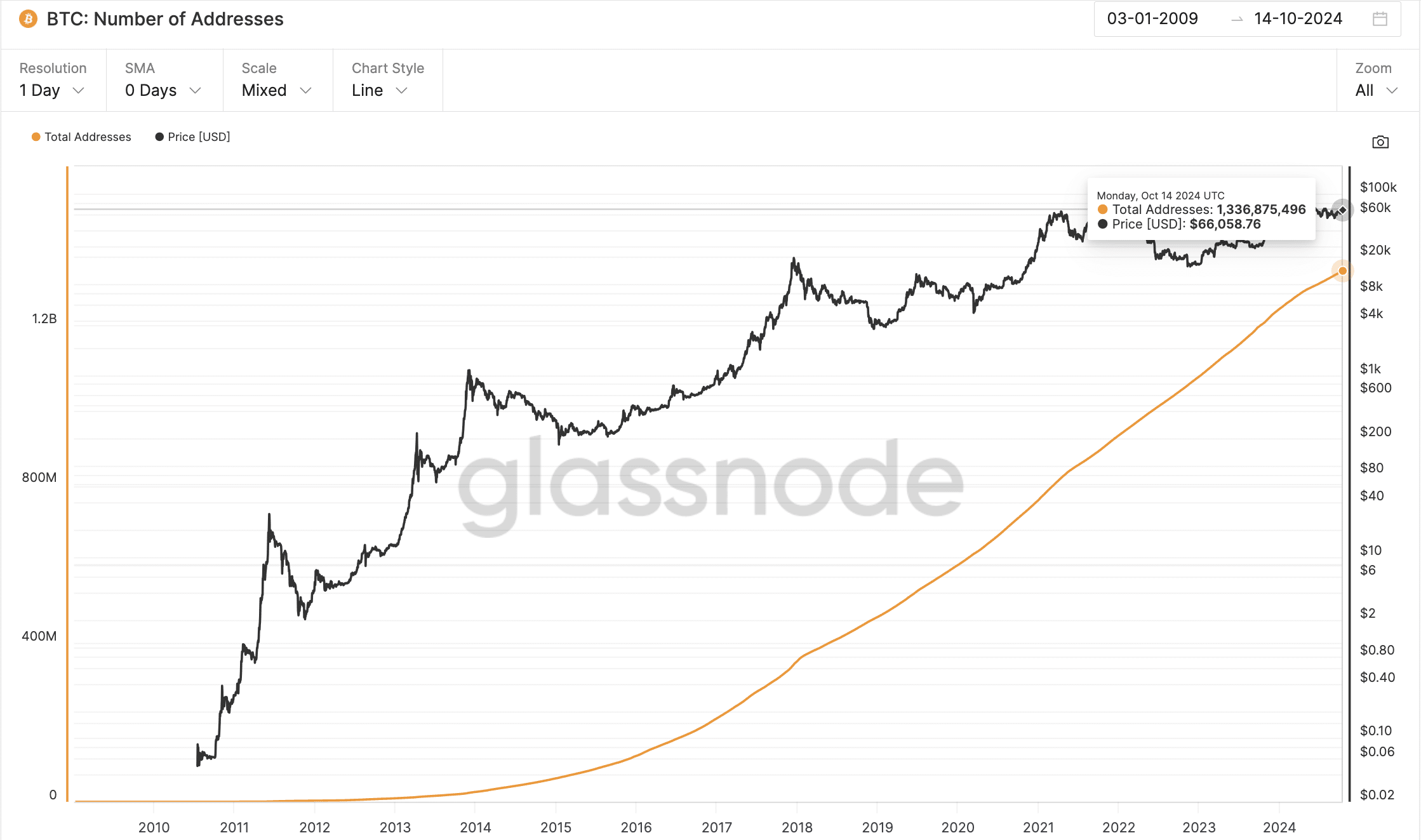

However, Bitcoin's performance tells a different story. According to Glassnode, its $1.3 trillion market capitalization and 1.3 billion addresses underline Bitcoin's widespread adoption, market trust, and recognition as a valuable digital asset, despite criticism.

Source: Glassnode