The price of Ethereum has seen very volatile trading recently, hovering between $2,600 and $2,300. However, in the midst of this, prominent crypto markets have highlighted important support levels below which could trigger further declines in the Ether market and drive prices lower. Furthermore, there are also a series of factors at play that could potentially influence the price of ETH in the coming days.

Ethereum price risks further decline

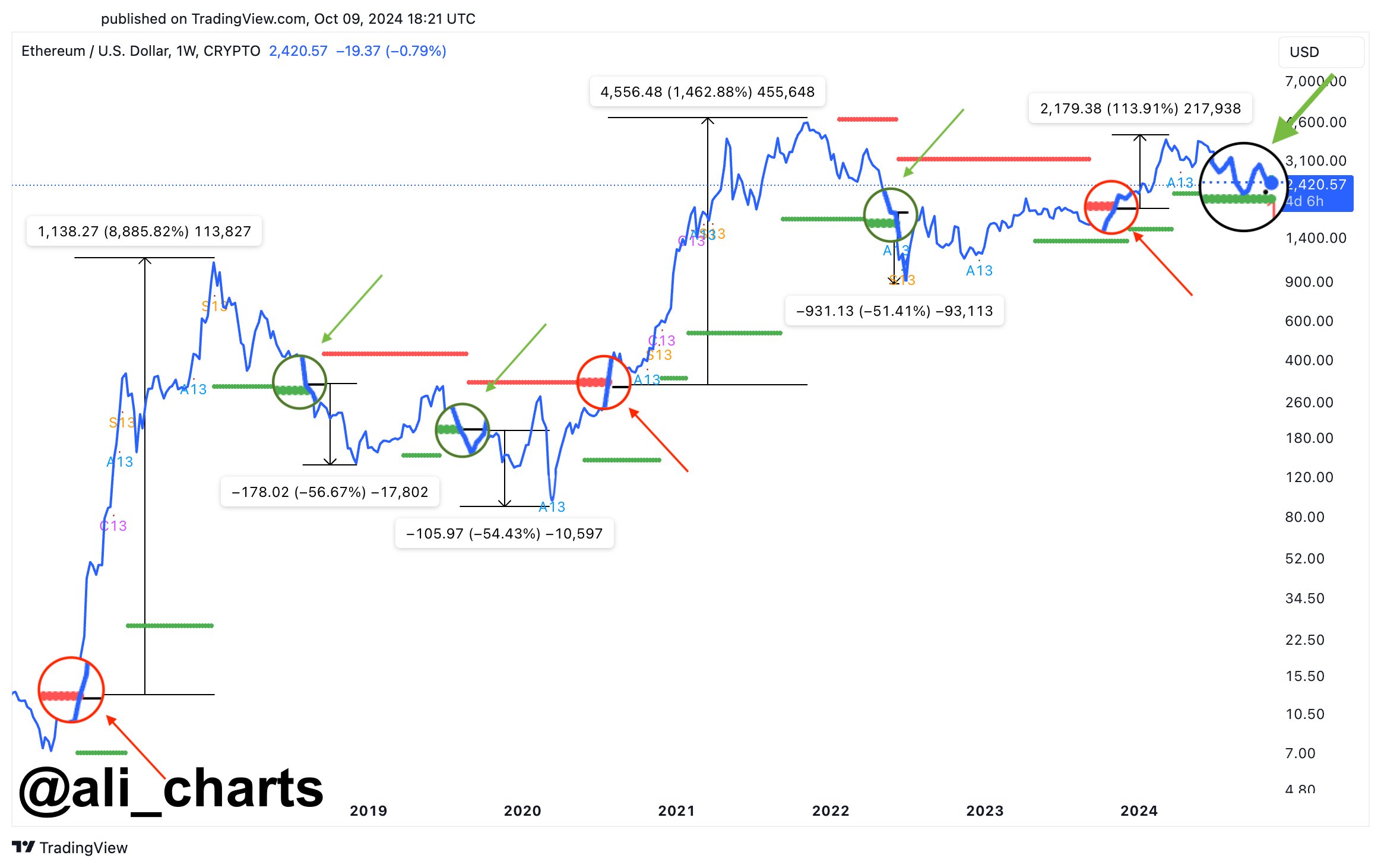

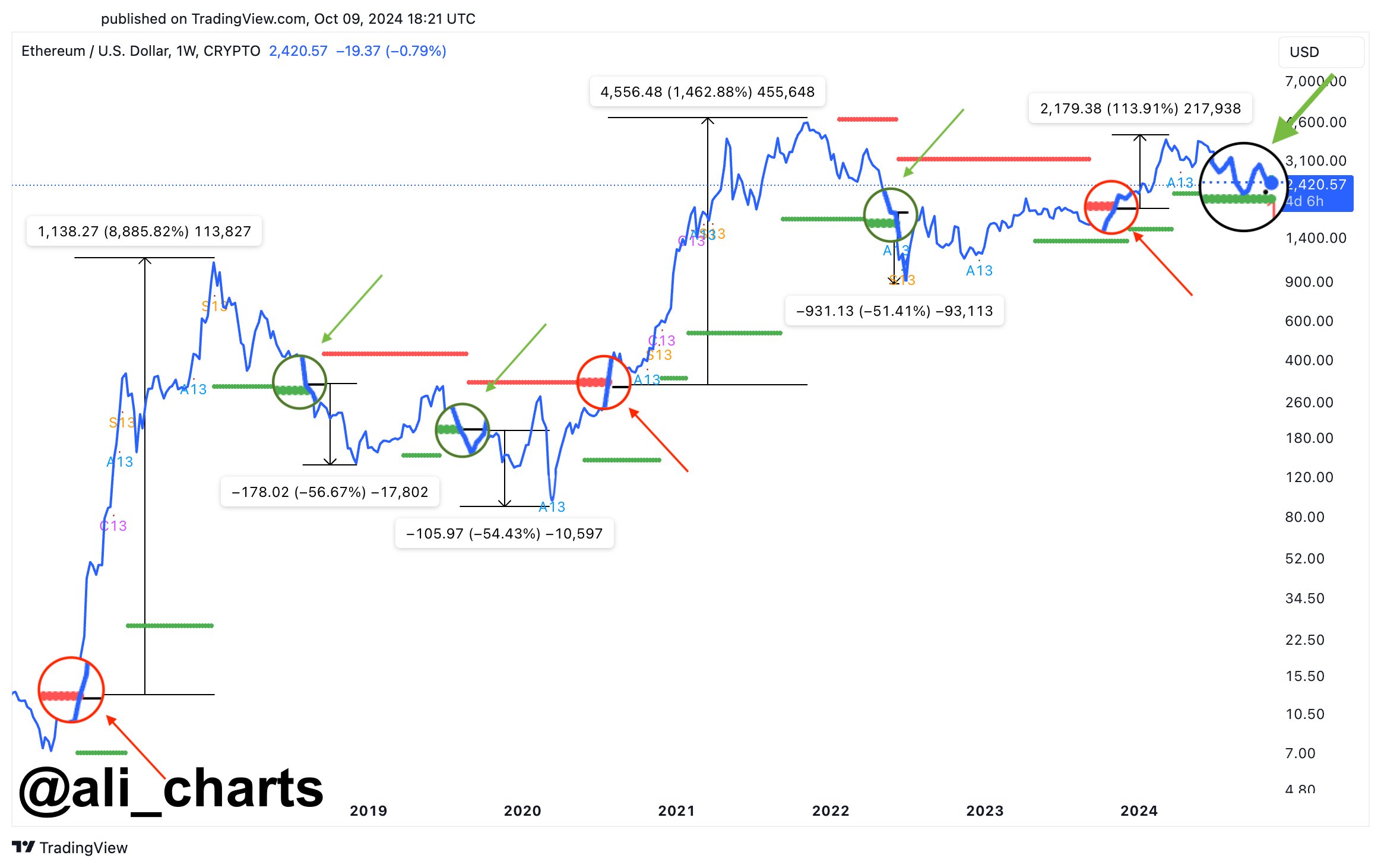

In a recent analysis shared on the X Platform, renowned crypto expert Ali Martinez identifies $2,300 as a key support level for Ethereum price. He noted that over 2.4 million addresses have purchased 5.6 million ETH at this level.

That said, he predicts that if Ether falls below this level, it could trigger a decline as investors may choose to minimize their losses. In other words, Martinez issued a stern warning that a drop below the $2.3,000 level could lead to further decline in ETH price.

In a separate analysis, Martinez said that Ether tends to see strong correlations whenever it breaks below the support trend line of a TD setup. Considering historical patterns, the average of such a decline is around 53%, which could spell trouble for cryptocurrencies. In his analysis, he noted that if the second-largest cryptocurrency by market capitalization loses support at $2,250, a significant price decline could ensue.

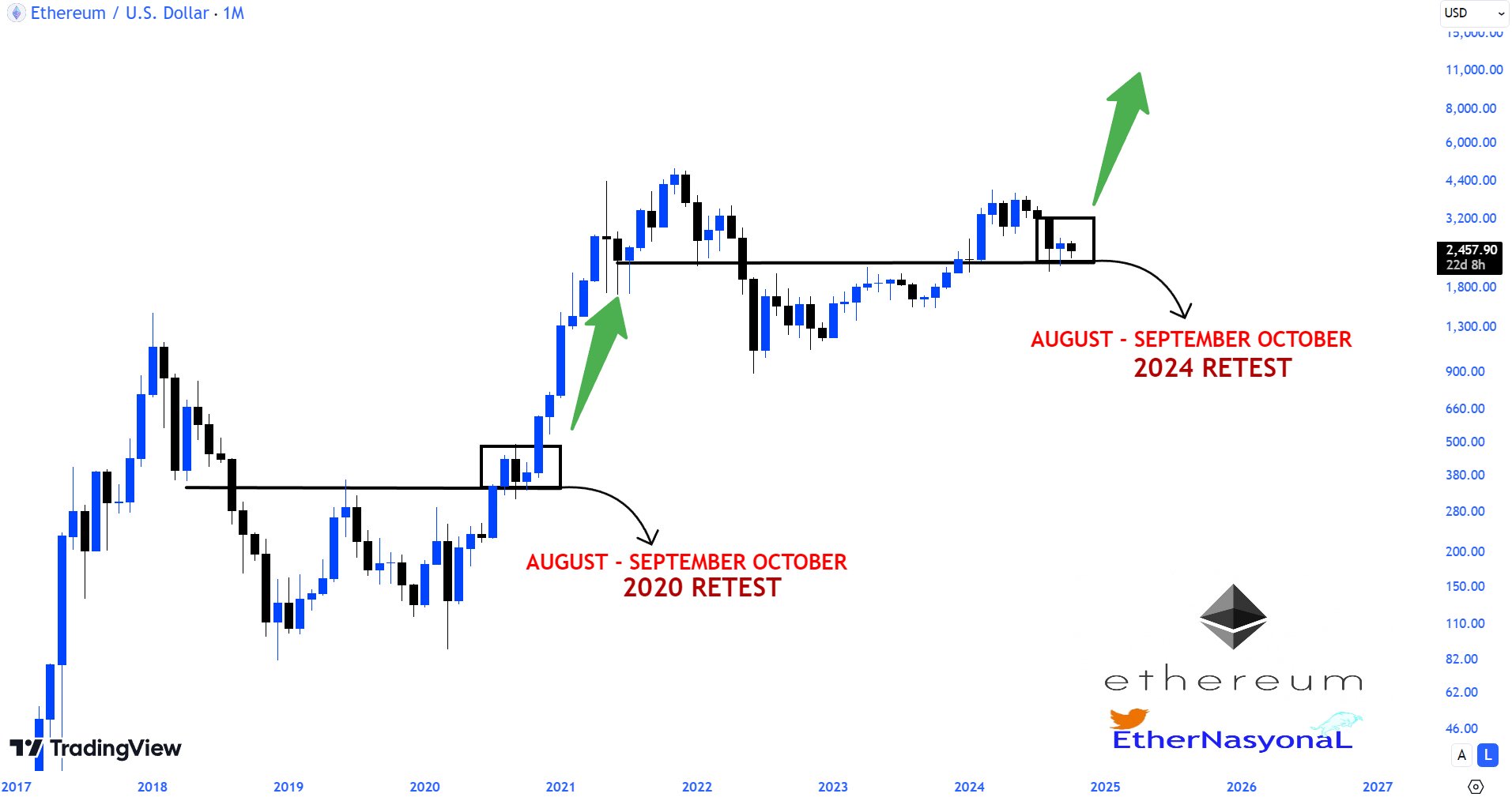

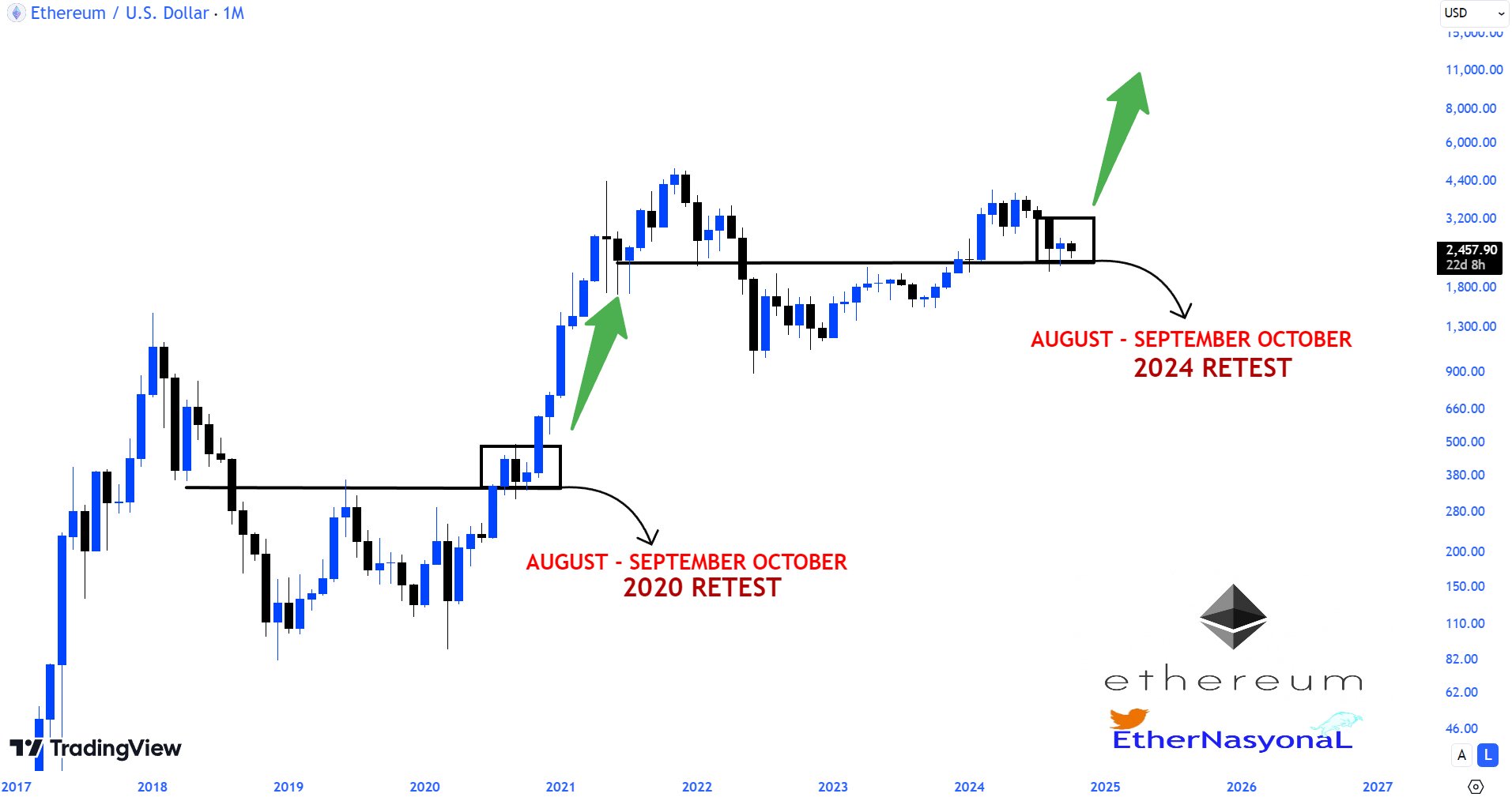

However, despite these, some analysts remain bullish on the long-term potential of cryptocurrencies. A popular crypto analyst known as EᴛʜᴇʀNᴀꜱʏᴏɴᴀL of He cited historical trends to support his comments.

What’s next for ETH price?

As you can see from its recent performance, the price of Ethereum has been very volatile over the past few days. Additionally, slowing inflows to the US Spot Ether ETF have also raised concerns that market participants are shifting their focus away from ETH and towards other top altcoins.

However, despite this, many in the crypto market remained bullish on the second-largest cryptocurrency by market capitalization. According to historical data, the cryptocurrency market showed strong performance in the last quarter of this year. Additionally, the upcoming US presidential election could also push ETH prices higher in the coming days.

Meanwhile, Jeff Kendrick, global head of digital asset research at Standard Chartered, also recently expressed his bullish view. According to him, if Donald Trump wins and maintains his pro-crypto stance, the price of Solana could increase five times by 2025. At the same time, he predicted that Ether would rise 4x and BTC 3x, sparking market optimism.

Furthermore, Ethereum price predictions suggest that ETH could rise by around 11% by December of this year. This has caused both speculation and optimism among investors, especially as the market is closely monitoring the price of cryptocurrencies.

Disclaimer: The content presented may contain the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or publication assumes no responsibility for your personal financial loss.

✓ Share: