- ETH saw a modest rise on the monthly chart, gaining just 2.89%

- Analysts believe ETH needs to stay above $2,300 to avoid mass sell-off

While Bitcoin [BTC] Ethereum has fallen over the past week. [ETH] took a different path. In doing so, ETH recorded modest gains on the monthly price chart.

At the time of writing, Ethereum was trading at $2,404. This marked an increase of 1.06% on the weekly chart, and the altcoin also gained on the daily chart.

However, despite these gains, ETH is still well below its recent high of $2,700 and 50.7% off its ATH of $4,878. As expected, analysts are debating these market conditions. One of them is popular crypto analyst Ali Martinez, who says $2,300 remains a major support level for ETH.

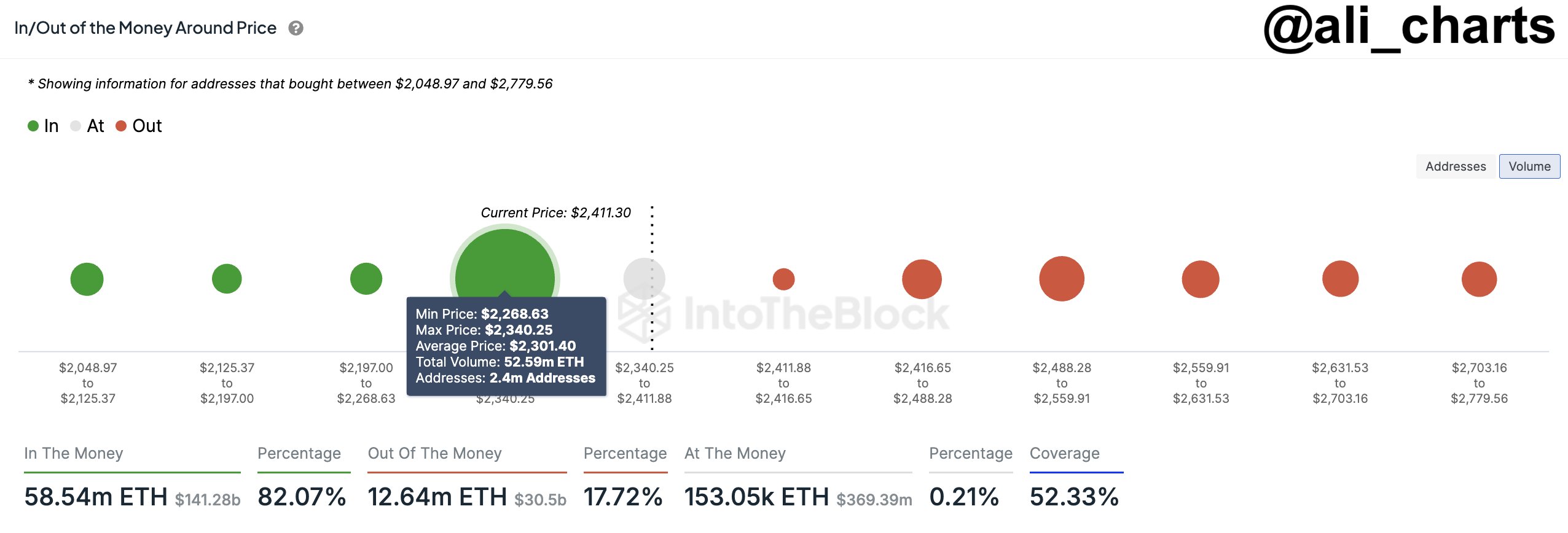

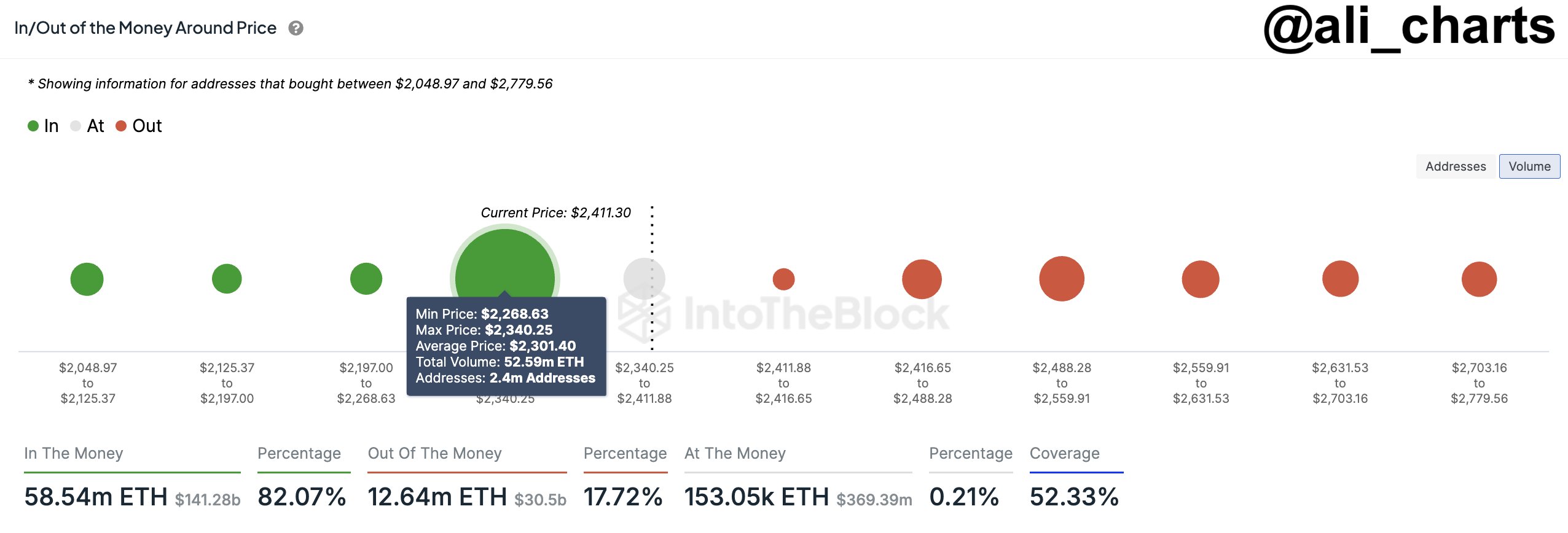

Why 2.4 million addresses matter

In his analysis, Martinez listed 2.4 million addresses that purchased 52.6 million ETH tokens for $2,300. According to him, ETH remains the most important support level for altcoins, so ETH needs to sustain above this level.

Source: X

As a result, if the altcoin fails to maintain this demand zone, ETH will record a massive decline. Below this level, investors will panic sell in an attempt to minimize losses.

In such a scenario, Ethereum would be under selling pressure, pushing the price further down the chart.

What does the ETH chart show?

Now, while Martinez's aforementioned observation pointed to a possible market decline, it is important to cross-check and determine what other market indicators are suggesting.

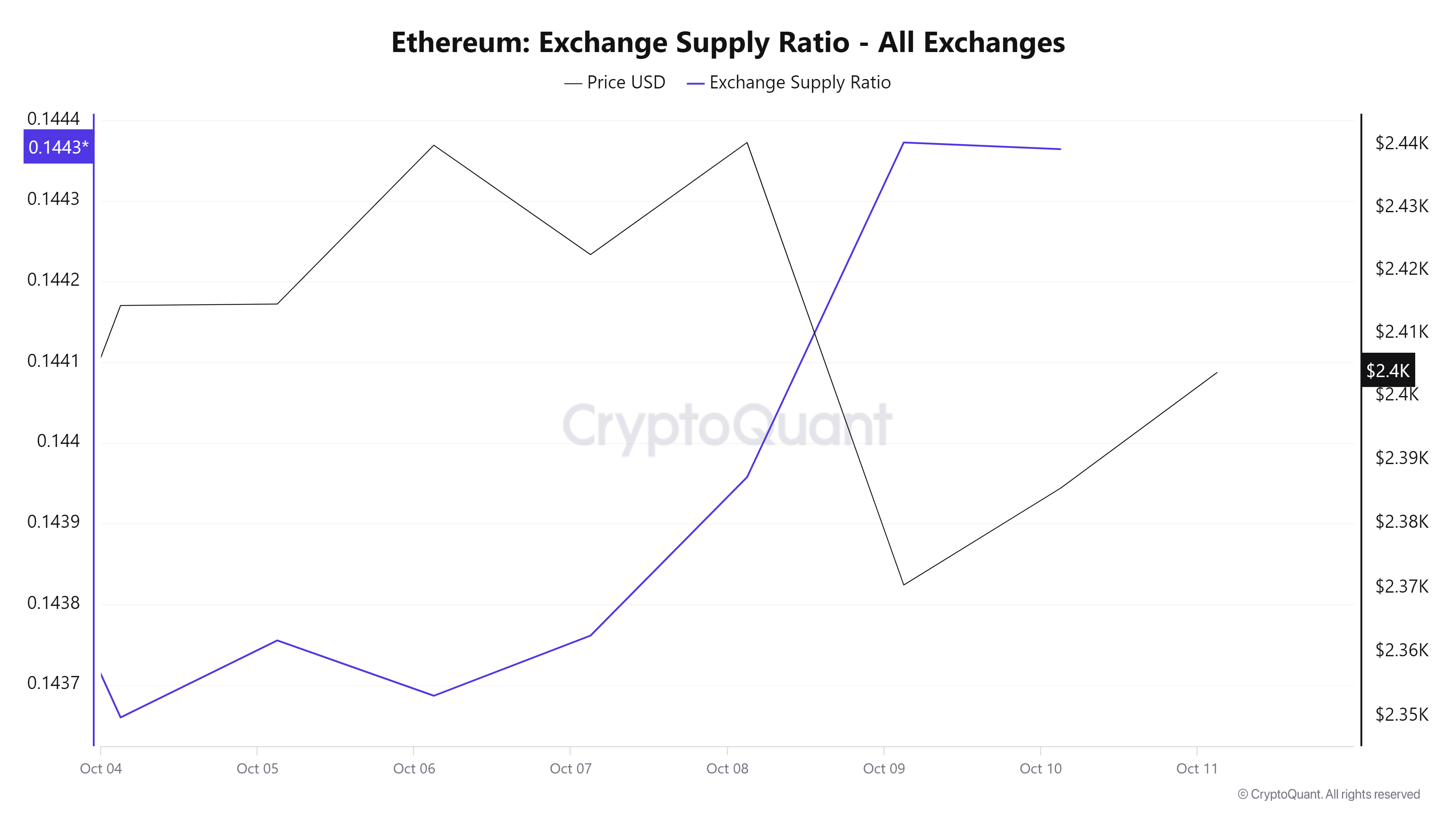

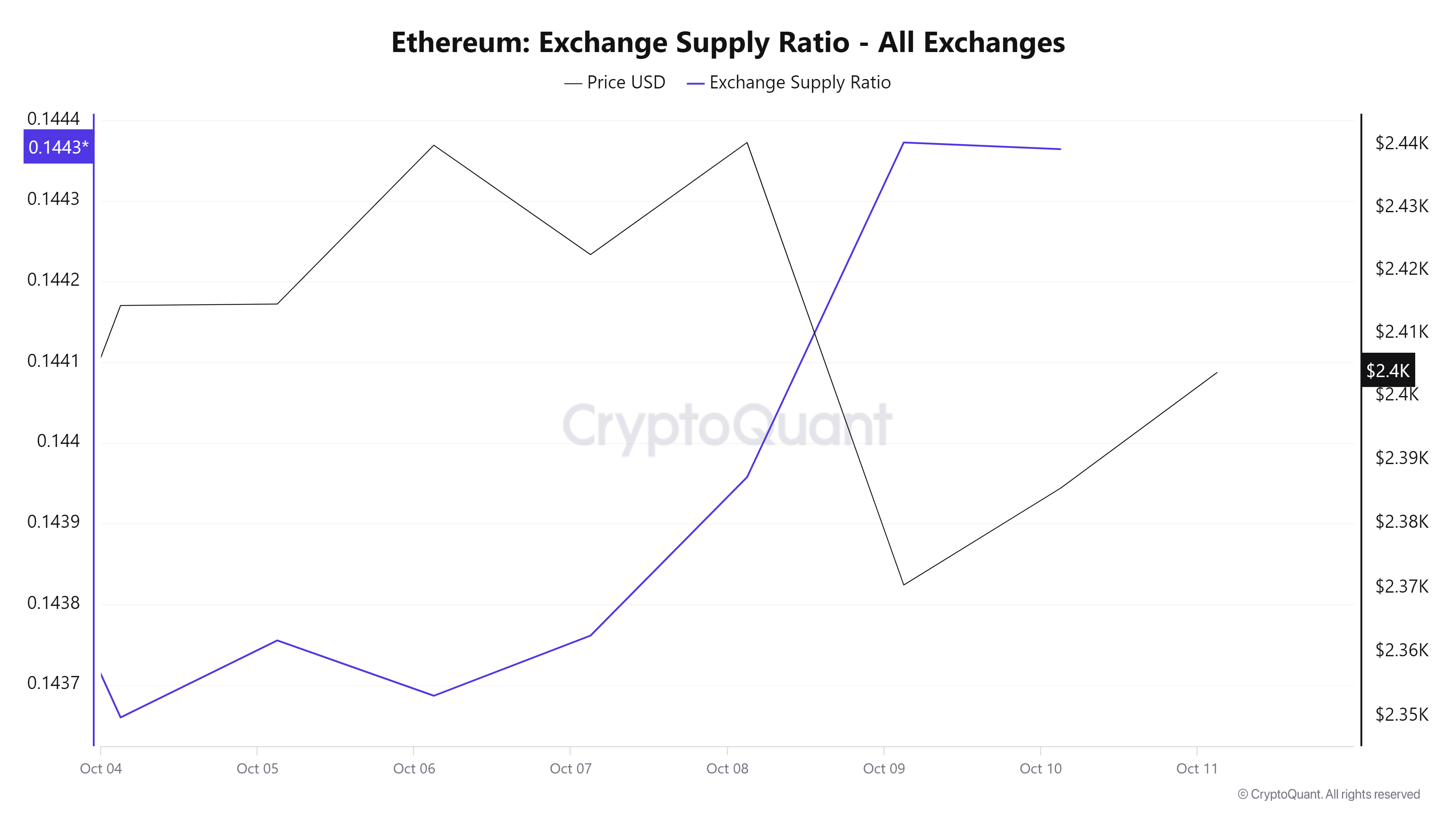

Source: Cryptocurrency

For example, Ethereum's exchange supply ratio has jumped from 0.143 to 0.1443 in the past week. An increase in the exchange supply ratio suggests that holders may be preparing to sell or take profits.

When an investor moves ETH from a private wallet to an exchange, this is usually a bearish signal.

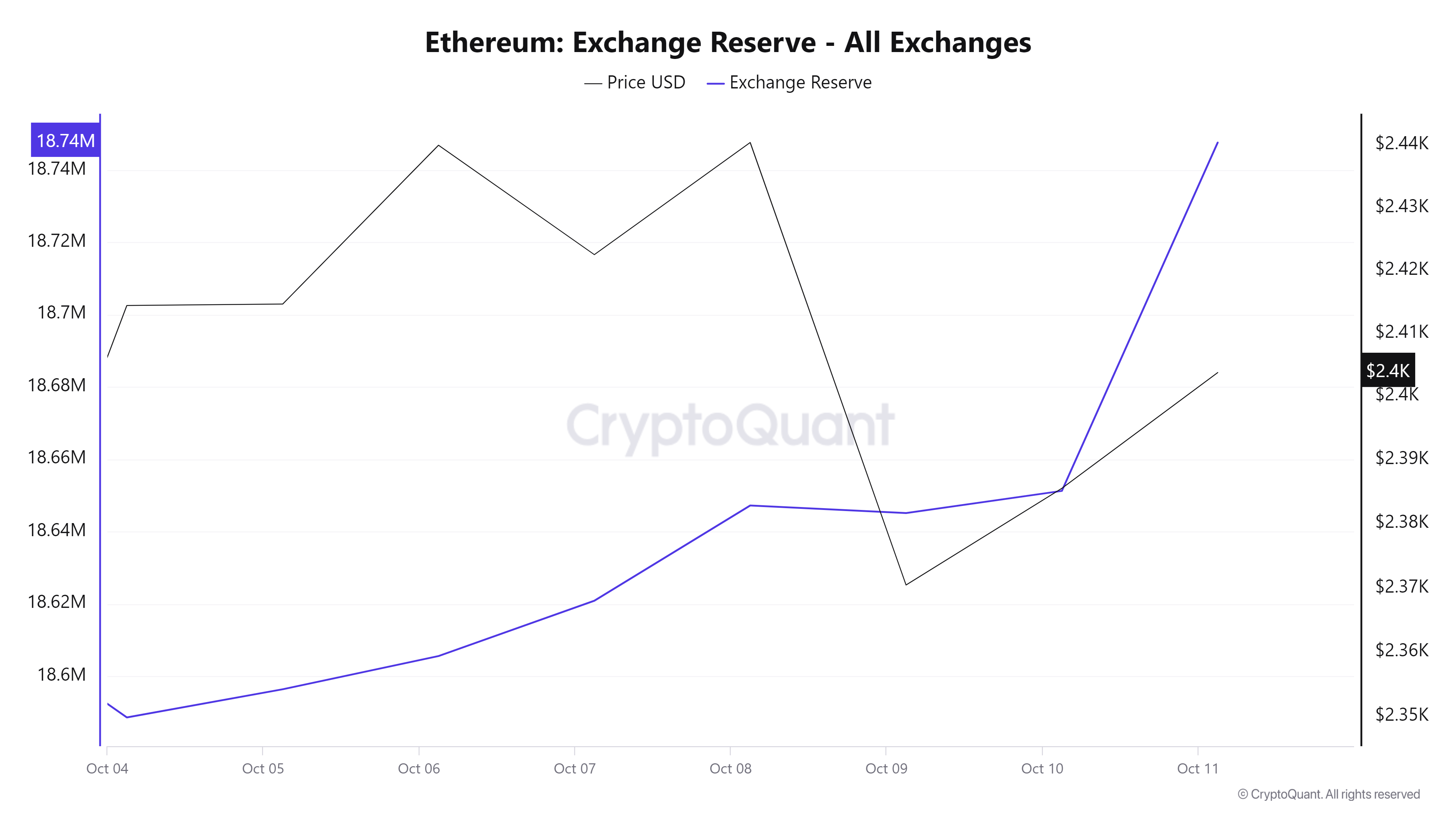

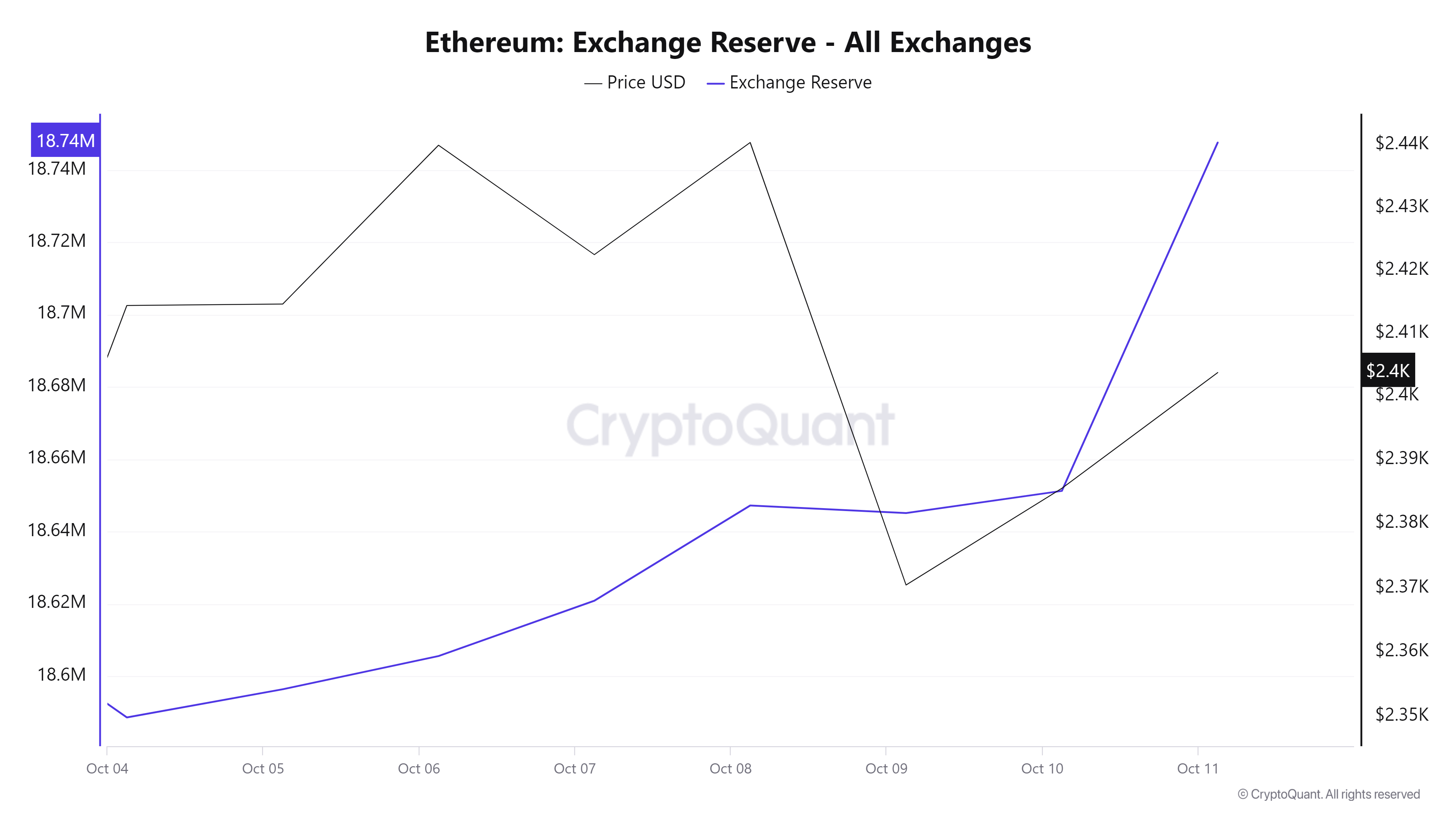

Source: Cryptocurrency

Additionally, Ethereum’s exchange reserves have been rising throughout this week, reaching the same figure of $18.7 million at the time of writing. This further confirmed our observation that investors are moving ETH to exchanges, as we observed earlier with the spike in the exchange supply ratio.

This type of market action can potentially lead to selling pressure, pushing prices down.

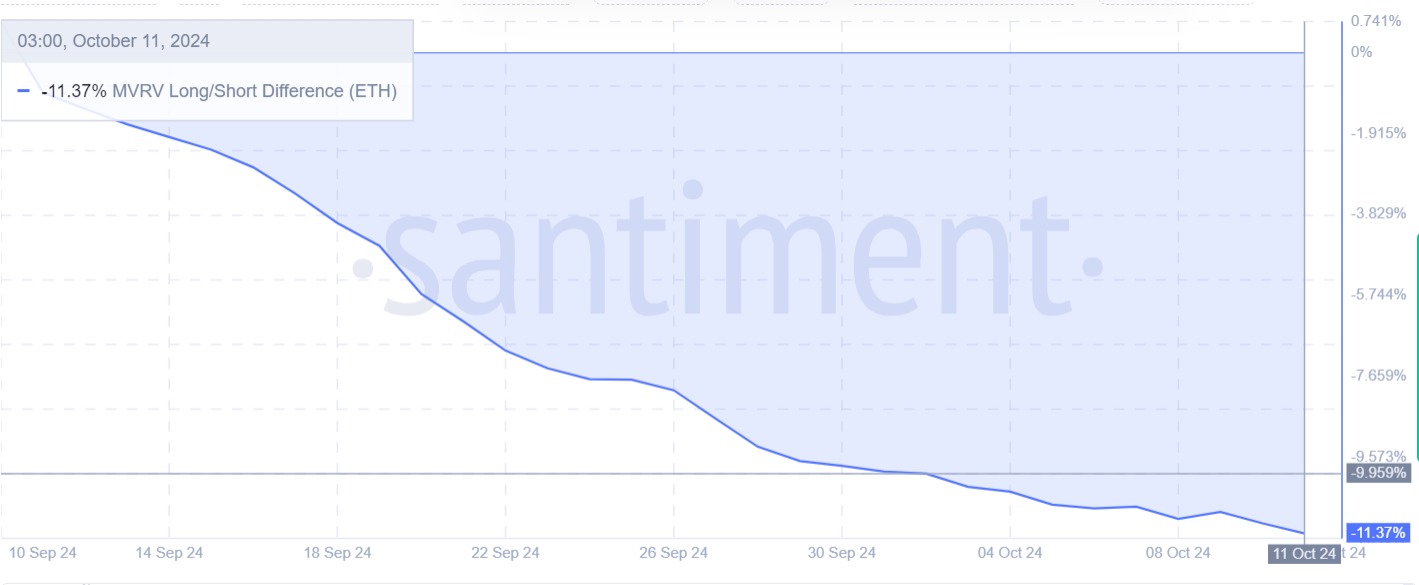

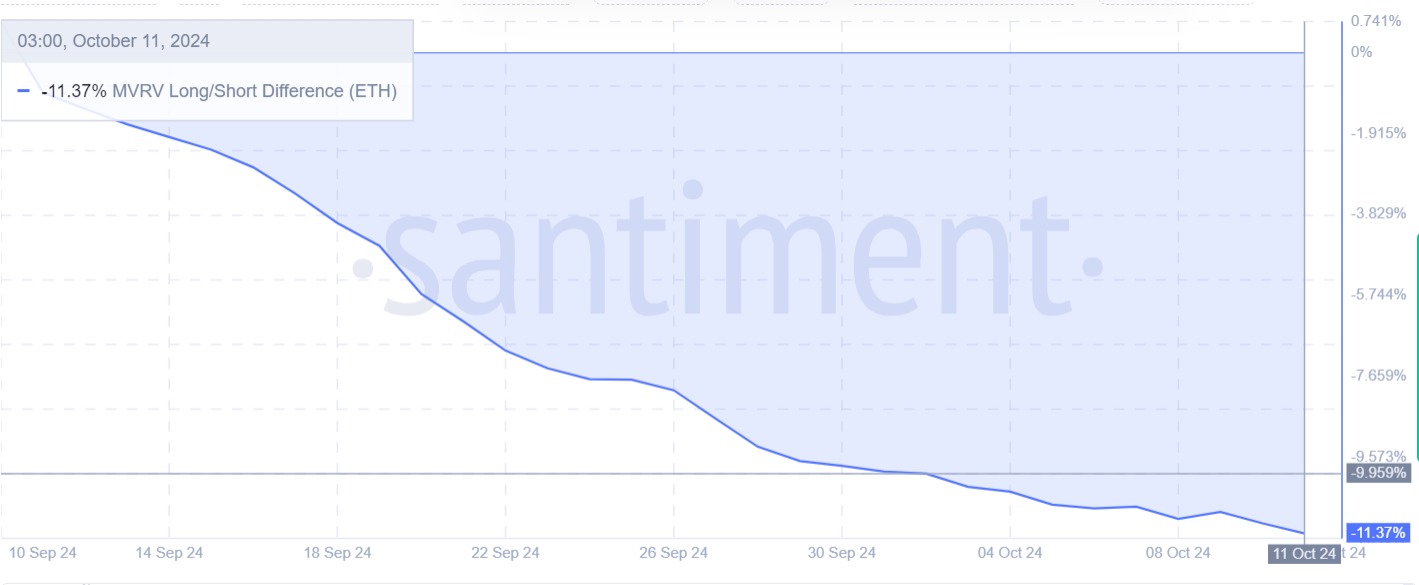

Source: Santiment

Finally, Ethereum’s MVRV long/short differential has remained negative for the past month. Typically, if short-term holders are making profits while long-term holders are incurring losses, this will lead to long-term holders capitulating. As a result, selling pressure increases to minimize losses.

Therefore, there is a risk that a capitulation by long-term holders as they close out their positions will create a temporary bottom, causing the price to fall in the short term.

Simply put, ETH has been trading within a descending channel for several months, according to AMBCrypto analysis. With negative market sentiment, Ethereum may fall before breaking out of this trend. In the event of a decline, ETH will find net support at $2,325.